NETGEAR, Inc. NTGR has announced the launch of the Nighthawk AXE3000 Wi-Fi 6E USB 3.0 Adapter (A8000) to further boost Internet connectivity and improve Wi-Fi speed. The adapter is priced at $89.99 and will be available by end of September 2022 on the company’s website and other retailers.

The current launch is aimed at tapping the growing demand for Wi-Fi and Internet connectivity. Per a report from Markets and Markets, the global Wi-Fi 6 market size is expected to grow from $11.5 billion in 2022 to $26.2 billion by 2027, at a CAGR of 17.9%. The industry is expected to benefit from increased Wi-Fi users and increased proliferation of smart devices, added the report.

The new adapter automatically switches between 2.4GHz, 5GHz and 6GHz, providing speed up to 1.2Gbps, so that users can stream HD videos and play games. Apart from that, it also features WPA3 Security to ensure user safety and is compatible with older Wi-Fi routers.

NETGEAR, Inc. Price and Consensus

NETGEAR, Inc. price-consensus-chart | NETGEAR, Inc. Quote

The company continues to invest heavily in research and development to expand its product line. In April, the company launched the Insight Managed Wi-Fi 6 AX3000 Dual-band Multi-Gig Poe Access Point (WAX615) to provide better Internet connectivity to small and medium businesses.

Prior to that, the company launched the Nighthawk RAXE300 Tri-band Wi-Fi 6E Router, which can deliver speed up to 7.8Gbps, and boasts the new 6GHz band for customers’ latest Wi-Fi 6E devices.

The current product launch of Nighthawk AXE3000 bodes well with the previous launch of Insight Managed Wi-Fi 6 and Nighthawk RAXE300 to provide users with high-speed Internet.

NETGEAR offers innovative networking and Internet-connected products for seamless networking, broadband access and network connectivity.

For the third quarter, the Zacks Consensus Estimate for revenues stands at $247 million, down 14.9% year over year. Also, the consensus mark for earnings is pegged at 10 cents per share, down 80% year over year.

For the third quarter of 2022, NETGEAR anticipates net revenues of $240-$255 million. The company remains optimistic that SMB and the CHP service provider channel will gain momentum in the second half of 2022 due to the solid demand and improving supply.

However, the company’s performance is negatively impacted due to continued softness in retail and service provider businesses. Increasing material, production and transportation costs are added concerns.

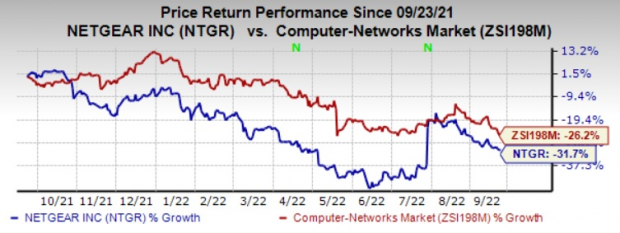

NETGEAR currently carries a Zacks Rank #4 (Sell). Shares of the company have lost 31.7% compared with the industry’s decline of 26.2% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Synopsys SNPS, Cadence Design System CDNS and Arista Networks ANET. Arista Networks and Cadence Design System each currently sport a Zacks Rank #1 (Strong Buy), whereas Synopsys presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.84 per share, up 4.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.2%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 3%. Shares of SNPS have decreased 3.8% in the past year.

The Zacks Consensus Estimate for CDNS 2022 earnings is pegged at $4.11 per share, rising 5.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.7%.

Cadence’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 9.8%. Shares of CDNS have jumped 2.1% in the past year.

The Zacks Consensus Estimate for Arista Network’s 2022 earnings is pegged at $4.04 per share, increasing 10.1% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.6%.

Arista Network’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.1%. Shares of ANET have increased 30.8% in the past year.

Just Released: Free Report Reveals Little-Known Strategies to Help Profit from the $30 Trillion Metaverse Boom

It's undeniable. The metaverse is gaining steam every day. Just follow the money. Google. Microsoft. Adobe. Nike. Facebook even rebranded itself as Meta because Mark Zuckerberg believes the metaverse is the next iteration of the internet. The inevitable result? Many investors will get rich as the metaverse evolves. What do they know that you don't? They’re aware of the companies best poised to grow as the metaverse does. And in a new FREE report, Zacks is revealing those stocks to you. This week, you can download, The Metaverse - What is it? And How to Profit with These 5 Pioneering Stocks. It reveals specific stocks set to skyrocket as this emerging technology develops and expands. Don't miss your chance to access it for free with no obligation.

>>Show me how I could profit from the metaverse!Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NETGEAR, Inc. (NTGR): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.