Marvell Technology’s MRVL data center switching business is one of the fastest-growing contributors within its data center portfolio. The company expects data center switch revenues to exceed $300 million in fiscal 2026 and $500 million in fiscal 2027. On its third-quarter fiscal 2026earnings call MRVL increased its data center growth projection for the rest of fiscal 2026, citing increased traction in its switching products.

Marvell Technology expects sustained demand for its 12.8T switch platforms as customers plan to use these for several more years in their scale-out networks. MRVL has also begun shipping next-generation 51.2T products, with a strong ramp expected in 2026. MRVL expects to introduce 100T switching products in 2026.

As data center switches are the core building block of the AI rack, enabling integration with interconnect, XPU attach, storage, and scale-up architectures, the company’s focus is on bringing out its 100T switches soon. MRVL’s 100T switch will come with high radix, supporting up to 576 ports, low power SerDes and high execution speed.

Marvell Technology is aligning itself with industry scale-up standards like UALink and ESUN. Sampling of 115T and 57T UALink solutions is planned for the second half of fiscal 2027, with volume production expected in fiscal 2028. In parallel, Marvell Technology is collaborating closely with customers on ESUN-based scale-up solutions, ensuring coverage across both ecosystems

How Competitors Fare Against MRVL

Marvell Technology competes with Broadcom AVGO and Cisco CSCO in the switching space. Broadcom’s PCIe Gen 6 switch and retimer are integrated in the AI rack solutions used by the world’s biggest hyperscalers, original design manufacturers and original equipment manufacturers. Cisco provides switching solutions under its campus networking portfolio.

Broadcom’s PCIe switch and retimer use these enterprises to simplify interoperability by leveraging Broadcom’s advanced telemetry and diagnostics. Cisco stands to gain from the start of a multi-year, multibillion-dollar refresh opportunity for its newest generation of switching products as the support for its 4000 and 6000 series switches ends.

MRVL's Price Performance, Valuation and Estimates

Shares of Marvell Technology have surged 11.6% in the past six months compared with the Zacks Electronics - Semiconductors industry’s appreciation of 21.8%.

MRVL 6-Month Performance Chart

Image Source: Zacks Investment Research

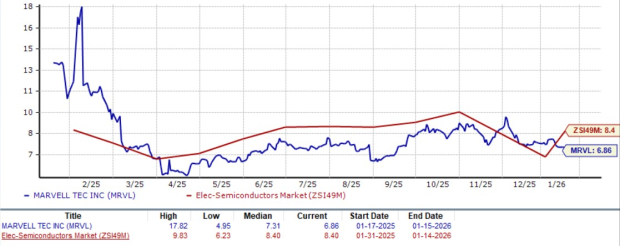

From a valuation standpoint, Marvell Technology trades at a forward price-to-sales ratio of 6.86, lower than the industry’s average of 8.40.

MRVL Forward 12-Month (P/S) Valuation Chart

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for MRVL’s fiscal 2026 and 2027 earnings implies year-over-year growth of 80.9% and 26.2%, respectively. The estimate for fiscal 2026 has been revised upward in the past 60 days, while the estimate for fiscal 2027 has been revised upward in the past 30 days.

Image Source: Zacks Investment Research

Marvell Technology currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.