Merck MRK is thriving on new products and pipeline candidates to drive its long-term growth. The company has built a substantial portfolio of new pipeline candidates and has made meaningful regulatory and clinical progress across areas like oncology, vaccines and infectious diseases while executing strategic business moves.

MRK’s phase III pipeline has almost tripled since 2021, supported by in-house pipeline progress as well as the addition of candidates through various merger and acquisition deals. This has positioned Merck to launch around 20 new vaccines and drugs over the next few years, with many having blockbuster potential.

Promising candidates in late-stage development include enlicitide decanoate/MK-0616, an oral PCSK9 inhibitor for hypercholesterolemia, tulisokibart, a TL1A inhibitor for ulcerative colitis, bomedemstat/MK-3543 for essential thrombocythemia, myelofibrosis and polycythemia vera, and Daiichi-Sankyo-partnered antibody-drug conjugates.

Yesterday, Merck reported positive top-line data from the pivotal phase III CORALreef Lipids study, which evaluated the safety and efficacy of enlicitide decanoate for treating adult patients with hypercholesterolemia who are on a moderate or high intensity statin (or with documented statin intolerance). The study met all the primary and key secondary endpoints.

Data from the CORALreef Lipids study showed that treatment with enlicitide decanoate led to statistically significant and clinically meaningful reduction in low-density lipoprotein cholesterol (LDL-C) or “bad cholesterol” versus placebo at week 24.

Treatment with enlicitide decanoate also led to statistically and clinically significant reductions across all key secondary endpoints including in non-high-density lipoprotein cholesterol, apolipoprotein B and lipoprotein(a) versus placebo.

Merck is also evaluating enlicitide decanoate in separate studies — the phase III CORALreef HeFH and the phase III CORALreef AddOn — for treating adults with hyperlipidemia already on lipid-lowering therapies, including at least a statin.

If successfully developed and upon potential approval, enlicitide decanoate would be the first marketed oral PCSK9 inhibitor for the given indication. Management believes that the therapy can potentially change the treatment paradigm for managing LDL levels.

MRK’s Potential Competition in the Target Market

Competition in the cholesterol management market has intensified with the introduction of PCSK9 inhibitors. Some notable PCSK9 inhibitors currently available in the cholesterol management market are Amgen’s Repatha and Regeneron REGN/Sanofi’s SNY Praluent.

AstraZeneca AZN is developing an oral, small-molecule PCSK9 inhibitor, AZD0780, for treating patients with elevated LDL-C levels, which cannot be controlled by statins alone.

Data from recent mid-stage studies have shown that AZN’s AZD0780 is well-tolerated and can significantly reduce LDL-C with a favorable safety profile.

Regeneron records net product sales of Praluent in the United States, and Sanofi does the same outside the country. The REGN/SNY drug generated sales worth $415.3 million in the first half of 2025.

MRK's Eyes New Drug Approvals for Long-Term Value

Merck is pinning hopes on new drug approvals for driving its long-term growth trajectory, especially when its blockbuster PD-L1 inhibitor, Keytruda, loses exclusivity in 2028. The company’s new 21-valent pneumococcal conjugate vaccine, Capvaxive, and pulmonary arterial hypertension drug, Winrevair, have the potential to generate significant long-term revenues. Both products have witnessed a strong launch so far.

Merck’s respiratory syncytial virus (RSV) antibody, Enflonsia (clesrovimab), was approved in the United States in June 2025, while it is under review in the EU. Merck is currently gearing up for the successful launch of Enflonsia to help protect infants entering their first RSV season.

A fixed-dose combination of doravirine and islatravir for the treatment of HIV is also under review in the United States, with an FDA decision expected in April next year.

MRK's Price Performance, Valuation and Estimates

Year to date, shares of Merck have lost 14.1% compared with the industry’s decrease of 0.5%.

Image Source: Zacks Investment Research

From a valuation standpoint, Merck appears attractive relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 9.12 forward earnings, lower than 14.78 for the industry and its 5-year mean of 12.73.

Image Source: Zacks Investment Research

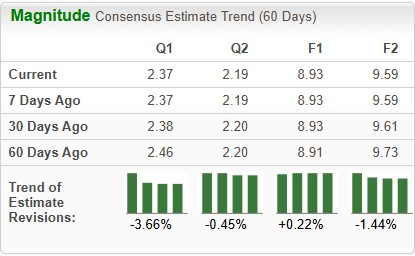

The Zacks Consensus Estimate for 2025 earnings has increased from $8.91 per share to $8.93, while the same for 2026 has decreased from $9.73 to $9.59 over the past 60 days.

Image Source: Zacks Investment Research

MRK's Zacks Rank

Merck currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.