Fintel reports that on August 9, 2023, Morgan Stanley maintained coverage of Doximity Inc - (NYSE:DOCS) with a Underweight recommendation.

Analyst Price Forecast Suggests 50.10% Upside

As of August 2, 2023, the average one-year price target for Doximity Inc - is 37.98. The forecasts range from a low of 28.28 to a high of $49.35. The average price target represents an increase of 50.10% from its latest reported closing price of 25.30.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Doximity Inc - is 534MM, an increase of 22.23%. The projected annual non-GAAP EPS is 0.81.

What is the Fund Sentiment?

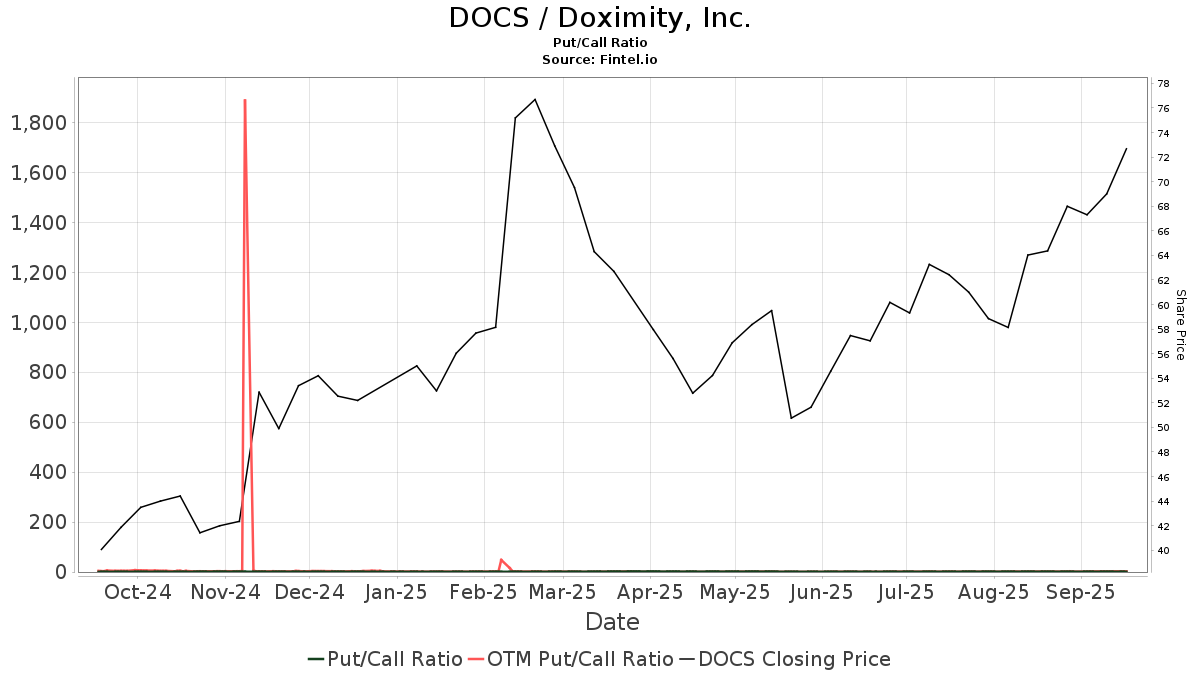

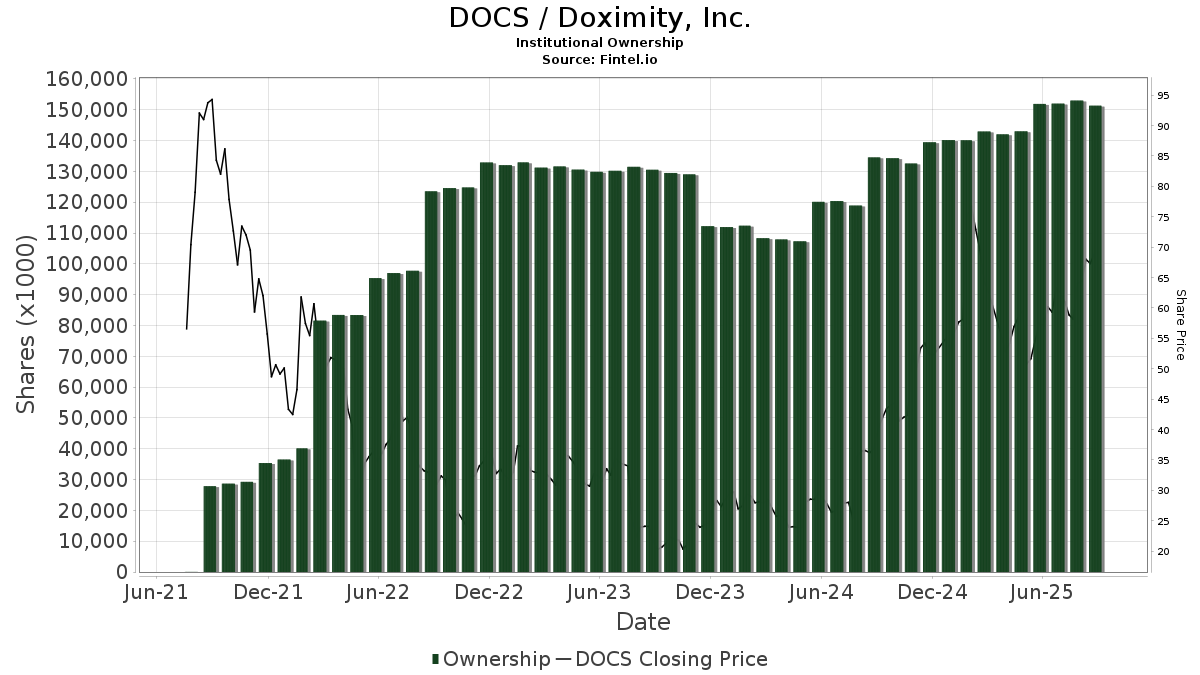

There are 684 funds or institutions reporting positions in Doximity Inc -. This is an increase of 11 owner(s) or 1.63% in the last quarter. Average portfolio weight of all funds dedicated to DOCS is 0.28%, a decrease of 8.82%. Total shares owned by institutions increased in the last three months by 0.18% to 133,268K shares.  The put/call ratio of DOCS is 0.95, indicating a bullish outlook.

The put/call ratio of DOCS is 0.95, indicating a bullish outlook.

What are Other Shareholders Doing?

Clearbridge Investments holds 6,774K shares representing 3.48% ownership of the company. In it's prior filing, the firm reported owning 5,805K shares, representing an increase of 14.31%. The firm increased its portfolio allocation in DOCS by 8.93% over the last quarter.

Baillie Gifford holds 6,599K shares representing 3.39% ownership of the company. In it's prior filing, the firm reported owning 4,389K shares, representing an increase of 33.50%. The firm increased its portfolio allocation in DOCS by 48.84% over the last quarter.

T. Rowe Price Investment Management holds 5,503K shares representing 2.83% ownership of the company. In it's prior filing, the firm reported owning 5,456K shares, representing an increase of 0.86%. The firm decreased its portfolio allocation in DOCS by 9.06% over the last quarter.

Eventide Asset Management holds 5,245K shares representing 2.69% ownership of the company. In it's prior filing, the firm reported owning 3,928K shares, representing an increase of 25.10%. The firm increased its portfolio allocation in DOCS by 19.86% over the last quarter.

ETGLX - Eventide Gilead Fund Class N holds 4,311K shares representing 2.21% ownership of the company. In it's prior filing, the firm reported owning 3,066K shares, representing an increase of 28.89%. The firm increased its portfolio allocation in DOCS by 25.11% over the last quarter.

Doximity Background Information

(This description is provided by the company.)

Founded in 2010, Doximity is the leading digital platform for U.S. medical professionals. The company's network members include over 80% of U.S. physicians across all specialties and practice areas. Doximity provides its verified clinical membership with digital tools built for medicine, enabling them to collaborate with colleagues, stay up to date with the latest medical news and research, manage their careers and conduct virtual patient visits. Doximity's mission is to help doctors be more productive so they can provide better health care for their patients.

Additional reading:

- Doximity Announces Fiscal 2024 First Quarter Financial Results Total revenues of $108.5 million, up 20% year-over-year Operating cash flow of $57.2 million, up 28% year-over-year Free cash flow of $55.6 million, up 31% year-over-year

- [Continued on next page]

- Doximity Announces New Workflow Products, Long-Term Financial Targets at Inaugural Investor Day Company Charts Path to $1 Billion in Revenue by Fiscal Year 2028

- INVESTOR DAY 2023 June 6, 2023 DOCS Investor Day — June 6, 2023 SAFE HARBOR This presentation and associated commentary may contain forward-looking statements, including statements regarding expectations of future results of operations or financial p

- Craig Overpeck Offer Letter

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.