The average one-year price target for ModivCare (NASDAQ:MODV) has been revised to 77.01 / share. This is an increase of 5.84% from the prior estimate of 72.76 dated October 31, 2023.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 60.60 to a high of 110.25 / share. The average price target represents an increase of 96.60% from the latest reported closing price of 39.17 / share.

What is the Fund Sentiment?

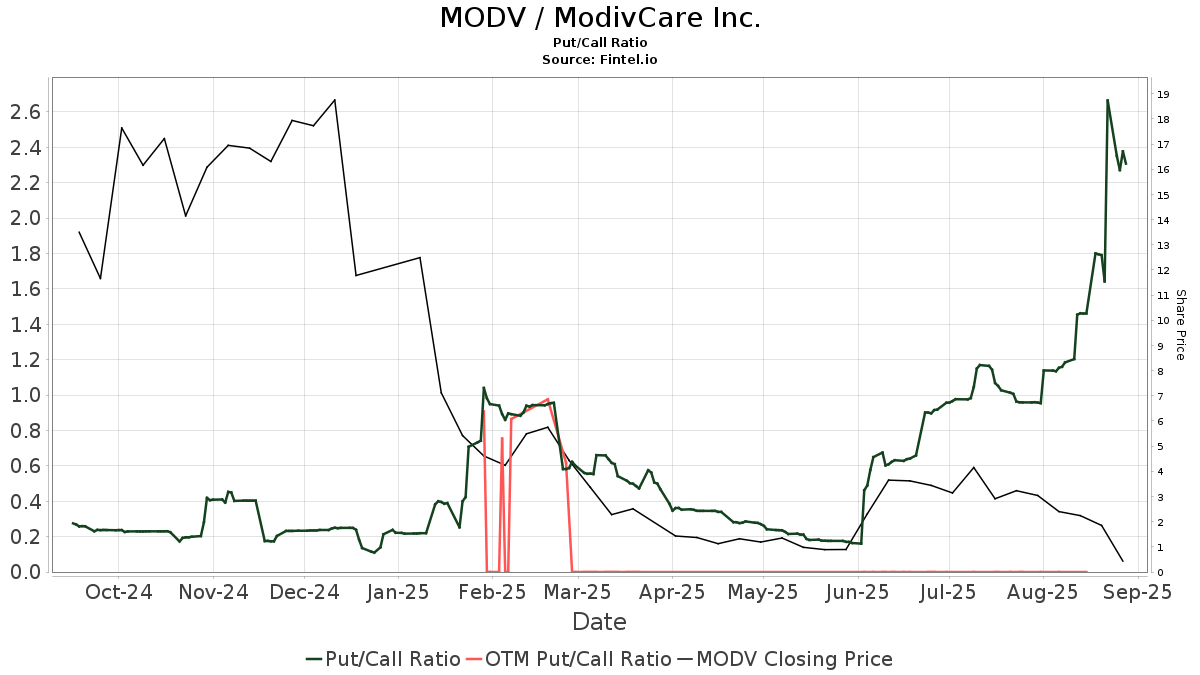

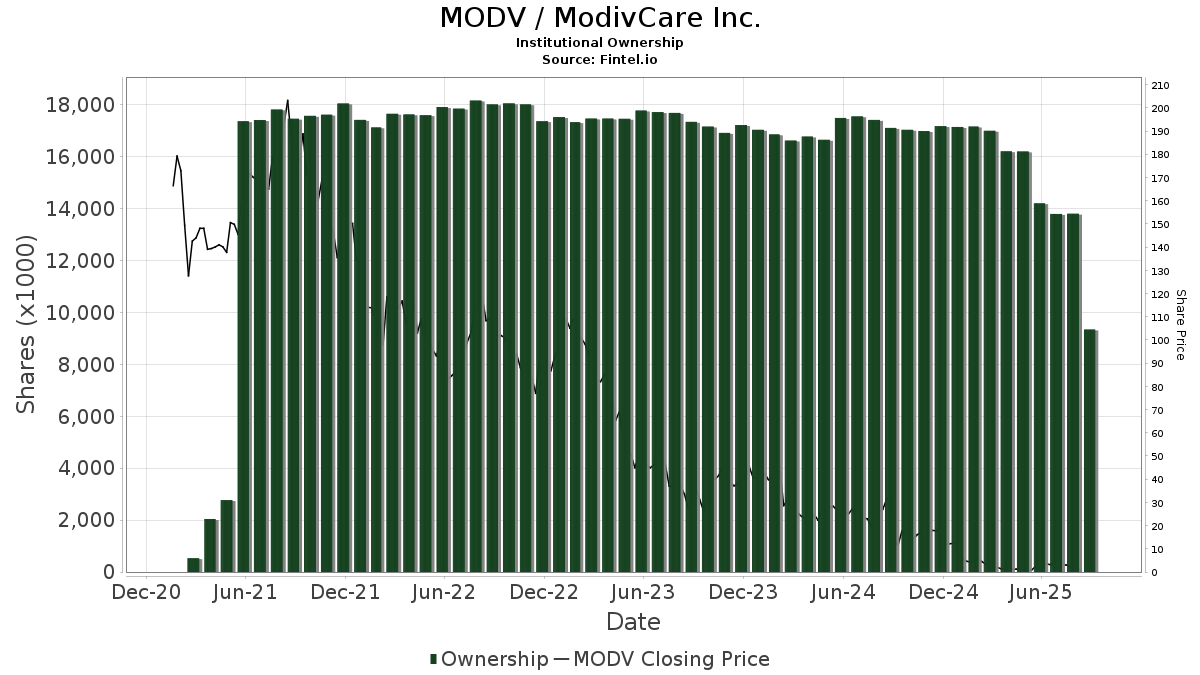

There are 401 funds or institutions reporting positions in ModivCare. This is a decrease of 22 owner(s) or 5.20% in the last quarter. Average portfolio weight of all funds dedicated to MODV is 0.11%, an increase of 10.08%. Total shares owned by institutions decreased in the last three months by 1.00% to 17,247K shares.  The put/call ratio of MODV is 0.91, indicating a bullish outlook.

The put/call ratio of MODV is 0.91, indicating a bullish outlook.

What are Other Shareholders Doing?

Coliseum Capital Management holds 2,983K shares representing 21.03% ownership of the company. In it's prior filing, the firm reported owning 1,668K shares, representing an increase of 44.08%. The firm increased its portfolio allocation in MODV by 44.10% over the last quarter.

Neuberger Berman Group holds 1,031K shares representing 7.27% ownership of the company. In it's prior filing, the firm reported owning 681K shares, representing an increase of 33.94%. The firm decreased its portfolio allocation in MODV by 45.40% over the last quarter.

Fuller & Thaler Asset Management holds 906K shares representing 6.39% ownership of the company. In it's prior filing, the firm reported owning 919K shares, representing a decrease of 1.39%. The firm decreased its portfolio allocation in MODV by 30.41% over the last quarter.

IJR - iShares Core S&P Small-Cap ETF holds 835K shares representing 5.88% ownership of the company. In it's prior filing, the firm reported owning 894K shares, representing a decrease of 7.12%. The firm decreased its portfolio allocation in MODV by 32.50% over the last quarter.

UBVLX - Undiscovered Managers Behavioral Value Fund Class L holds 756K shares representing 5.33% ownership of the company. In it's prior filing, the firm reported owning 752K shares, representing an increase of 0.54%. The firm decreased its portfolio allocation in MODV by 45.44% over the last quarter.

ModivCare Background Information

(This description is provided by the company.)

ModivCare Inc. ('ModivCare') is a technology-enabled healthcare services company, which provides a suite of integrated supportive care solutions for public and private payors and their patients. Its value-based solutions address the social determinants of health (SDoH), enable greater access to care, reduce costs, and improve outcomes. The Company is a leading provider of non-emergency medical transportation (NEMT), personal and home care, and nutritional meal delivery. ModivCare also holds a minority equity interest in CCHN Group Holdings, Inc. and its subsidiaries ('Matrix Medical Network'), which partners with leading health plans and providers nationally, delivering a broad array of assessment and care management services to individuals that improve health outcomes and health plan financial performance.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.