Midpoint Extended Life Order (M-ELO): Striking the Right Balance

Trading has always been a balance between execution quality, opportunity costs, and liquidity. Nasdaq Chief Economist Phil Mackintosh recently highlighted how trading strategies vary and dictate performance in What Markouts Are and Why They Don't Always Matter. There is a tradeoff between hit rates, fill rates and market impact. M-ELO is an order type that focuses on the execution quality experience, which means at times it will have a lower hit rate than other order types – for example, a displayed order will have a higher hit rate because the advertisement of liquidity that is inherent in the displayed nature of the order attracts liquidity seekers.

However, it is also likely to have more market impact. This is the tradeoff that algos and traders weigh when deciding how to execute an order. By listening to our customers, we realized the desire to make M-ELO more available for trading strategies that seek liquidity with exceptional execution quality and minimal market impact. To meet this need for improved hit and fill rates, we lowered the M-ELO holding period in May to refine the balance between hit and fill rates, and market impact.[1]

M-ELO has been live with its reduced holding period of 10 milliseconds for nearly five months, and the execution quality continues to perform among the best in the industry. Since M-ELO's timer enhancement, it has now asserted itself as an order type that strikes the balance of seeking liquidity while providing high-quality executions. Using execution data provided by Clearpool’s Venue Analysis, we looked at two widely utilized algo strategies, VWAP and Arrival Price.[2] The data indicates a significant increase in M-ELO hit rates while still outperforming competitive offerings. Since introducing the enhanced timer in May, M-ELOs hit and fill rates for the VWAP Strategy increased by 14%.

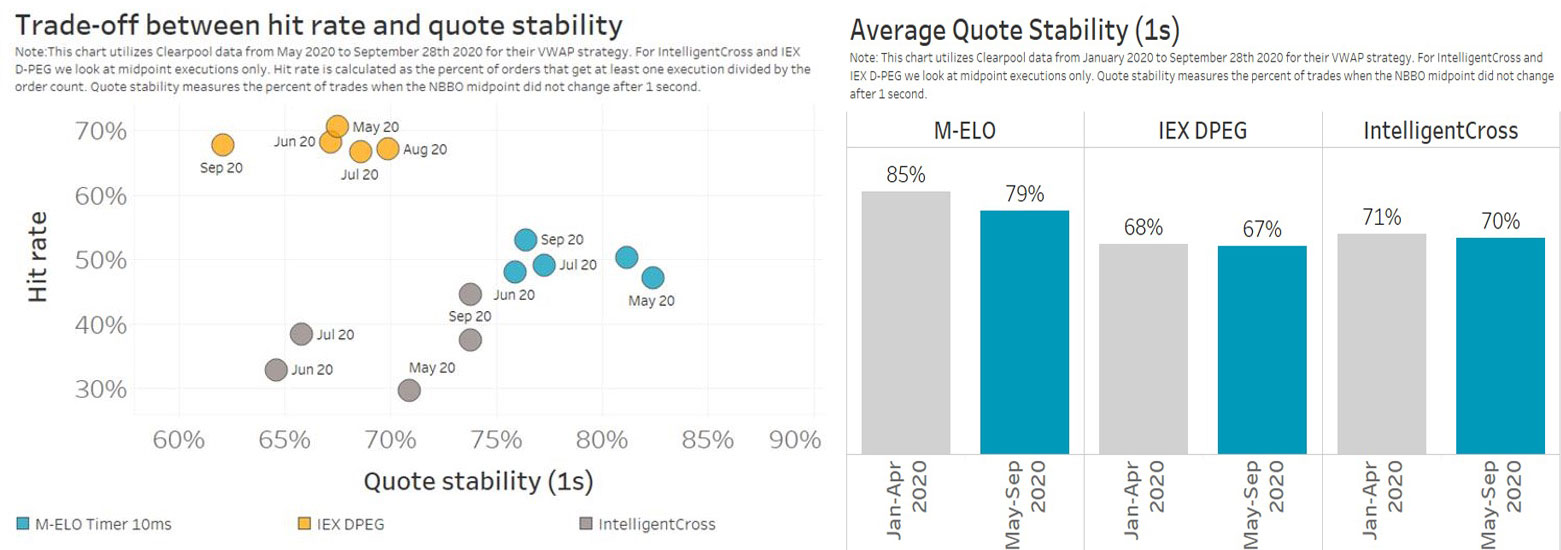

Not only have the hit and fill rates increased, the two charts below illustrates M-ELO continues to be the leader when it comes to performance and quote stability.

Arrival Price Algo

Looking at executions resulting from Clearpool’s Arrival Price strategy, we have seen more consistent results since the M-ELO timer enhancement. Hit rates have more than tripled while quote stabilty is 9% higher than D-PEG and 12% higher than IntelligentCross.

Utilizing data from Clearpool and looking at executions embedded in popular algo strategies, we continue to see M-ELO outperform in quote stability and execution quality. These strong performance trends continue, “…because M-ELO orders are selective about the liquidity that it interacts with, they are likely to have lower fulfillment than other midpoint or advertised liquidity. That’s the tradeoff for having a high quality fill, among other benefits.”[3] Post-timer-change M-ELO has improved its hit rate dramatically, while also maintaining strong post-trade quote stability, indicating low market impact and confirming that M-ELO is a best-in-class offering.

[2] All data provided by Clearpool’s Venue Analysis is aggregated and anonymous