It's the biggest of the big. It's Microsoft (NASDAQ: MSFT), a $3 trillion behemoth that, once again, claims the title as the world's largest company.

However, only 15 years ago, Microsoft was in a very different place. It ranked 35th on the Fortune 100, reflecting its poor performance as a company and as a stock.

Indeed, shares had declined in value by 67% from 2000 to 2009.

Yet, over the last 15 years, Microsoft's shares are up a staggering 2,730% -- meaning a $10,000 investment in 2009 would be worth $283,000 today.

So, what's behind this massive turnaround? One chart can help explain it. Let's have a look.

Microsoft has its head in the cloud

In short, the reason for Microsoft's renaissance under Chief Executive Officer (CEO) Satya Nadella (who took over for Steve Ballmer in 2014) is the growth of its cloud business.

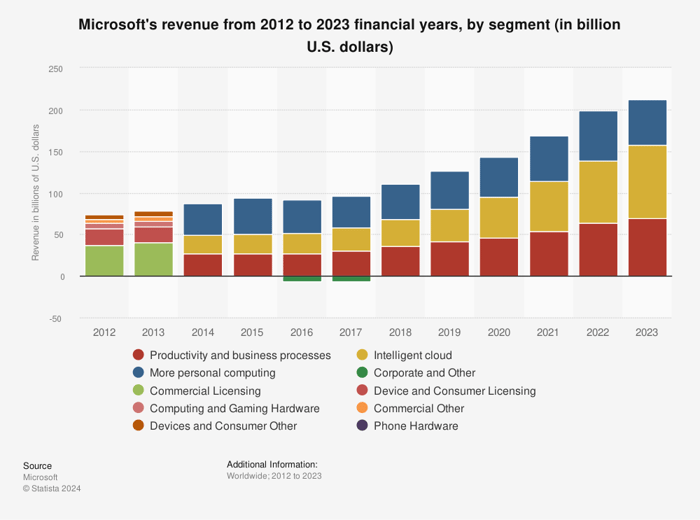

Take a look at this chart, which shows Microsoft's revenue by segment from 2012 through 2023:

Image source: Statista

As you can see, the company's cloud business (Intelligent Cloud-appears in yellow on the chart) was the smallest of its three segments when Nadella reorganized the company's divisions in 2014. It trailed both the Productivity and Business Processes segment (made up of the company's signature Office software suite; appears in dark red) and the More Personal Computing segment (made up of Windows software, Xbox gaming, and hardware devices; appears in navy blue).

Yet, in its latest quarter (the three months ending on Dec. 31, 2023), Microsoft reported Intelligent Cloud revenue of $25.9 billion, far ahead of the other two segments, which reported $19.2 billion and $16.9 billion, respectively.

In other words, Nadella has transformed an iconic personal computing and software company into a cloud services powerhouse. That's one of the reasons Nadella is arguably the most impressive CEO working today. And it's why Microsoft is riding high yet again.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 26, 2024

Jake Lerch has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.