Micron Technology, Inc. MU is benefiting from a sharp rise in demand for high-bandwidth memory (HBM), which has become a major driver of its dynamic random access memory (DRAM) growth. As artificial intelligence (AI) workloads expand across data centers, the need for faster and more efficient memory has surged, lifting Micron Technology’s shipments and pricing.

In the last reported financial results for the fourth quarter of fiscal 2025, MU’s DRAM revenues soared 68.7% year over year and 27% sequentially to $8.98 billion. DRAM bit shipments increased in the low-teens percentage range sequentially, while average selling prices rose in the low-double-digit percentage range during the fourth quarter.

The robust growth in DRAM revenues was supported by the strong adoption of Micron Technology’s HBM3E, high-capacity DIMMs and other advanced data center products. Management expects this momentum to continue in fiscal 2026 as AI training and inference workloads grow at an accelerated pace.

Micron Technology’s HBM business is advancing quickly, with the company now preparing for a transition to HBM4. Early samples have shown industry-leading bandwidth and power efficiency, giving it a competitive edge as major customers finalize their next-generation platform plans. The firm is also expanding its customer base and has already secured pricing agreements for most of its 2026 HBM3E supply, signaling strong revenue growth visibility.

Tight DRAM supply is another factor supporting Micron Technology’s growth outlook. Limited industry capacity additions and slowing node transitions are expected to keep supply constrained, giving Micron Technology greater pricing power. At the same time, broader demand from AI personal computers, smartphones and automobiles is adding more support to DRAM consumption.

Analysts are also optimistic about the company’s DRAM revenue growth prospects. The Zacks Consensus Estimate for Micron Technology’s fiscal 2026 DRAM revenues is currently pegged at $45.49 billion, indicating a year-over-year increase of 59%.

How Do Micron’s Rivals Stack Up in the Memory Chip Race?

Although there are no U.S. stock exchange-listed direct competitors for MU in the memory chip space, Intel Corporation INTC and Broadcom Inc. AVGO play key roles in the HBM supply chain and AI hardware ecosystem.

Intel is expanding its AI memory chip portfolio by integrating HBM into its high-performance accelerators. Intel's flagship AI accelerator, the Gaudi 3, features 128GB of HBM2e memory to provide high memory bandwidth for large-scale AI training and inference workloads.

Broadcom is expanding its AI chip business by developing high-performance custom AI accelerators and integrated advanced networking solutions that enable hyperscalers to utilize vast amounts of HBM effectively. Broadcom is co-designing and producing proprietary custom AI chips for companies like OpenAI, Google, Meta and ByteDance.

Micron’s Price Performance, Valuation and Estimates

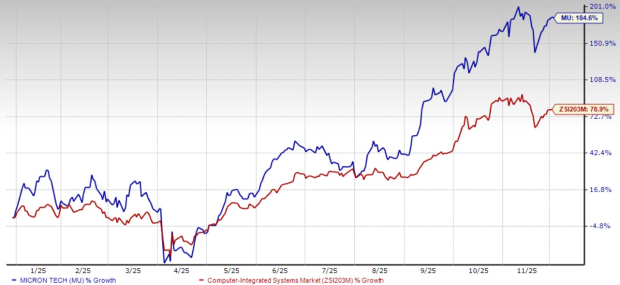

Shares of Micron have surged around 184.6% year to date compared with the Zacks Computer – Integrated Systems industry’s gain of 78.9%.

Micron YTD Price Return Performance

Image Source: Zacks Investment Research

From a valuation standpoint, MU trades at a forward price-to-earnings ratio of 13.01, significantly lower than the industry’s average of 23.01.

Micron Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Micron Technology’s fiscal 2026 and 2027 earnings implies a year-over-year increase of 109.4% and 23.5%, respectively. Bottom-line estimates for fiscal 2026 and 2027 have been revised upward in the past 30 days.

Image Source: Zacks Investment Research

Micron Technology currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Intel Corporation (INTC) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.