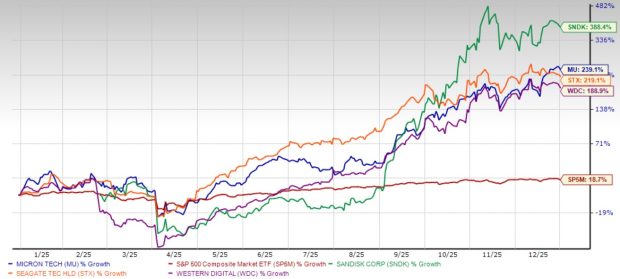

Micron Technology, Inc. MU stock had a remarkable run last year. With its shares soaring 239.1%, the memory chip maker was one of the top gainers of the S&P 500 Index, which was up 18.7% in 2025.

Micron Technology has been a key beneficiary of the artificial intelligence (AI) boom, which has driven strong demand for its memory chips. The ongoing AI boom has also benefited other memory and data storage solution providers, including Sandisk Corporation SNDK, Seagate Technology Holdings Plc STX and Western Digital Corporation WDC. In 2025, shares of Sandisk, Western Digital and Seagate Technology have gained 388.4%, 219.1% and 188.9%, respectively.

As the demand for memory solutions supporting AI and high-performance computing (HPC) is likely to remain strong, MU is well-positioned to capitalize on this opportunity. This makes the stock a more attractive investment option at present.

Micron Technology Price Return Performance in 2025

Image Source: Zacks Investment Research

New Tech Trends to Aid Micron’s Prospects

Micron Technology sits at the heart of several transformative tech trends. Its exposure to AI, high-performance data centers, autonomous vehicles and industrial IoT uniquely positions the company for sustainable long-term growth. As AI adoption accelerates, the demand for advanced memory solutions like DRAM and NAND is soaring. Micron Technology’s investments in next-generation DRAM and 3D NAND ensure it remains competitive in delivering the performance needed for modern computing.

The company’s diversification strategy is also yielding positive results. Micron Technology has created a more stable revenue base by shifting its focus away from the more volatile consumer electronics market and toward resilient verticals, such as automotive and enterprise IT. This balance enhances its ability to weather cyclical downturns, a critical trait in the semiconductor space.

Micron Technology is also riding on a strong wave in high-bandwidth memory (HBM) demand. Its HBM3E products are attracting significant interest for their superior energy efficiency and bandwidth, which are ideal for AI workloads.

In 2025, NVIDIA confirmed that Micron Technology is a core HBM supplier for its GeForce RTX 50 Blackwell GPUs, signaling deep integration in the AI supply chain. Additionally, its under-construction HBM advanced packaging facility in Singapore, set to launch in 2026 with further expansion in 2027, underscores the company’s commitment to scaling production for AI-driven markets.

Micron Technology’s Strong Financial Performance

Despite ongoing macroeconomic challenges, geopolitical issues, and trade and tariff wars, Micron Technology’s financials remain rock solid. The memory chip maker kicked off fiscal 2026 on a strong note by reporting overwhelming first-quarter results.

In the first quarter, revenues jumped 57% year over year to $13.64 billion, while non-GAAP earnings per share (EPS) rose 167% to $4.78. The top and bottom lines surpassed the Zacks Consensus Estimate by 7.26% and 22.25%, respectively.

Micron Technology reported a non-GAAP gross margin of 56.8%, a robust improvement from 39.5% in the year-ago quarter. Non-GAAP operating income increased to $6.42 billion from $2.39 billion in the year-ago quarter. Non-GAAP operating margin improved to 47% from 27.5%, reflecting the company’s ability to convert strong revenue growth into bottom-line gains.

Micron Technology, Inc. Price, Consensus and EPS Surprise

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

Analysts’ expectations for fiscal 2026 depict continued growth momentum for Micron Technology. The Zacks Consensus Estimate for fiscal 2026 revenues and EPS calls for year-over-year growth of 89.3% and 278.3%, respectively. The consensus mark for fiscal 2026 EPS has been revised upward by 80.6% over the past 30 days.

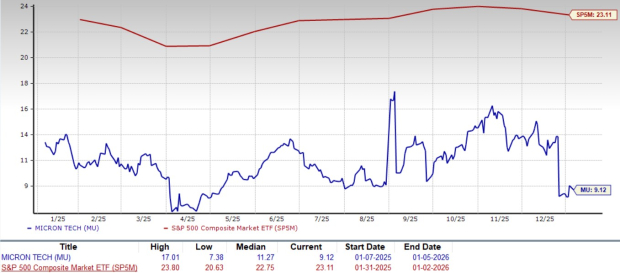

Low Valuation Justifies a Buy Strategy on MU Stock

Despite its strong growth, MU stock still looks reasonably priced. It trades at a forward 12-month price-to-earnings (P/E) multiple of 9.12, which is significantly lower than the S&P 500 average of 23.11. This discount adds to the appeal for long-term investors.

Micron Technology Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

Compared with other memory and data storage solution providers, Micron Technology has a lower P/E multiple than Seagate Technology, Western Digital and Sandisk. At present, Seagate Technology, Western Digital and Sandisk trade at P/E multiples of 22.21, 18.89 and 13.14, respectively.

Given its exposure to AI growth, Micron Technology’s relative valuation strengthens the case for buying the stock.

Conclusion: Buy MU Stock for Now

Micron Technology’s fundamentals remain strong, and its position in the AI-driven memory market is well-established. The company offers compelling long-term growth potential, maintains a disciplined approach to innovation and trades at a discount relative to peers. Considering these factors, it is prudent to accumulate MU stock.

Currently, Micron Technology sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Western Digital Corporation (WDC) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Sandisk Corporation (SNDK) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.