Marvell (MRVL) delivered stellar Q3 earnings last week, fueled by explosive growth in AI-related sales. Data center revenue surged 98% year-over-year, showcasing the company’s recent foray in this space. This strong performance and accelerating momentum in sales and earnings suggest Marvell could emerge as the next Nvidia (NVDA).

In the quarterly update, Marvell reported 19% sequential revenue growth in Q3, exceeding guidance. For Q4, the company projects another 19% sequential increase and 26% year-over-year growth, signaling the start of a new growth phase. CEO Matt Murphy attributed this success to custom AI silicon programs now in volume production and robust demand for cloud interconnect products, with substantial momentum expected to carry into FY26.

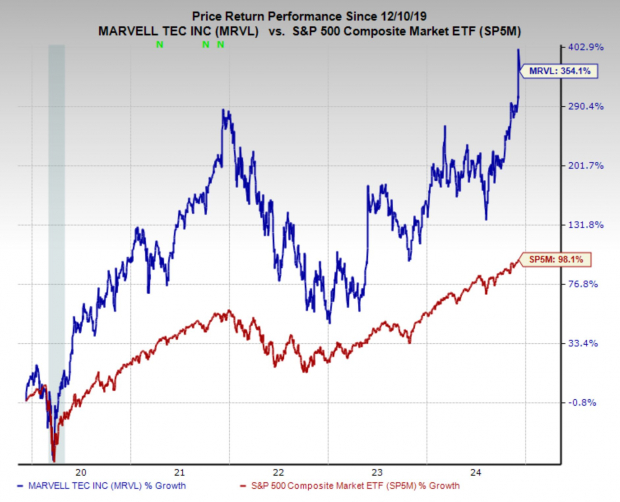

Marvell has been an outstanding stock over the past five years, delivering a remarkable annualized return of 35.3%. Now, with AI emerging as a major growth catalyst and price momentum accelerating, the outlook is brighter than ever. Analysts have taken notice, upgrading earnings and giving Marvell a coveted Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

Marvell Stock Rallies on AI Chip Designs

While Nvidia dominates the AI revolution with its powerful GPUs and full-stack solutions for hyperscalers, Marvell is carving out its own niche in the AI ecosystem. Rather than competing directly with Nvidia, Marvell’s custom ASIC chips complement Nvidia’s GPUs by handling specific AI workloads, offering tailored solutions for cloud and enterprise customers.

Marvell has already established itself as a critical partner for tech giants like Microsoft (MSFT) and Alphabet (GOOGL). Most recently, the company inked a massive five-year deal with Amazon (AMZN) to design AI chips, further solidifying its role in the next generation of cloud and AI infrastructure.

This pivot toward AI couldn’t come at a better time. While some of Marvell’s legacy segments have struggled, the booming demand for AI workloads, fueled by insatiable compute power and data requirements, has created a surge of optimism. With data center and AI-related sales expected to become the dominant driver of growth, Marvell is well-positioned to thrive in an increasingly AI-focused market.

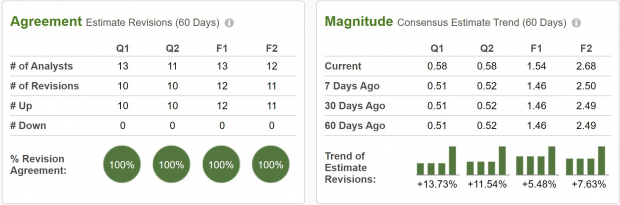

Marvell’s Earnings Revision Trend

These developments have clearly caught the attention of Wall Street analysts, as they have now unanimously upgraded earnings estimates for Marvell. In just the last week, earnings estimates have jumped 13.7% for the current quarter, 5.5% for the current year and 7.6% for next year.

Next year sales are forecast to grow 39.4% to $7.95 billion and earnings are forecast to climb 73.6% to $2.68 per share.

Image Source: Zacks Investment Research

Should Investors Buy Shares in MRVL?

Following last week’s strong earnings report, Marvell shares surged 23%. However, Monday’s 5% pullback presents a potential buying opportunity rather than a cause for concern. With exciting developments in AI, robust growth forecasts, and a top Zacks Rank, MRVL stands out as a compelling addition to any portfolio.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.