Lumen Technologies, Inc. LUMN has selected Blue Planet, a division of Ciena, for its intelligent automation software to support its strategic network inventory transformation efforts.

Enhanced visibility into network inventory through Blue Planet Inventory (BPI) will expedite the creation, development and support of Lumen solutions, such as Network-as-a-Service and the newly introduced Private Connectivity Fabric.

Instead of depending on multiple legacy inventory systems that need continuous, expensive and extensive customization, the Blue Planet deployment offers Lumen a modernized network inventory solution. This solution will help Lumen eliminate operational silos and address the issues caused by inaccurate inventory data.

By digitizing its network assets, Lumen can create a digital twin of its network, enabling test simulations for network planning, detecting potential issues and fostering new use cases like automation. Additionally, BPI will assist Lumen in resolving outages more rapidly and improving future data capture.

Lumen, a global communications services provider, offers networking, edge cloud, collaboration and cybersecurity solutions, and managed services to enhance business efficiency and create seamless, user-friendly technology environments.

Lumen Technologies, Inc. Price and Consensus

Lumen Technologies, Inc. price-consensus-chart | Lumen Technologies, Inc. Quote

Lumen’s second-quarter revenues were $3.268 billion, down 10.7% year over year on a reported basis. The decline was due to the negative impact of divestitures, commercial agreements and the sale of the CDN business.

However, opportunities driven by AI proliferation are emerging as a tailwind. Demand for the company’s Private Connectivity Fabric solutions is an encouraging development. Recently, Lumen secured $5 billion in new business driven by AI demand and is negotiating another $7 billion in sales. Additionally, Microsoft selected Lumen to enhance its network capacity and support next-gen applications.

To further support this expansion, LUMN signed its largest cable purchase agreement with Corning, securing 10% of the latter global fiber capacity for the next two years.

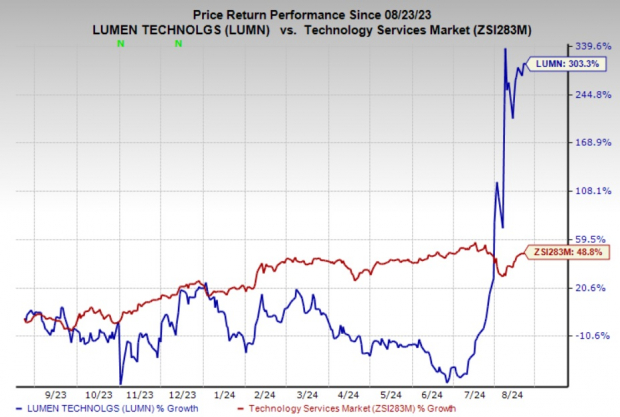

It currently carries a Zacks Rank #3 (Hold). Shares of the company have skyrocketed 303.3% in the past year compared with the sub-industry’s growth of 48.8%.

Image Source: Zacks Investment Research

Stocks to Consider

Badger Meter, Inc. BMI, sporting a Zacks Rank #1 (Strong Buy) at present, has a long-term earnings growth expectation of 17.9% and delivered an earnings surprise of 12.89%, on average, in the trailing four quarters. In the last reported quarter, BMI delivered an earnings surprise of 14.29%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, has a long-term earnings growth expectation of 17.2% and delivered an earnings surprise of 15.02%, on average, in the trailing four quarters. In the last reported quarter, ANET delivered an earnings surprise of 8.25%.

Itron, Inc. ITRI, carrying a Zacks Rank #2 (Buy) at present, has a long-term earnings growth expectation of 26% and delivered an earnings surprise of 57.02%, on average, in the trailing four quarters. In the last reported quarter, ITRI delivered an earnings surprise of 26.04%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.