Fintel reports that on May 10, 2023, Loop Capital maintained coverage of Lumentum Holdings (NASDAQ:LITE) with a Buy recommendation.

Analyst Price Forecast Suggests 25.36% Upside

As of May 11, 2023, the average one-year price target for Lumentum Holdings is 55.86. The forecasts range from a low of 40.40 to a high of $81.90. The average price target represents an increase of 25.36% from its latest reported closing price of 44.56.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Lumentum Holdings is 2,013MM, an increase of 10.71%. The projected annual non-GAAP EPS is 5.27.

What is the Fund Sentiment?

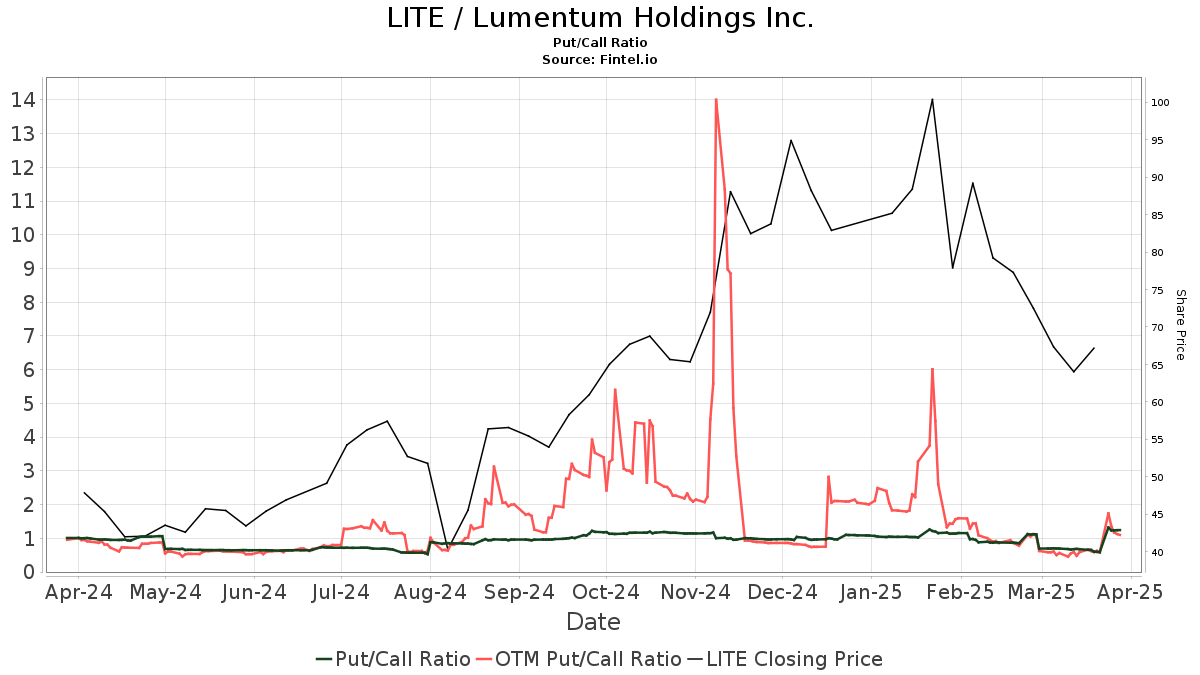

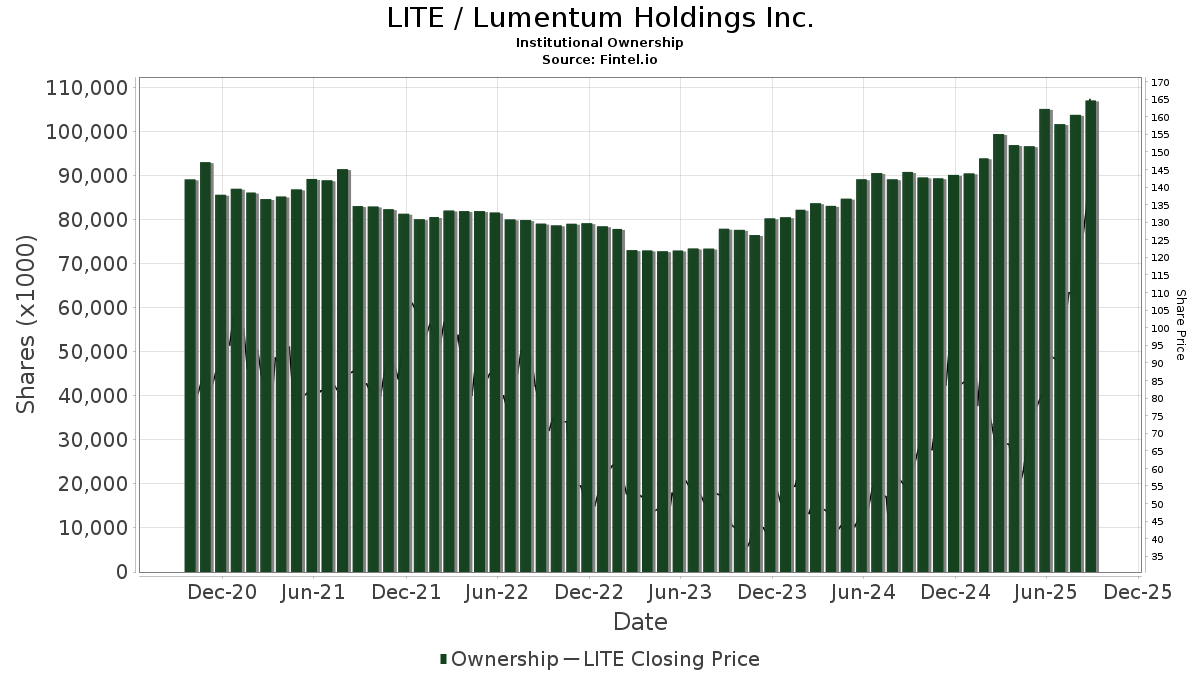

There are 883 funds or institutions reporting positions in Lumentum Holdings. This is a decrease of 38 owner(s) or 4.13% in the last quarter. Average portfolio weight of all funds dedicated to LITE is 0.22%, a decrease of 3.32%. Total shares owned by institutions decreased in the last three months by 6.44% to 71,949K shares.  The put/call ratio of LITE is 1.92, indicating a bearish outlook.

The put/call ratio of LITE is 1.92, indicating a bearish outlook.

What are Other Shareholders Doing?

Wellington Management Group Llp holds 5,092K shares representing 7.43% ownership of the company. No change in the last quarter.

Alliancebernstein holds 4,849K shares representing 7.08% ownership of the company. In it's prior filing, the firm reported owning 5,219K shares, representing a decrease of 7.62%. The firm decreased its portfolio allocation in LITE by 34.28% over the last quarter.

Ameriprise Financial holds 2,915K shares representing 4.26% ownership of the company. In it's prior filing, the firm reported owning 2,720K shares, representing an increase of 6.69%. The firm increased its portfolio allocation in LITE by 312.23% over the last quarter.

IJH - iShares Core S&P Mid-Cap ETF holds 2,106K shares representing 3.07% ownership of the company. In it's prior filing, the firm reported owning 2,016K shares, representing an increase of 4.26%. The firm decreased its portfolio allocation in LITE by 30.64% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,966K shares representing 2.87% ownership of the company. In it's prior filing, the firm reported owning 1,921K shares, representing an increase of 2.27%. The firm decreased its portfolio allocation in LITE by 28.10% over the last quarter.

Lumentum Holdings Background Information

(This description is provided by the company.)

Lumentum is a market-leading designer and manufacturer of innovative optical and photonic products enabling optical networking and laser applications worldwide. Lumentum optical components and subsystems are part of virtually every type of telecom, enterprise, and data center network. Lumentum lasers enable advanced manufacturing techniques and diverse applications including next-generation 3D sensing capabilities. Lumentum is headquartered in San Jose, California with R&D, manufacturing, and sales offices worldwide.

See all Lumentum Holdings regulatory filings.This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.