Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- Total Q3 earnings for the S&P 500 index are expected to be up +5% from the same period last year on +6% higher revenues.

- Unlike other recent periods, the revisions trend has been positive, with estimates for Q3 modestly up since the quarter got underway. Since the start of July, earnings estimates have increased for 5 of the 16 Zacks sectors, including Tech, Finance, and Energy.

- Excluding the Tech sector contribution, Q3 earnings for the rest of the S&P 500 index would be up only +2.1% (vs. +5% otherwise).

- For the Magnificent 7 group, Q3 earnings are expected to be up +11.4% from the same period last year on +14.5% higher revenues, which would follow the group’s +26.4% earnings growth on +15.5% revenue growth in the preceding period.

Positive Setup for the Q3 Earnings Season

As we have consistently highlighted in recent weeks, the overall revisions trend remains positive, with estimates for the back half of the year steadily going up.

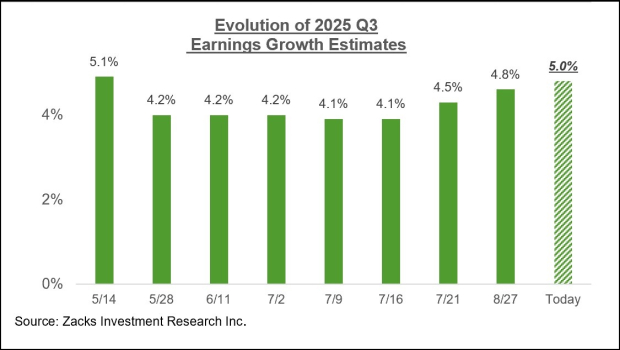

For 2025 Q3, the expectation is for earnings growth of +5.0% on +6.0% revenue gains. The chart below illustrates the evolution of Q3 earnings growth expectations over recent weeks.

Image Source: Zacks Investment Research

Since the start of Q3 this month, estimates have modestly increased for five of the 16 Zacks sectors, including Finance, Tech, Energy, Retail, and others.

On the negative side, Q3 estimates remain under pressure for the remaining 11 Zacks sectors, with significant declines to estimates for the Medical, Basic Materials, Construction, Transportation, and other sectors.

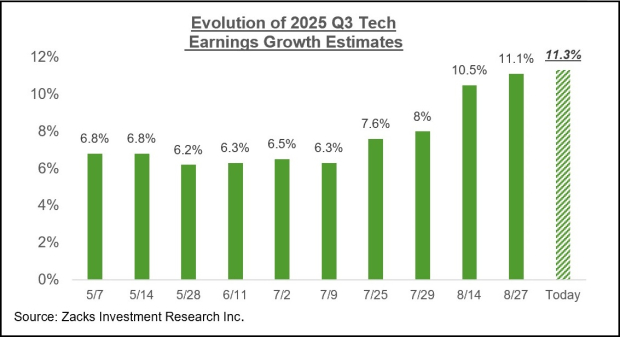

For the Tech sector, Q3 earnings are expected to be up +11.3% from the same period last year on +12.4% higher revenues. The chart below shows how the sector’s Q3 earnings growth expectations have evolved over the last couple of months.

Image Source: Zacks Investment Research

You can see the Tech sector’s positive revisions trend by looking at bellwether Tech sector operators like Microsoft MSFT, Nvidia NVDA, and others.

Microsoft is currently expected to bring in $3.65 per share in earnings in Q3 on $75.37 billion in revenues, representing year-over-year changes of +10.6% and +14.9%, respectively. Microsoft’s Q3 EPS estimate has increased from $3.64 a month ago and $3.53 two months ago.

The current Q3 EPS estimate for Nvidia has risen +2.6% over the past month and +4.4% over the last two months.

The Earnings Big Picture

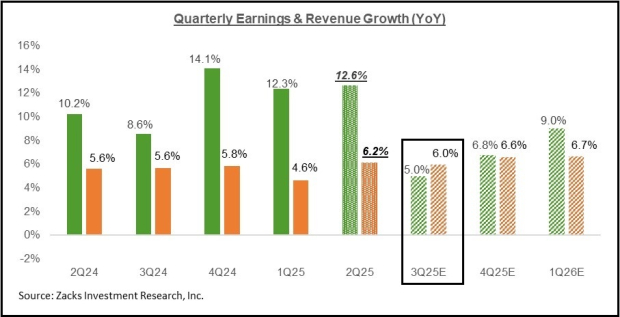

The chart below shows expectations for 2025 Q3 in terms of what was achieved in the preceding five periods and what is currently expected for the next two quarters.

Image Source: Zacks Investment Research

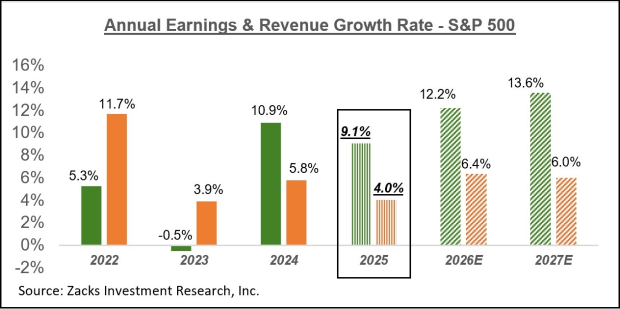

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

The aforementioned favorable revisions trend validates the market’s rebound from the April lows. With the Q2 reporting cycle now effectively behind us, the revisions trend has plateaued in recent days.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpMicrosoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.