UiPath (NYSE:PATH) is gearing up to announce its quarterly earnings on Thursday, 2025-05-29. Here's a quick overview of what investors should know before the release.

Analysts are estimating that UiPath will report an earnings per share (EPS) of $0.10.

UiPath bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

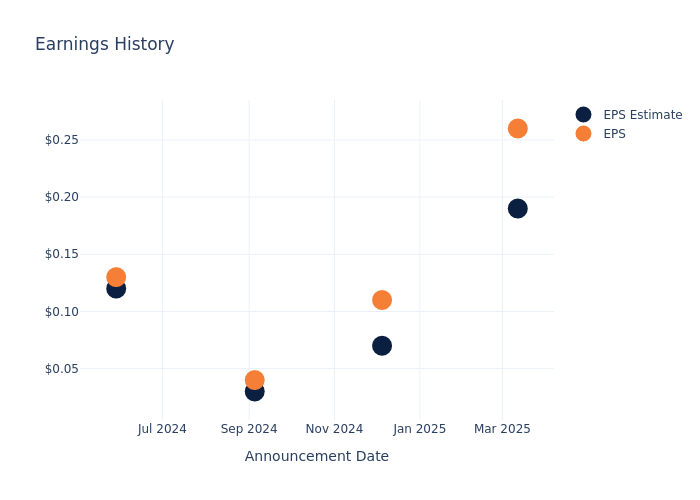

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.07, leading to a 15.72% drop in the share price on the subsequent day.

Here's a look at UiPath's past performance and the resulting price change:

| Quarter | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.19 | 0.07 | 0.03 | 0.12 |

| EPS Actual | 0.26 | 0.11 | 0.04 | 0.13 |

| Price Change % | -16.0% | -1.0% | -6.0% | -34.0% |

Performance of UiPath Shares

Shares of UiPath were trading at $12.67 as of May 27. Over the last 52-week period, shares are up 5.51%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about UiPath

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on UiPath.

The consensus rating for UiPath is Neutral, based on 13 analyst ratings. With an average one-year price target of $11.81, there's a potential 6.79% downside.

Comparing Ratings with Competitors

The following analysis focuses on the analyst ratings and average 1-year price targets of Dolby Laboratories, SentinelOne and GitLab, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Dolby Laboratories, with an average 1-year price target of $102.33, suggesting a potential 707.66% upside.

- Analysts currently favor an Outperform trajectory for SentinelOne, with an average 1-year price target of $24.19, suggesting a potential 90.92% upside.

- Analysts currently favor an Outperform trajectory for GitLab, with an average 1-year price target of $69.0, suggesting a potential 444.59% upside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for Dolby Laboratories, SentinelOne and GitLab, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| UiPath | Neutral | 4.54% | $359.11M | 2.90% |

| Dolby Laboratories | Buy | 1.38% | $333.72M | 3.61% |

| SentinelOne | Outperform | 29.48% | $168.51M | -4.28% |

| GitLab | Outperform | 29.10% | $188.56M | 0.77% |

Key Takeaway:

UiPath ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. UiPath is at the bottom for Return on Equity.

All You Need to Know About UiPath

UiPath Inc offers an end-to-end cross-application enterprise automation platform principally with computer vision technology and user interface automations in its initial RPA offering, which remains the foundation of the platform. The platform leverages a range of automation technologies including robotic process automation, application programming interface, and artificial intelligence. UiPath's solution can automate a broad range of repetitive tasks across industries including claims processing, employee onboarding, invoice to cash, loan applications, and customer service.

Understanding the Numbers: UiPath's Finances

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: UiPath's remarkable performance in 3 months is evident. As of 31 January, 2025, the company achieved an impressive revenue growth rate of 4.54%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 12.23%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): UiPath's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.9%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.87%, the company showcases effective utilization of assets.

Debt Management: UiPath's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.04.

To track all earnings releases for UiPath visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PATH

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2025 | Mizuho | Maintains | Neutral | Neutral |

| Mar 2025 | RBC Capital | Reiterates | Sector Perform | Sector Perform |

| Mar 2025 | Needham | Reiterates | Hold | Hold |

View More Analyst Ratings for PATH

View the Latest Analyst Ratings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.