ResMed (NYSE:RMD) is gearing up to announce its quarterly earnings on Wednesday, 2025-04-23. Here's a quick overview of what investors should know before the release.

Analysts are estimating that ResMed will report an earnings per share (EPS) of $2.36.

Anticipation surrounds ResMed's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

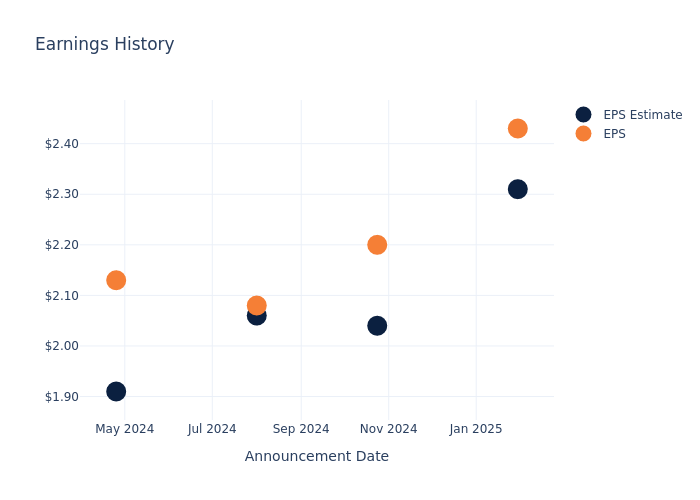

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.12, leading to a 8.33% drop in the share price the following trading session.

Here's a look at ResMed's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.31 | 2.04 | 2.06 | 1.91 |

| EPS Actual | 2.43 | 2.20 | 2.08 | 2.13 |

| Price Change % | -8.0% | 7.000000000000001% | 4.0% | 19.0% |

Stock Performance

Shares of ResMed were trading at $210.87 as of April 21. Over the last 52-week period, shares are up 15.82%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on ResMed

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on ResMed.

Analysts have provided ResMed with 5 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $267.0, suggesting a potential 26.62% upside.

Peer Ratings Overview

The following analysis focuses on the analyst ratings and average 1-year price targets of IDEXX Laboratories, GE HealthCare Techs and DexCom, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for IDEXX Laboratories, with an average 1-year price target of $507.0, suggesting a potential 140.43% upside.

- Analysts currently favor an Buy trajectory for GE HealthCare Techs, with an average 1-year price target of $104.33, suggesting a potential 50.52% downside.

- Analysts currently favor an Buy trajectory for DexCom, with an average 1-year price target of $97.8, suggesting a potential 53.62% downside.

Insights: Peer Analysis

The peer analysis summary outlines pivotal metrics for IDEXX Laboratories, GE HealthCare Techs and DexCom, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| ResMed | Outperform | 10.26% | $751.27M | 6.60% |

| IDEXX Laboratories | Neutral | 5.84% | $570.66M | 13.45% |

| GE HealthCare Techs | Buy | 2.17% | $2.27B | 8.60% |

| DexCom | Buy | 7.64% | $655.80M | 7.43% |

Key Takeaway:

ResMed ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Return on Equity.

All You Need to Know About ResMed

ResMed is one of the largest respiratory care device companies globally, primarily developing and supplying flow generators, masks and accessories for the treatment of sleep apnea. Increasing diagnosis of sleep apnea combined with ageing populations and increasing prevalence of obesity is resulting in a structurally growing market. The company earns roughly two thirds of its revenue in the Americas and the balance across other regions dominated by Europe, Japan and Australia. Recent developments and acquisitions have focused on digital health as ResMed is aiming to differentiate itself through the provision of clinical data for use by the patient, medical care advisor and payer in the out-of-hospital setting.

ResMed's Financial Performance

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: ResMed displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 10.26%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: ResMed's net margin excels beyond industry benchmarks, reaching 26.88%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): ResMed's ROE excels beyond industry benchmarks, reaching 6.6%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): ResMed's ROA excels beyond industry benchmarks, reaching 4.8%. This signifies efficient management of assets and strong financial health.

Debt Management: ResMed's debt-to-equity ratio is below the industry average at 0.16, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for ResMed visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for RMD

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2025 | Keybanc | Maintains | Overweight | Overweight |

| Mar 2025 | Citigroup | Upgrades | Neutral | Buy |

| Mar 2025 | Stifel | Maintains | Hold | Hold |

View More Analyst Ratings for RMD

View the Latest Analyst Ratings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.