Lockheed Martin Corp.’s LMT Rotary and Mission Systems business segment recently clinched a modification contract for Surface Electronic Warfare Improvement Program (SEWIP). The award has been offered by the Naval Sea Systems Command, Washington, DC.

Details of the Deal

Valued at $63.3 million, the contract is expected to be completed by February 2025. Per the terms of the deal, Lockheed will be engaged in full-rate production of SEWIP AN/SLQ-32(V)6 and AN/SLQ-32C(V)6 systems.

A major part of the work related to this contract will be executed in Liverpool, NY.

Importance of SEWIP

The rising threat of missile attacks has been fueling the demand for an effective electronic attack system that excels in defeating inbound threats.

In this context, it is imperative to mention that Lockheed’s AN/SLQ-32C(V)6 or “SEWIP Lite” is part of the SEWIP product line. The system provides early detection, analysis, threat warning and protection from anti-ship missiles.

SEWIP Lite is capable of both littoral and open ocean electronic surveillance. This system will be installed on fast frigate class and U.S. Coast Guard Offshore Patrol Cutters.

Such advantages of the electronic warfare system make it an attractive option for the military, resulting in LMT winning orders for the same, like the latest one. The aforementioned developments, along with Lockheed’s more than 40 years of Integrated Electronic Warfare experience, are likely to boost the company’s revenue-generation prospects from the SEWIP electronic warfare system.

Growth Prospects

Countries globally have been reinforcing their military resources due to intense geopolitical tensions and amplified terrorist threats. As a result, an effective electronic warfare system with anti-missile solution features is likely to witness a pent-up demand.

Per a report from the Markets and Markets firm, the global electronic warfare system market is projected to witness a CAGR of more than 4% during 2022-2027. Such growth prospects are likely to benefit Lockheed as its SEWIP product already holds a strong position in the aforementioned market.

The abounding growth prospects should also benefit other defense majors who have forayed into the laser-based countermeasure system like Northrop Grumman NOC, L3Harris Technologies LHX and General Dynamics GD.

Northrop Grumman’s SEWIP Block 3 is the third in a series of incremental upgrades that adds an electronic attack capability to the AN/SLQ-32 electronic warfare system to defend ships against anti-ship missiles. The SEWIP Block 3 system is inherently multifunctional, creating an expanded mission set to defeat emergent threats and support the U.S. Navy’s Distributed Maritime Operations CONOPS.

NOC’s long-term earnings growth rate is pegged at 3.5%. The Zacks Consensus Estimate for the company’s 2023 sales indicates an improvement of 4.6% from the prior-year reported figure.

L3Harris’ Viper Shield all-digital electronic warfare suite is custom designed to be a baseline on advanced F-16 Block 70/72 aircraft and maximize their survivability and mission success. Some other products of LHX are AN/ALQ-161A, AN / ALQ-211 CV-22, NH 90, F-16 self-protection system, AN / ALQ-214 (IDECM) F/A-18 countermeasure system, etc.

The company’s long-term earnings growth rate is pegged at 2.6%. The Zacks Consensus Estimate for its 2023 sales indicates an improvement of 3.6% from the prior-year reported figure.

Since many years, General Dynamics has been performing as the Lead Systems Integrator for SEWIP Block 1. Its SEWIP, a spiral-block development program, provides an immediate improvement for the legacy surface ship electronic warfare detection and countermeasure system — the AN/SLQ-32.

GD boasts a long-term earnings growth rate of 8.6%. The Zacks Consensus Estimate for the company’s 2023 sales indicates an improvement of 4.2% from the prior-year reported figure.

Price Movement

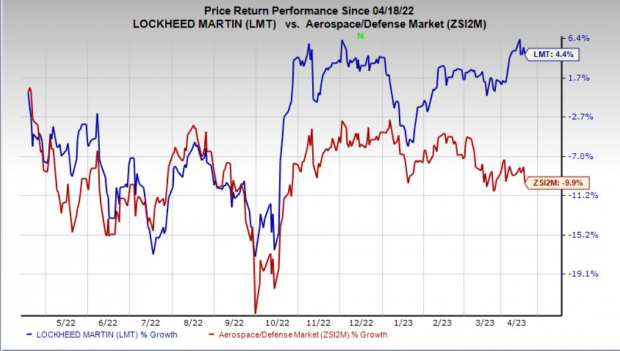

In the past year, shares of Lockheed have rallied 4.4% against the industry’s 9.9% decline.

Image Source: Zacks Investment Research

Zacks Rank

Lockheed currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don't miss your chance to download Zacks' top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

>>Send me my free report on the top 5 EV stocksLockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.