Lockheed Martin Corp.’s LMT business segment, Rotary and Mission Systems, recently clinched a modification contract involving the AEGIS Combat System. The Naval Sea Systems Command, Washington, DC, has awarded the deal.

Valued at $92.5 million, the contract is projected to be completed by December 2022. Per the terms, Lockheed will make AEGIS Combat System Engineering Agent efforts for the design, development, integration, test and delivery of Advanced Capability Build.

Importance of Aegis Combat System

Manufactured by Lockheed Martin, the Aegis Weapon System is the world’s premier naval air defense system and the sea-based element of the U.S. Ballistic Missile Defense System. A key component of this naval warfare system is the SPY-1 multi-function phased array radar, which is the world’s most advanced and versatile maritime radar. It is scalable to meet the mission needs of a range of ships, from corvettes to aircraft carriers.

Globally, the Aegis Weapon System is at sea or part of current new ship construction programs for more than 100 ships.

Looking Ahead

Countries worldwide have been reinforcing their military resources due to intense geopolitical tensions and amplified terrorist threats. This has spurred demand for missile systems. The United States, which is the largest exporter of military weaponries worldwide, is also focused on strengthening military resources, with Aegis being one of the key defense programs. This is quite evident from the allotment of a $1-billion investment plan in the U.S. fiscal 2022 defense budget for Aegis Ballistic Missile Defense systems. Hence, we may expect a solid flow of contracts from the Pentagon involving Aegis systems.

Price Movement

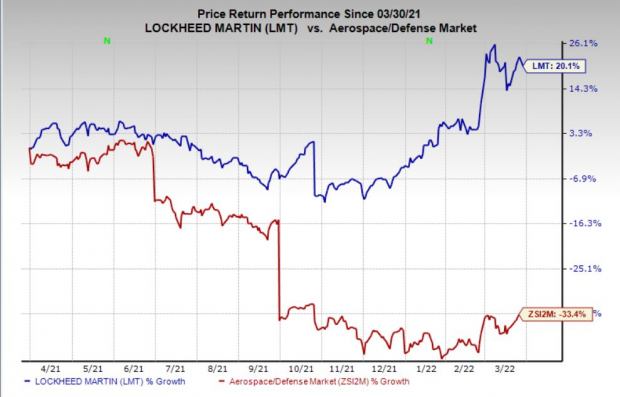

In the past year, shares of Lockheed Martin have gained 20.1% against the industry's 33.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Lockheed Martin currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same industry include Huntington Ingalls Industries HII, Airbus Group EADSY and Spire SPIR, each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Huntington Ingalls boasts a four-quarter average earnings surprise of 22.22%. The Zacks Consensus Estimate for HII’s 2022 earnings indicates an improvement of 14.1% from the 2021 reported figure.

The Zacks Consensus Estimate for HII’s 2022 sales indicates an improvement of 13.9% from the 2021 reported figure. The stock has gained 3.7% in the past six months.

Airbus boasts a four-quarter average earnings surprise of 69.02%. The Zacks Consensus Estimate for EADSY’s 2022 earnings has moved up 2.7% over the past 60 days.

The Zacks Consensus Estimate for EADSY’s 2022 sales indicates an improvement of 9.7% from the 2021 reported figure. The stock has gained 4.4% in the past year.

Spire posted an earnings surprise of 21.43% in the last reported quarter. The Zacks Consensus Estimate for SPIR’s 2022 earnings indicates an improvement of 47.3% from the 2021 reported figure.

The Zacks Consensus Estimate for SPIR’s 2022 sales indicates an improvement of 101.3% from the 2021 reported figure.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free.Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Airbus Group (EADSY): Free Stock Analysis Report

Spire Global, Inc. (SPIR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.