The average one-year price target for Ladder Capital Corp - (NYSE:LADR) has been revised to 12.45 / share. This is an increase of 9.33% from the prior estimate of 11.39 dated July 5, 2023.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 11.62 to a high of 13.65 / share. The average price target represents an increase of 13.31% from the latest reported closing price of 10.99 / share.

Ladder Capital Corp - Declares $0.23 Dividend

On June 15, 2023 the company declared a regular quarterly dividend of $0.23 per share ($0.92 annualized). Shareholders of record as of June 30, 2023 received the payment on July 17, 2023. Previously, the company paid $0.23 per share.

At the current share price of $10.99 / share, the stock's dividend yield is 8.37%.

Looking back five years and taking a sample every week, the average dividend yield has been 9.05%, the lowest has been 6.43%, and the highest has been 33.33%. The standard deviation of yields is 3.82 (n=236).

The current dividend yield is 0.18 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.84. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is -0.32%.

What is the Fund Sentiment?

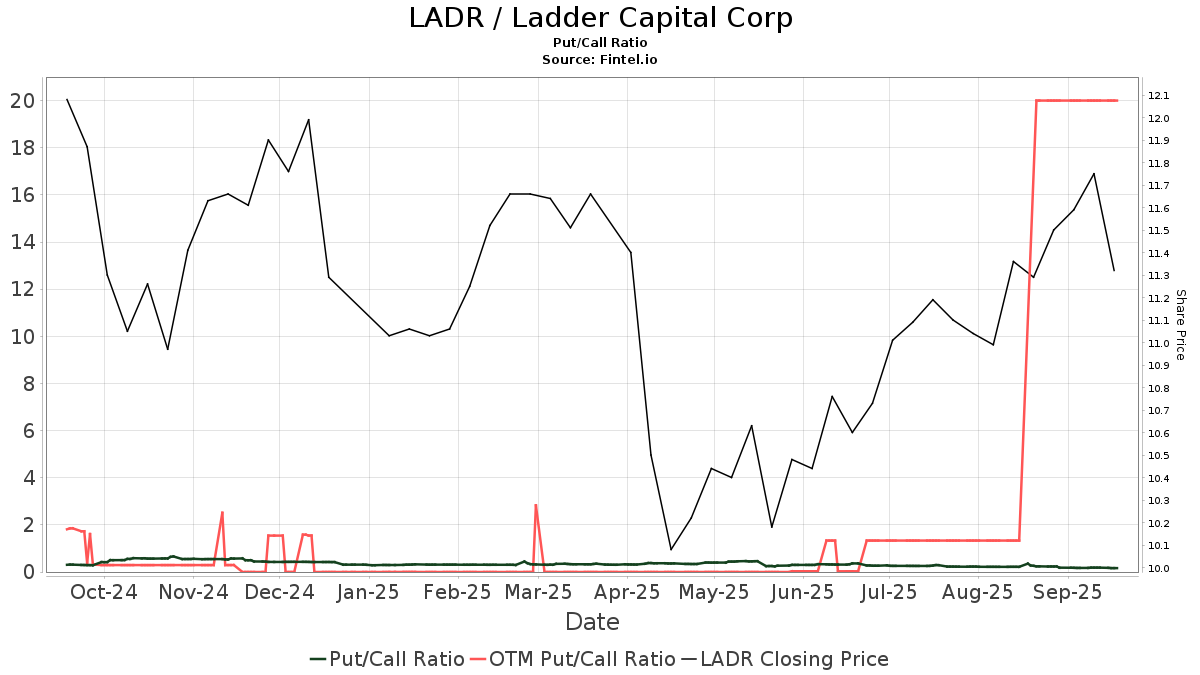

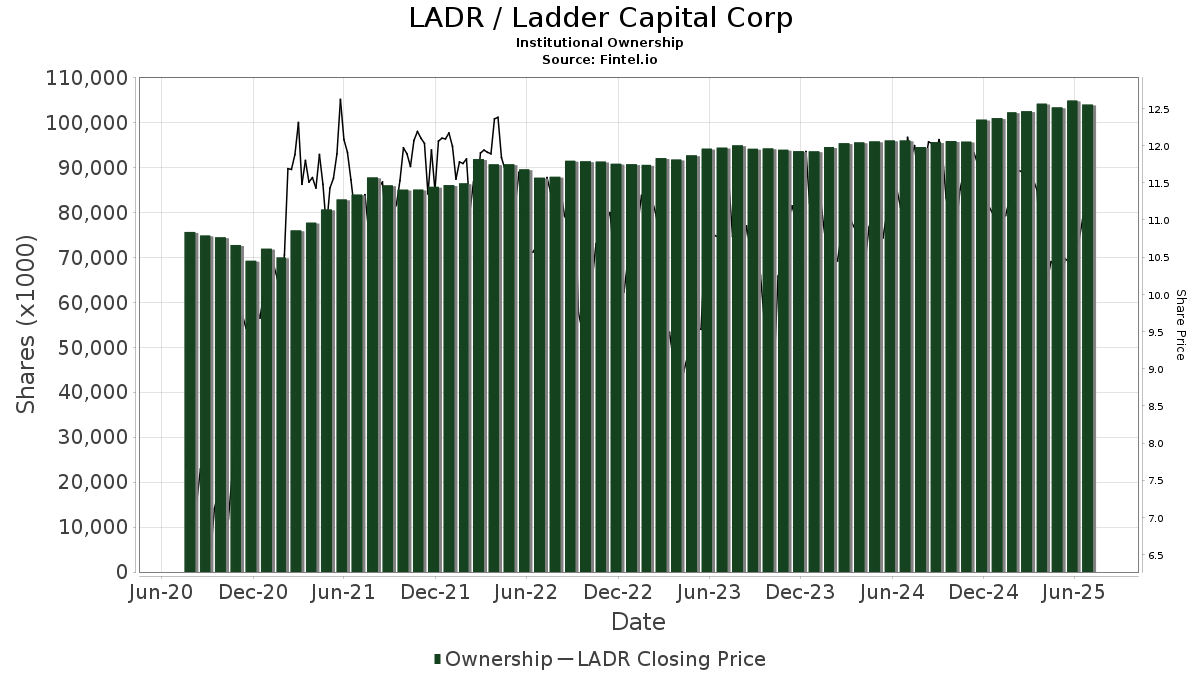

There are 385 funds or institutions reporting positions in Ladder Capital Corp -. This is an increase of 12 owner(s) or 3.22% in the last quarter. Average portfolio weight of all funds dedicated to LADR is 0.16%, a decrease of 39.84%. Total shares owned by institutions increased in the last three months by 2.40% to 94,911K shares.  The put/call ratio of LADR is 0.44, indicating a bullish outlook.

The put/call ratio of LADR is 0.44, indicating a bullish outlook.

What are Other Shareholders Doing?

Jennison Associates holds 5,325K shares representing 4.20% ownership of the company. In it's prior filing, the firm reported owning 4,309K shares, representing an increase of 19.08%. The firm decreased its portfolio allocation in LADR by 43.67% over the last quarter.

Brown Advisory holds 4,331K shares representing 3.41% ownership of the company. In it's prior filing, the firm reported owning 4,187K shares, representing an increase of 3.33%. The firm decreased its portfolio allocation in LADR by 57.44% over the last quarter.

Koch Industries holds 4,000K shares representing 3.15% ownership of the company. No change in the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,521K shares representing 2.77% ownership of the company. In it's prior filing, the firm reported owning 3,525K shares, representing a decrease of 0.12%. The firm decreased its portfolio allocation in LADR by 13.19% over the last quarter.

Nuveen Asset Management holds 3,164K shares representing 2.49% ownership of the company. In it's prior filing, the firm reported owning 2,984K shares, representing an increase of 5.69%. The firm decreased its portfolio allocation in LADR by 4.28% over the last quarter.

Ladder Capital Background Information

(This description is provided by the company.)

Ladder Capital Corp is an internally-managed commercial real estate investment trust with over $6 billion of assets. Our investment objective is to preserve and protect shareholder capital while producing attractive risk-adjusted returns. As one of the nation’s leading commercial real estate capital providers, we specialize in underwriting commercial real estate and offering flexible capital solutions within a sophisticated platform.

Additional reading:

- Ladder Capital Corp Reports Results for the Quarter Ended June 30, 2023

- Amended and Restated Employment Agreement, dated June 15, 2023, between Ladder Capital Finance LLC and Paul J. Miceli

- Employment Agreement, dated June 15, 2023, between Ladder Capital Finance LLC and Kelly Porcella

- 2023 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K filed on June 7, 2023)

- Amendment to Second Amended and Restated Certificate of Incorporation of Ladder Capital Corp (incorporated by reference to Exhibit 3.1 to the Company’s Form 8-K filed on June 7, 2023)

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.