L3Harris Technologies, Inc. LHX unveiled Diamondback — a new autonomous reconnaissance and security vehicle system — this week at the Association of the United States Army's annual convention. This launch should expand LHX’s footprint in the booming unmanned ground vehicle (“UGV”) market space.

Brief Note on LHX’s Diamondback

Diamondback is an autonomous reconnaissance and security system that can be instantly modified to suit any mission and provide a technical advantage over any danger. Diamondback's open development methodology enhances production ramp-up, lowers costs, boosts maintainability and speeds technology insertions to allow mission adaption.

Diamondback's system's mobility, autonomous stack and mission-specific modular payload suites enable initial contact to occur anywhere, decreasing the danger of force. It is intended to supplement current classes of robotic vehicles by filling functions and costs associated with manned vehicles.

The vehicle and its mission systems are designed to operate autonomously, reducing the requirement for direct control while increasing the mission’s efficiency.

LHX’s Growth Opportunities

Factors like the rapidly increasing demand for autonomous systems in the defense and commercial sectors have been bolstering the demand for UGVs. Solid technological upgrades, enabling UGVs to be used in civilian operations like rescue missions during natural calamities, have also contributed significantly to the demand for UGVs over the past decade.This must have prompted the Mordor Intelligence firm to expect the global UGV market to witness a CAGR of 9.8% over 2024-2029.

Such a solid growth opportunity offered by the global UGV market should bode well for LHX. In addition to Diamondback, L3Harris’ T4 is a versatile, advanced unmanned ground vehicle with exceptional mobility, strength and performance across all-terrain and all-weather capability to tackle any task.

Opportunities for Other Aerospace Companies

Apart from L3Harris, the expanding UGV market provides growth opportunities to defense majors like Northrop Grumman NOC, BAE Systems BAESY and Teledyne Technologies, Inc.’s TDY, which hold a strong presence in this space.

Northrop Grumman's Andros FX is a dexterous UGV designed to defeat a wide range of threats, including vehicle-borne improvised explosive devices. It also includes updated system electronics, mobility improvements for increased speed and maneuverability, and a new touchscreen operator control unit with 3-D system graphics, advanced manipulator controls and an improved user interface.

Northrop Grumman has a long-term (three to five years) earnings growth rate of 8.7%. The Zacks Consensus Estimate for NOC’s 2024 sales implies an improvement of 5.4% from the prior-year reported figure.

BAE Systems' Ironclad offers a distinct set of capabilities for a UGV. It uses high-endurance battery power to provide near-silent operation over a range of 50 kilometers. A modular connection system connects two vehicles to carry additional weights, such as a customized stretcher. It is also insulated from explosions and small weapons fire, thereby increasing mission survivability.

BAE Systems boasts a long-term earnings growth rate of 12.4%. The Zacks Consensus Estimate for BAESY’s 2024 sales calls for an improvement of 37.4% from the prior-year reported figure.

Teledyne’s SUGV 325 is an unmanned ground vehicle offering superior mobility in the portable robotics space, designed to effectively address modern challenges. In its lightest operational configuration, the SUGV 325 weighs only 9.1 kilograms, which makes this single-person-lift robot easier to carry across rough terrain.

TDY’s long-term earnings growth rate is pegged at 7.3%. The company delivered an average earnings surprise of 3.47% in the last four quarters.

LHX’s Stock Price Movement

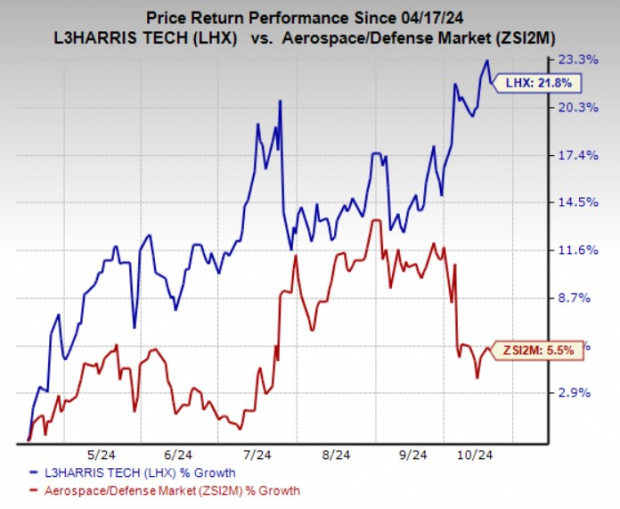

In the past six months, shares of L3Harris have risen 21.8% compared with the industry’s growth of 5.5%.

Image Source: Zacks Investment Research

LHX’s Zacks Rank

L3Harris currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.