Keysight Technologies, Inc. KEYS recently joined the Silicon Integration Initiative (Si2) Technology Interoperability Trajectory Advisory Council (“TITAN”).

TITAN is a leadership forum focused on accelerating ecosystem collaboration with technology interoperability for silicon-to-system success.

TITAN serves as the technology advisor to the Si2 board of directors, which forwards proposals to Si2 technology teams for action plans.

Keysight’s leaders participate in the TITAN executive council and its subcommittees. Niels Fache, vice president and general manager for Keysight’s PathWave Software Solutions, joins the 15-member TITAN executive council.

Si2 creates innovative electronic design automation (EDA) tools and system interoperability initiatives that serve Keysight’s customers in the semiconductor and electronics systems industries.

The TITAN membership reflects Keysight’s commitment to contributing to technology interoperability and supporting industry standards within its PathWave workflows.

TITAN’s goal is to accelerate time to market by fostering innovation through industry collaboration. The council explores technology interoperability gaps between EDA suppliers, cloud providers, foundries, semiconductor and silicon-to-system companies.

Keysight brings a critical perspective to TITAN from its vertical market expertise in delivering software-centric solutions that address radio frequency and microwave applications.

Keysight is witnessing growth in both Communications Solutions Group and Electronic Industrial Solutions Group segments. The Santa Rosa, CA-based company is likely to benefit from industry-wide growth and a strong pipeline of new business bookings.

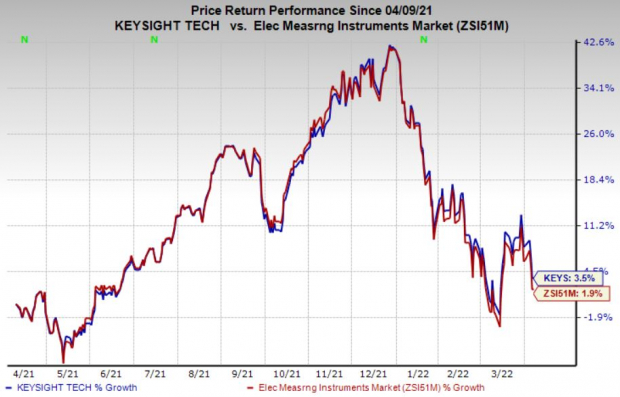

The stock has inched up 3.5% in the past year compared with the industry’s growth of 1.9%.

Image Source: Zacks Investment Research

KEYS currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearfield, Inc. CLFD is a better-ranked stock in the broader Zacks Computer and Technology sector, sporting a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised upward by 20.5% over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.7%, on average. It has gained 97.2% in the past year.

Qualcomm, Inc. QCOM, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. The consensus estimate for current-year earnings has been revised upward by 12.2% over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 12.2%, on average. It has moved down 0.9% in the past year.

Sierra Wireless, Inc. SWIR carries a Zacks Rank #2. The consensus mark for current-year earnings has been revised upward by 237.5% over the past 60 days.

Sierra Wireless pulled off a trailing four-quarter earnings surprise of 58%, on average. The stock has returned 12.1% in the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Sierra Wireless, Inc. (SWIR): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Clearfield, Inc. (CLFD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.