Keysight Technologies, Inc. KEYS recently announced that it has collaborated with Synopsys Inc. SNPS to develop an enhanced cybersecurity validation solution for loT (Internet of Things) devices. This easy and cost-effective solution is likely to offer a comprehensive security testing platform to identify potential vulnerabilities and thwart cyber threats with an easy-to-use interface.

loT devices are witnessing rising demand for various industry use cases owing to automation and cost-saving features. The surge in demand and complex functionalities make it imperative to ensure a robust security standard in these devices, which are often found missing in the manufacturing products, to prevent data breaches and protect user privacy.

Keysight’s IoT security assessment software suite offers an automated solution that quickly detects security flaws with a simple and intuitive user interface. Furthermore, integration of Synopsys Defensics Fuzz Testing significantly boosts the capability of Keysight loT Security Assessment technology.

Software vulnerabilities can be classified as either known or unknown. When an attacker exploits these unknown vulnerabilities to initiate malicious activities, they can remain unnoticed for extended periods. Reactive security solution often struggles to mitigate this kind of threat. The intelligent Fuzz testing from Synopsys empowers Keysight testing solutions with features that proficiently discover unknown vulnerabilities and weaknesses.

The advanced features can be applied in a wide range of use cases, including issues like weak authentication, encryption flaws, expired certificates, detection of Android vulnerabilities and Android Debug Bridge exposures, and more. It analyzes more than 300 technology protocols from various industry scenarios, offering users versatile, automated testing methods that ensure affordability and accelerate time to market. The comprehensive solution also simplifies the process for manufacturers to obtain White House Cyber Trust Mark certification for new loT products.

The market valuation for loT devices is expected to reach a staggering $413.7 billion by 2031 and per a recent study, roughly 57% of loT products are susceptible to various cyber-attacks. Keysight is taking active initiatives to capitalize on this market opportunity. The introduction of an effective, reliable and automated testing method will boost the company's commercial prospects significantly.

Keysight is gaining traction from strong industry-wide growth. It is witnessing solid adoption of its electronic design and test solutions. Electronic devices form the fulcrum of IoT services, wireless devices, data centers and 5G technologies. The rapid adoption of these devices is increasing demand for electronics testing equipment.

Keysight boasts a robust 5G portfolio. Its 5G product design validation solutions, ranging from Layer 1 to 7, enable telecom and semiconductor companies to accelerate their 5G initiatives. The company has also experienced an increase in investments in digital health, IoT and advanced research. Further, Keysight’s 5G network emulation solutions facilitate end-to-end processes from development to deployment, accelerating the 5G device architecture. The solutions offer cost-efficient test techniques with high flexibility and control capabilities, reducing time-to-market. Apart from strength in the 5G domain, Keysight’s efforts in other emerging growth markets like IoT and high-speed data centers bode well for the top line.

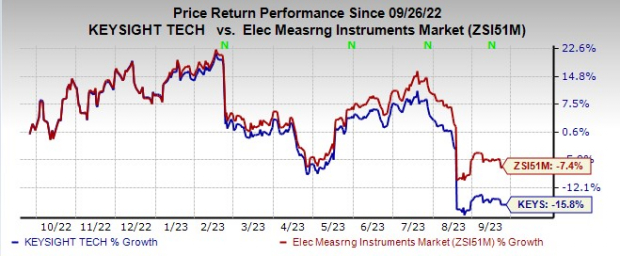

Shares of the company have declined 15.8% over the past year compared with the industry’s fall of 7.4%.

Image Source: Zacks Investment Research

Keysight currently carries a Zacks Rank #3. (Hold)

Stocks to Consider

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 (Buy) at present, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 5.58%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

It provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 9.79%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 29.19%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.