Fintel reports that on February 12, 2025, Keybanc initiated coverage of Rapid Micro Biosystems (NasdaqCM:RPID) with a Overweight recommendation.

Analyst Price Forecast Suggests 149.89% Upside

As of January 29, 2025, the average one-year price target for Rapid Micro Biosystems is $8.16/share. The forecasts range from a low of $8.08 to a high of $8.40. The average price target represents an increase of 149.89% from its latest reported closing price of $3.27 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Rapid Micro Biosystems is 52MM, an increase of 97.39%. The projected annual non-GAAP EPS is -1.20.

What is the Fund Sentiment?

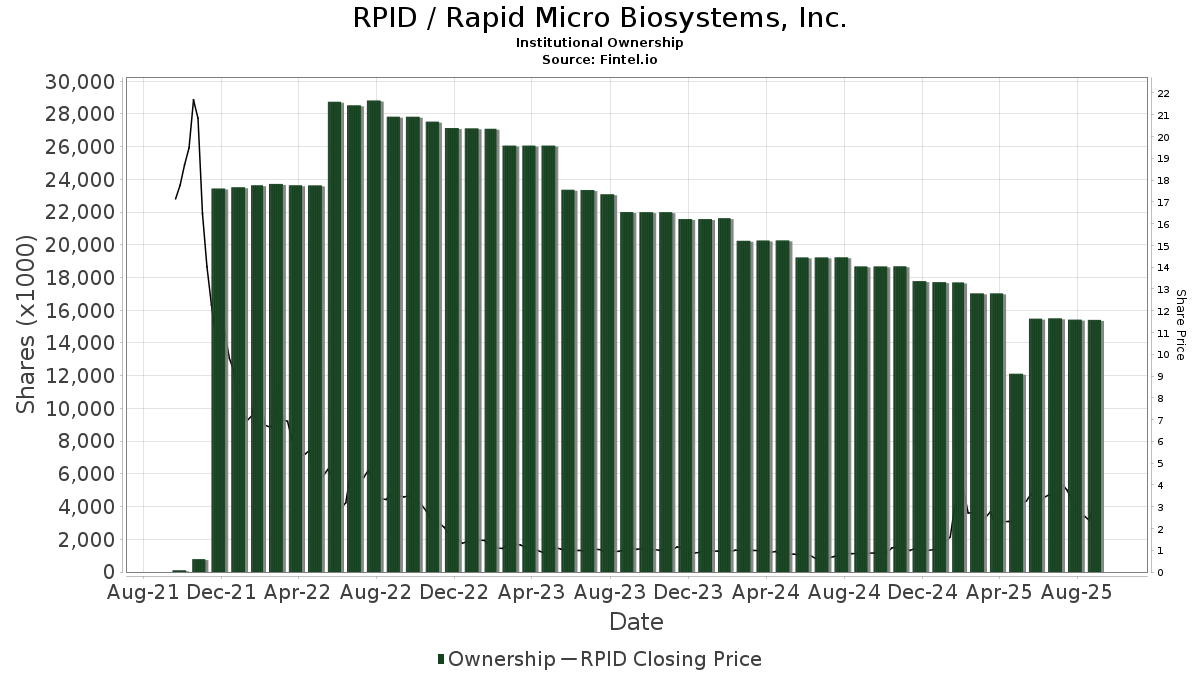

There are 31 funds or institutions reporting positions in Rapid Micro Biosystems. This is an decrease of 7 owner(s) or 18.42% in the last quarter. Average portfolio weight of all funds dedicated to RPID is 0.82%, an increase of 32.17%. Total shares owned by institutions decreased in the last three months by 2.48% to 17,706K shares.

What are Other Shareholders Doing?

Bain Capital Life Sciences Investors holds 8,435K shares representing 22.36% ownership of the company. No change in the last quarter.

Kennedy Lewis Management holds 4,940K shares representing 13.09% ownership of the company. No change in the last quarter.

ABG-WTT Global Life Science Capital Partners GP holds 1,038K shares representing 2.75% ownership of the company. No change in the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 595K shares representing 1.58% ownership of the company. No change in the last quarter.

Advent International holds 578K shares representing 1.53% ownership of the company. No change in the last quarter.

Rapid Micro Biosystems Background Information

(This description is provided by the company.)

Rapid Micro Biosystems is the industry leader in automated detection of microbial contamination with innovative products for fast, accurate, and efficient detection of microbial contamination in the manufacture of pharmaceuticals, biologics, biotechnology products, medical devices, and personal care products. The company’s Growth Direct® platform - the only growth-based platform to fully automate traditional microbial testing - detects contamination more quickly, delivering compelling economic benefits to manufacturers while improving their quality control (QC) process. The company is headquartered and has U.S. manufacturing in Lowell, Massachusetts, and global locations in Germany and the Netherlands.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.