KBR, Inc. KBR has nabbed a contract from Taiwan's state-owned oil company, CPC Corporation, for its market-leading Rose technology.

Shares of KBR gained 1.1% during the trading session on Apr 13, 2022.

Per the contract, KBR will provide a license, basic engineering and proprietary equipment to CPC for its ROSE supercritical Solvent De-Asphalting (SDA) technology and Vacuum Distillation Unit (VDU).

Pertaining to the last award, Doug Kelly, KBR president, Technology, said, “KBR's design features an innovative integration solution between the VDU and ROSE unit, which significantly reduces the project's carbon footprint.”

The demand for KBR’s technologies across ammonia for food productions, olefins for non-single-use plastics, and in refining for product diversification and more green solutions to meet tighter environmental standards has been going strong.

Being a leader in residue upgrading technologies, KBR has the largest installed base and has been involved in the licensing, design, engineering, and/or construction of 70 ROSE units worldwide, with a combined licensed capacity of nearly 1.6 million barrels per stream day.

Overall, the determination to lower emissions, product diversification, energy efficiency, and more sustainable technologies and solutions have been driving KBR’s performance. At present, the company’s ROSE technology — which delivers 50% energy savings compared to conventional SDA technologies — is a cost-effective residue upgrading process. It enables refiners to produce higher grade, cleaner products while reducing the facility's carbon footprint.

KBR has been performing pretty well. KBR’s solid backlog level of $14.97 billion (as of Dec 31, 2021) highlights its underlying strength. This was backed by a solid contract-winning spree, strong project execution, and impressive performance of its government and technology businesses.

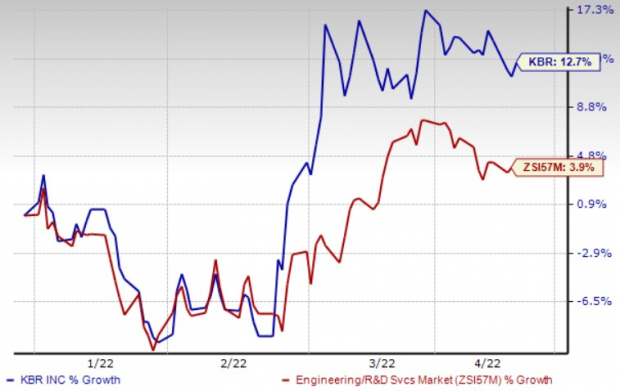

KBR’s solid prospects are backed by continuous contract wins, strong project execution, backlog level, and potential government as well as technology businesses. KBR’s shares have gained 12.7% year to date, outperforming the Zacks Engineering - R and D Services industry’s 3.9% rise.

Image Source: Zacks Investment Research

Zacks Rank

Currently, KBR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Top-Ranked Stocks From the Broader Construction Sector

Tri Pointe Homes TPH currently holds a Zacks Rank #1. This Irvine, CA-based homebuilder has been gaining from higher pricing and improved operating leverage. Cost-cutting initiatives and focus on entry-level buyers have been adding to the positives.

Tri Pointe Homes’ earnings are expected to grow 20.9% in 2022.

AECOM ACM — a Zacks Rank #2 company — is a leading solutions provider delivering professional, technical and management solutions for diverse industries across end markets. ACM has been continuously focusing on delivering industry-leading margins and unlocking capital to promote growth as well as innovation. Also, focus on higher-margin and lower-risk Professional Services businesses bodes well.

Over the past 60 days, AECOM’s earnings estimates for fiscal 2022 have increased to $3.40 from $3.35. The projected figure indicates a 20.6% year-over-year rise.

Lennar Corporation LEN — a Zacks Rank #2 company — is a well-known homebuilder. The company is benefiting from effective cost control and focus on making its homebuilding platform more efficient, leading to higher operating leverage.

The consensus mark for LEN’s earnings for fiscal 2022 has increased to $16.43 from $15.82 per share over the past 30 days. Lennar’s earnings for fiscal 2022 are expected to rise 15.1% year over year.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the Zacks Top 10 Stocks portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Lennar Corporation (LEN): Free Stock Analysis Report

Tri Pointe Homes Inc. (TPH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.