JPMorgan Chase’s JPM European arm, J.P. Morgan SE, has been fined €12.18 million ($14.32 million) by the European Central Bank (ECB) for incorrectly reporting its capital requirements. The action follows findings that the bank miscalculated its risk-weighted assets (RWAs), a key metric used to determine how much capital lenders must hold against potential losses.

The decision, announced yesterday, centers on reporting discrepancies that stretched across several years and affected the regulator’s assessment of the bank’s risk exposure.

JPMorgan’s Capital Errors Per ECB

According to the ECB, between 2019 and 2024, JPMorgan reported lower RWAs than required under regulatory standards. For 15 consecutive quarters, corporate exposures were misclassified, leading to the application of reduced credit risk weights that did not align with banking rules.

When RWAs are understated, capital ratios, which signal a bank’s ability to absorb losses, appear stronger than they actually are.

In addition, for 21 straight quarters, the lender excluded certain transactions when calculating RWAs tied to credit valuation adjustment (CVA) risks. CVA risks reflect the possibility that a counterparty in a derivatives contract may default. By omitting these transactions, the reported risk exposure did not fully capture the underlying obligations.

The ECB concluded that the inaccurate figures prevented supervisors from obtaining a complete and accurate view of the bank’s risk profile. It further stated that the breaches were committed with serious negligence, citing clear shortcomings in internal processes and controls that failed to detect the errors in a timely manner. The credit risk breach was categorized as “severe,” while the CVA-related breach was deemed “moderately severe.”

JPMorgan’s Response?

JPM acknowledged the penalty and said that the matter was fully addressed. A spokesperson stated that the issues were proactively identified and self-reported, and have since been remediated.

The regulator has noted that the decision may be challenged before the court of justice of the European Union.

JPMorgan has emphasized that it has consistently maintained strong capital buffers and that its prudent capitalization approach remains unchanged.

Thus, while the financial penalty is modest relative to the bank’s scale, the case underscores the importance regulators place on accurate risk reporting and robust internal controls within Europe’s banking system.

JPM’s Price Performance & Zacks Rank

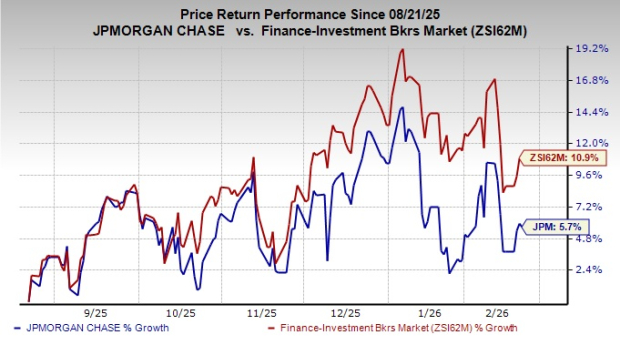

In the past six months, shares of JPMorgan have gained 5.7% compared with the industry’s 10.9% growth.

Image Source: Zacks Investment Research

Currently, JPM carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Firms Facing Legal Troubles

In November 2025, the Federal Deposit Insurance Corporation (“FDIC”) filed a lawsuit against Capital One COF, alleging that the bank paid about $100 million less than it should have to help bail out depositors of Silicon Valley Bank and Signature Bank, when both collapsed in 2023.

The FDIC took control of Silicon Valley Bank and Signature Bank in March 2023, and estimated in June 2024 that it would recover $18.6 billion from 111 banks through special assessments. Banks with less than $5 billion in assets were exempted from these charges.

In sync with this, Capital One estimated in July 2025 that it might have to reserve an additional $200 million. The main concern of the dispute was whether Capital One understated its level of uninsured deposits by excluding a $56-billion position between two subsidiaries from regulatory filings that describe its financial condition.

In September, UBS Group AG UBS agreed to pay €835 million ($986.8 million) to resolve a long-running French tax case concerning its cross-border business activities between 2004 and 2012.

UBS Group agreed to pay a €730-million ($862.7 million) fine and €105 million ($124.1 million) in civil damages to the French state. The company stated that the matter is fully provisioned and its resolution is consistent with its strategy of addressing legacy issues in the best interests of all stakeholders.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.