Fintel reports that on July 27, 2023, JP Morgan maintained coverage of Arch Capital Group (NASDAQ:ACGL) with a Neutral recommendation.

Analyst Price Forecast Suggests 5.57% Upside

As of July 6, 2023, the average one-year price target for Arch Capital Group is 86.65. The forecasts range from a low of 78.78 to a high of $96.60. The average price target represents an increase of 5.57% from its latest reported closing price of 82.08.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Arch Capital Group is 11,833MM, an increase of 0.37%. The projected annual non-GAAP EPS is 5.59.

What is the Fund Sentiment?

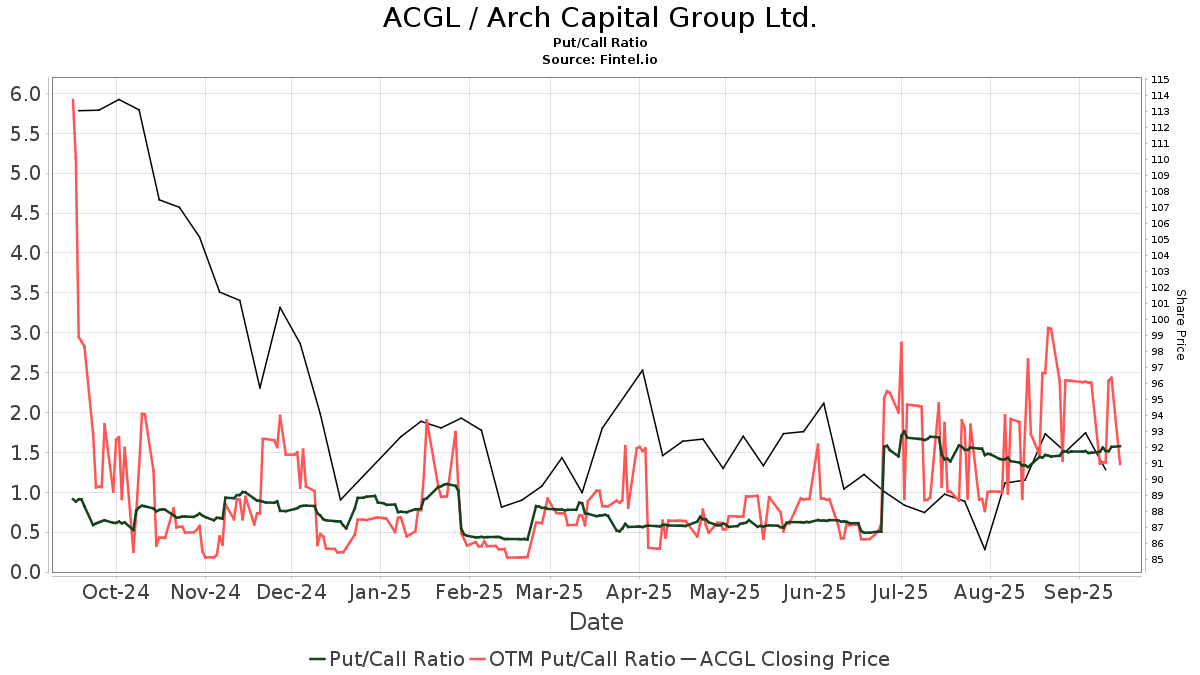

There are 1379 funds or institutions reporting positions in Arch Capital Group. This is an increase of 71 owner(s) or 5.43% in the last quarter. Average portfolio weight of all funds dedicated to ACGL is 0.44%, a decrease of 18.51%. Total shares owned by institutions decreased in the last three months by 0.75% to 437,043K shares.  The put/call ratio of ACGL is 1.22, indicating a bearish outlook.

The put/call ratio of ACGL is 1.22, indicating a bearish outlook.

What are Other Shareholders Doing?

Artisan Partners Limited Partnership holds 28,100K shares representing 7.59% ownership of the company. In it's prior filing, the firm reported owning 31,135K shares, representing a decrease of 10.80%. The firm decreased its portfolio allocation in ACGL by 9.23% over the last quarter.

Bamco holds 21,291K shares representing 5.75% ownership of the company. In it's prior filing, the firm reported owning 21,416K shares, representing a decrease of 0.59%. The firm decreased its portfolio allocation in ACGL by 3.92% over the last quarter.

ARTKX - Artisan International Value Fund Investor Shares holds 19,131K shares representing 5.17% ownership of the company. In it's prior filing, the firm reported owning 21,095K shares, representing a decrease of 10.26%. The firm decreased its portfolio allocation in ACGL by 15.65% over the last quarter.

Capital World Investors holds 14,854K shares representing 4.01% ownership of the company. In it's prior filing, the firm reported owning 19,256K shares, representing a decrease of 29.64%. The firm decreased its portfolio allocation in ACGL by 19.14% over the last quarter.

Wcm Investment Management holds 13,752K shares representing 3.71% ownership of the company. In it's prior filing, the firm reported owning 12,769K shares, representing an increase of 7.15%. The firm increased its portfolio allocation in ACGL by 12.04% over the last quarter.

Arch Capital Group Background Information

(This description is provided by the company.)

Arch Capital Group Ltd., a Bermuda-based company with approximately $15.2 billion in capital at Sept. 30, 2020, provides insurance, reinsurance and mortgage insurance on a worldwide basis through its wholly owned subsidiaries.

Additional reading:

- Contacts Arch Capital Group Ltd. Investor Relations François Morin: (441) 278-9250 Donald Watson: (914) 872-3616; dwatson@archgroup.com Source - Arch Capital Group Ltd. arch-corporate

- Arch Capital Group Ltd. and Subsidiaries Table of Contents

- Power of Attorney

- Third Amendment to Third Amended and Restated ACGL Incentive Compensation Plan

- Contacts Arch Capital Group Ltd. Investor Relations François Morin: (441) 278-9250 Donald Watson: (914) 872-3616; dwatson@archgroup.com Source - Arch Capital Group Ltd. arch-corporate

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.