Fintel reports that on October 18, 2023, Jefferies maintained coverage of Crown Holdings (NYSE:CCK) with a Buy recommendation.

Analyst Price Forecast Suggests 35.67% Upside

As of October 5, 2023, the average one-year price target for Crown Holdings is 110.16. The forecasts range from a low of 86.86 to a high of $134.40. The average price target represents an increase of 35.67% from its latest reported closing price of 81.20.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Crown Holdings is 13,283MM, an increase of 7.52%. The projected annual non-GAAP EPS is 6.93.

Crown Holdings Declares $0.24 Dividend

On July 27, 2023 the company declared a regular quarterly dividend of $0.24 per share ($0.96 annualized). Shareholders of record as of August 10, 2023 received the payment on August 24, 2023. Previously, the company paid $0.24 per share.

At the current share price of $81.20 / share, the stock's dividend yield is 1.18%.

Looking back five years and taking a sample every week, the average dividend yield has been 1.21%, the lowest has been 0.64%, and the highest has been 2.42%. The standard deviation of yields is 0.39 (n=236).

The current dividend yield is 0.06 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.29. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is -0.17%.

What is the Fund Sentiment?

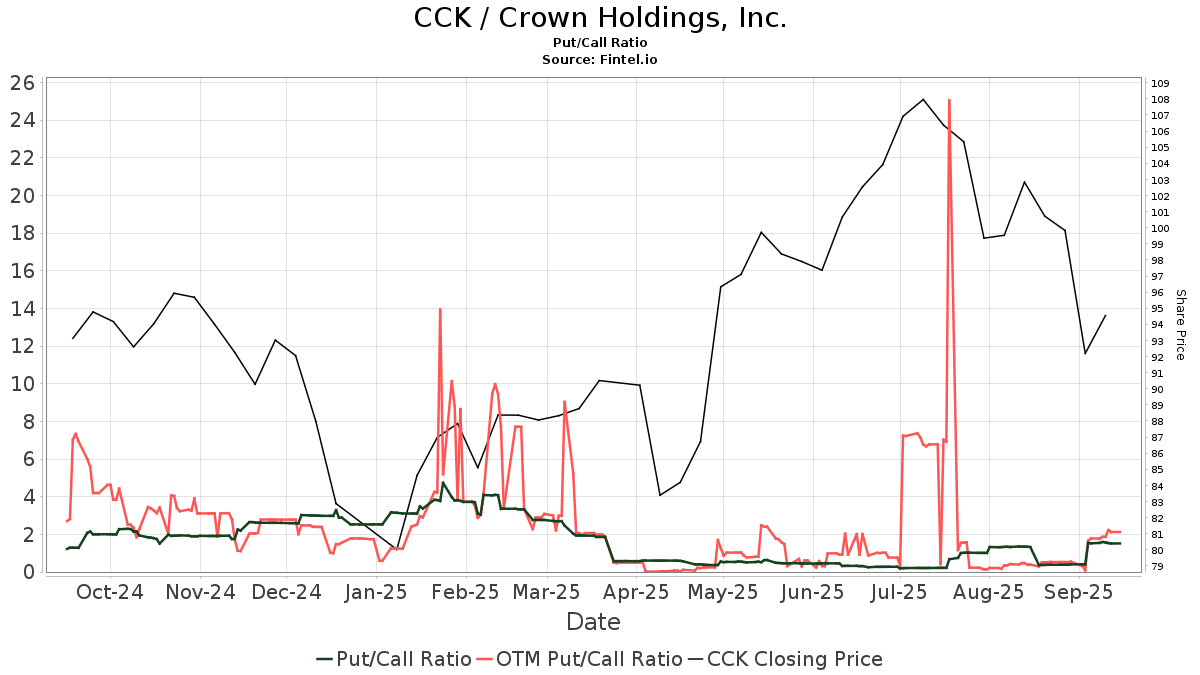

There are 910 funds or institutions reporting positions in Crown Holdings. This is a decrease of 6 owner(s) or 0.66% in the last quarter. Average portfolio weight of all funds dedicated to CCK is 0.37%, an increase of 7.53%. Total shares owned by institutions increased in the last three months by 5.54% to 139,043K shares.  The put/call ratio of CCK is 0.81, indicating a bullish outlook.

The put/call ratio of CCK is 0.81, indicating a bullish outlook.

What are Other Shareholders Doing?

Janus Henderson Group holds 5,764K shares representing 4.81% ownership of the company. In it's prior filing, the firm reported owning 5,904K shares, representing a decrease of 2.44%. The firm decreased its portfolio allocation in CCK by 4.52% over the last quarter.

Victory Capital Management holds 4,368K shares representing 3.65% ownership of the company. In it's prior filing, the firm reported owning 3,966K shares, representing an increase of 9.20%. The firm increased its portfolio allocation in CCK by 12.77% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,740K shares representing 3.12% ownership of the company. In it's prior filing, the firm reported owning 3,713K shares, representing an increase of 0.73%. The firm decreased its portfolio allocation in CCK by 2.38% over the last quarter.

IJH - iShares Core S&P Mid-Cap ETF holds 3,647K shares representing 3.05% ownership of the company.

Nuveen Asset Management holds 3,529K shares representing 2.95% ownership of the company. In it's prior filing, the firm reported owning 3,696K shares, representing a decrease of 4.75%. The firm decreased its portfolio allocation in CCK by 6.19% over the last quarter.

Crown Holdings Background Information

(This description is provided by the company.)

Crown Holdings, Inc., through its subsidiaries, is a leading global supplier of rigid packaging products to consumer marketing companies, as well as transit and protective packaging products, equipment and services to a broad range of end markets. World headquarters are located in Yardley, Pennsylvania.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.