Fintel reports that on May 21, 2025, Jefferies initiated coverage of SelectQuote (NYSE:SLQT) with a Hold recommendation.

Analyst Price Forecast Suggests 229.51% Upside

As of May 6, 2025, the average one-year price target for SelectQuote is $7.48/share. The forecasts range from a low of $7.07 to a high of $8.40. The average price target represents an increase of 229.51% from its latest reported closing price of $2.27 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for SelectQuote is 1,157MM, a decrease of 22.28%. The projected annual non-GAAP EPS is -0.07.

What is the Fund Sentiment?

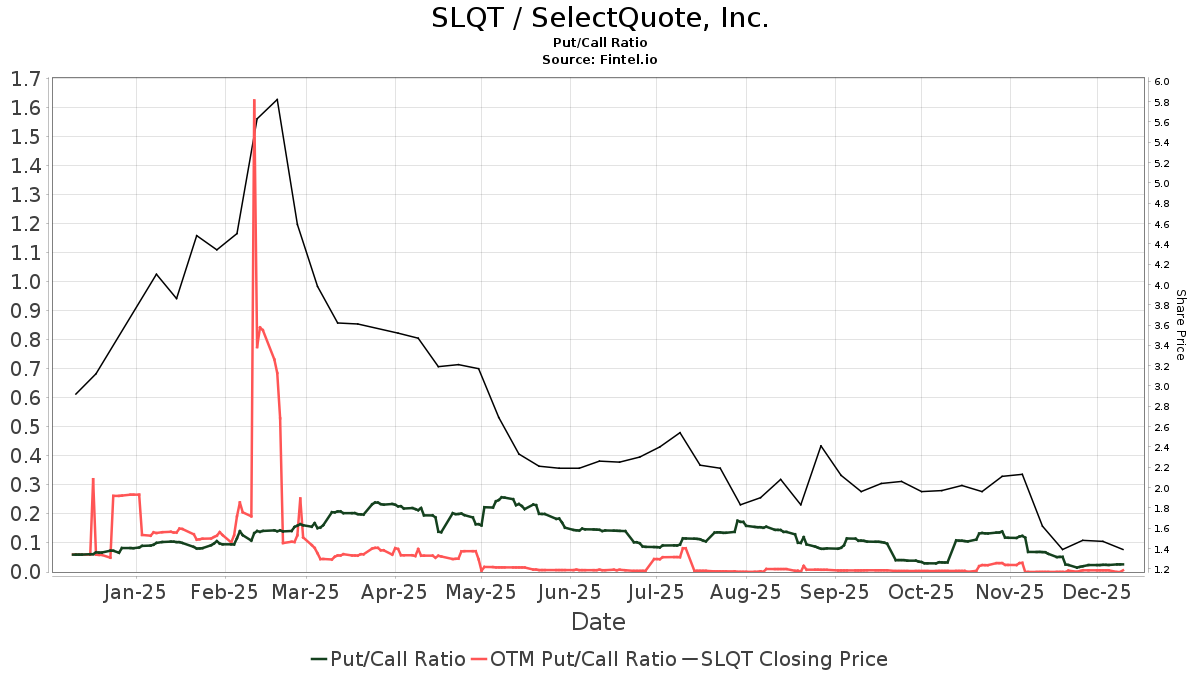

There are 307 funds or institutions reporting positions in SelectQuote. This is an increase of 38 owner(s) or 14.13% in the last quarter. Average portfolio weight of all funds dedicated to SLQT is 0.03%, an increase of 2.58%. Total shares owned by institutions increased in the last three months by 10.12% to 81,193K shares.  The put/call ratio of SLQT is 0.23, indicating a bullish outlook.

The put/call ratio of SLQT is 0.23, indicating a bullish outlook.

What are Other Shareholders Doing?

Abrams Bison Investments holds 7,911K shares representing 4.58% ownership of the company. No change in the last quarter.

Mariner holds 6,288K shares representing 3.64% ownership of the company. In its prior filing, the firm reported owning 6,314K shares , representing a decrease of 0.42%. The firm decreased its portfolio allocation in SLQT by 72.08% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 4,072K shares representing 2.36% ownership of the company. No change in the last quarter.

IWM - iShares Russell 2000 ETF holds 3,929K shares representing 2.27% ownership of the company. In its prior filing, the firm reported owning 3,816K shares , representing an increase of 2.88%. The firm increased its portfolio allocation in SLQT by 70.08% over the last quarter.

Geode Capital Management holds 3,170K shares representing 1.84% ownership of the company. In its prior filing, the firm reported owning 3,075K shares , representing an increase of 3.00%. The firm decreased its portfolio allocation in SLQT by 50.31% over the last quarter.

SelectQuote Background Information

(This description is provided by the company.)

Founded in 1985, SelectQuote provides solutions that help consumers protect their most valuable assets: their families, health and property. The company pioneered the model of providing unbiased comparisons from multiple, highly-rated insurance companies allowing consumers to choose the policy and terms that best meet their unique needs. Two foundational pillars underpin SelectQuote’s success: a force of more than 1,500 highly-trained and skilled agents who provide a consultative needs analysis for every consumer, and proprietary technology that sources and routes high-quality leads. The company has three core business lines: SelectQuote Senior, SelectQuote Life and SelectQuote Auto and Home. SelectQuote Senior, the largest and fastest-growing business, serves the needs of a demographic that sees 10,000 people turn 65 each day with a range of Medicare Advantage and Medicare Supplement plans.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.