Janus International Group, Inc. JBI launched the NS Series, two new roll-up door solutions for self-storage facilities. These doors are designed to enhance safety and security, showcasing the company's focus on innovation in access control technologies and building product solutions.

JBI's NS Series features an improved design with anchored floor guides, ensuring stability and durability. The lower bar has secure clips that glide smoothly within the guides and support angles firmly anchored to the floor, providing strength and support. It addresses concerns related to theft in the industry, offering enhanced security solutions to protect tenants' valuable possessions.

The innovative series complements Janus's existing R3 Program (Restore, Rebuild, Replace), which focuses on replacing storage unit doors, optimizing unit mix and land use and enhancing security solutions. This enables owner-operators to potentially increase rental rates and maintain a competitive edge in the market.

Focus on Self-Storage Segment

The company excels in providing self-storage solutions, offering specialized services and continuously enhancing capabilities to support customers in managing the current shortage of self-storage space. JBI's primary business focuses on self-storage solutions through two sales channels — new construction and R3. This segment generates about two-thirds of its revenues and an even higher portion of its EBITDA, with similar profit margins between the two channels.

In first-quarter 2024, the top line inched up 1% year over year to $254.5 million, driven by improved market conditions, product mix and commercial actions. Despite registering declines in its Commercial and Other segment, JBI saw strong contributions from its Self-Storage segment.

During the quarter, total self-storage revenues increased 11% year over year, driven by new construction. Industry trends continue to favor investment in self-storage facilities, particularly focusing on developing new greenfield sites in recent quarters. The company anticipates continued growth in total self-storage throughout the year. It is also exploring merger and acquisition opportunities in self-storage, commercial, technology and services sectors.

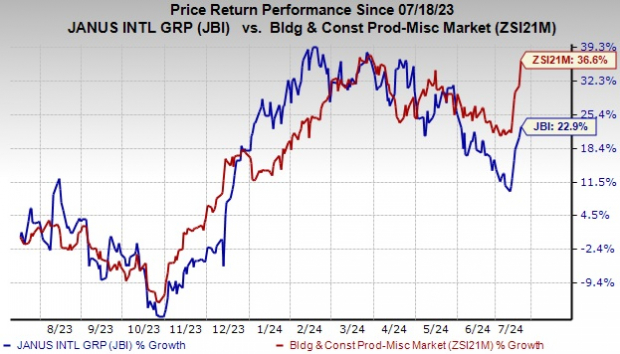

Image Source: Zacks Investment Research

Shares of this manufacturer and supplier of turnkey solutions increased 22.9% in the past year compared with the Zacks Building Products - Miscellaneous industry’s 36.6% growth. Although the shares of the company have underperformed its industry, its focus on the efficient execution of business growth strategies, especially through the expansion of the Noke Smart Entry system adoption, is likely to ensure possibilities of outperformance in the near term.

Janus is optimistic about its growth trajectory through 2024, given its varied and innovative mix of technology-driven product offerings, along with its resilient business model.

Zacks Rank & Key Picks

Presently, Janus carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Construction sector.

AAON, Inc. AAON flaunts a Zacks Rank of #1 (Strong Buy). AAON delivered a trailing four-quarter earnings surprise of 9.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AAON’s 2024 sales and EPS indicates a rise of 3.1% and 1.8%, respectively, from the prior-year levels.

KB Home KBH holds a Zacks Rank #1. It has a trailing four-quarter average earnings surprise of 18.4%.

The Zacks Consensus Estimate for KBH’s fiscal 2024 sales and EPS indicates a rise of 6.5% and 18.2%, respectively, from the prior-year levels.

D.R. Horton, Inc. DHI holds a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 15.6%.

The Zacks Consensus Estimate for DHI’s fiscal 2024 sales and EPS indicates a rise of 4.3% and 3.4%, respectively, from the prior-year levels.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>KB Home (KBH) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

AAON, Inc. (AAON) : Free Stock Analysis Report

Janus International Group, Inc. (JBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.