By Nick Hill, Vice President of Business Development, Invictus Capital

Crypto is famous for its cult-like investor following. Risk-seeking individuals, seemingly hypnotized by the unlimited upside potential offered by crypto, are only too eager to go all in. Famous tales of Bitcoin having minted millionaires in record time often cloud judgement and leave novice investors unaware of the potential risks.

The obvious issue is that many crypto investors are left overexposed to one asset class with extreme risk. Crypto is considered a risky investment due to its price volatility. If an investment is considered volatile, it means that its price is prone to frequent and extreme price movements.

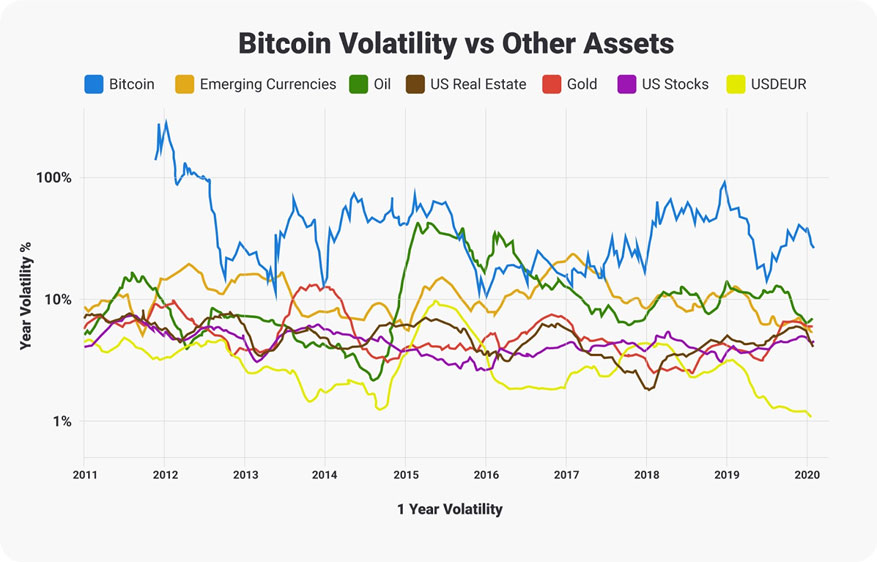

gyrations have demonstrated significantly greater volatility (as measured by standard deviation) than most other asset classes. The chart below, courtesy WooBull, shows that Bitcoin’s volatility is in many cases at least 5x greater than common asset classes (note: the y-axis uses a logarithmic scale).

Source: WooBull.com

The evangelical position of many of crypto’s most famous influencers (e.g. Roger Ver, Craig Wright) only serves to compound the risk-seeking behavior of devout crypto followers. These influencers, however, typically exhibit an overconfidence bias in their investments. Antony Pompliano, for example, proudly claimed in August 2019 that more than 50% of his wealth is bet on Bitcoin. Market commentators pounced on his Bitcoin bet. Kevin O’Leary, a Canadian celebrity businessman, flat out called it “crazy” and “insane,” adding that it “breaches everything about diversification investing.”

Diversification, diversification, diversification -- it’s the mantra drummed by most investment advisors. It’s essential in investing because it offers risk mitigation while considering the return performance of a portfolio as a whole. With this in mind, where should crypto-only investors allocate their additional capital? The obvious choice should be stocks and bonds, consistent with most traditional portfolios. Today, though, the choice isn’t so obvious.

Current indicators suggest today’s stock market is expensive by historical standards. The U.S. stock market is on an 11-year bull run with the S&P 500 trading at 19 times the projected earnings for 2020, a 40-year high. Similarly, in fixed income markets, central bank rates are at historic lows, pulling yields on bonds lower. For example, nearly 30 percent of all investment-grade bonds had rates below 0 percent in mid-2019, which means that holders of these bonds will make a loss at maturity.

So if stock markets are pricey and fixed income returns are virtually non-existent, what other options exist? What about alternative investments?

What are alternative investments?

In simple terms, an alternative investment is any investment other than stocks, bonds, or cash. Through their unique risk/return characteristics, alternative investments offer diversification benefits to traditional investment portfolios.

Typical alternative investments include real estate, hedge funds, private equity, private income funds, venture capital, and commodities. Even crypto assets are considered alternative investments thanks to their unique return profile and the benefits they can provide to a traditional portfolio.

Interest in alternatives is gaining momentum. Institutional investors are increasingly allocating more of their assets under management (AUM) to alternative investments as they, too, search for superior yield and risk diversification. Continued institutional interest is expected to drive alternative investment AUM to rise 59 percent, to $14 trillion, by 2023, according to research by Preqin, a leading alternatives data provider.

Crypto investors would be well served by diversifying into other alternative assets

So if alternative investments offer these appealing benefits, what options do you, the individual, have for investing?

Until now, most individual investors have not had access to these types of high-yield investment opportunities due to structural issues, such as illiquidity of underlying investments and high investment minimums.

The rising interest in alternatives, however, has led to a proliferation of investment platforms, such as AngelList and YieldStreet. While these platforms have slightly expanded access to these investment classes, they typically only open their doors to accredited investors, meaning participation is limited.

To overcome these limitations, alternative investment platforms that offer alternative investment funds to retail investors will have to emerge, and with the advancements in fintech, primarily spurred by blockchain technology, they already are. Crypto investors -- accredited and retail alike -- shouldn’t miss out on the opportunity to participate in the alternative investment market and diversify their portfolio. If they stick to Bitcoin and altcoins alone, they are not only risking financial loss, but also Kevin O’Leary’s wrath.

About: Nick Hill is the Vice President of Business Development at Invictus Capital.

He is an experienced financial services professional with a background in financial engineering and FinTech. Nick’s skills and expertise include financial instrument valuation, financial modelling, and start-up valuation. Nick is a chartered accountant and a Chartered Financial Analyst. He holds a Masters in Finance.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.