Itron, Inc. ITRI has teamed up with Verizon Communications Inc. VZ to incorporate its Network Continuity solutions into Itron's Intelligent Connectivity platform, leveraging VZ’s multi-network embedded SIM (eSIM) technology. With this communications flexibility, utilities can ensure uninterrupted cellular connectivity across their entire service area, boosting operational efficiency, Itron highlighted.

Based in New York, Verizon offers communication services in the form of local phone service, long-distance, wireless and data services. The company’s eSIM technology is a digital SIM embedded directly into mobile devices, allowing users to connect to cellular networks without needing a physical SIM card. Many modern devices now feature eSIM as an alternative to or in addition to traditional removable SIM cards.

To improve connectivity for utilities in remote areas, Itron has partnered with Verizon to create an eSIM solution based on global mobile standards from the 3rd Generation Partnership Project (3GPP) and Global System for Mobile Communications Association (GSMA). The new eSIM solution delivers consistent and resilient network performance when combined with Itron’s Gen5 Cellular Access Point, ensuring seamless operations. Remote management of eSIMs also helps utilities safeguard their networks for future advancements and emerging technologies.

These partnerships will help Itron meet the growing demand for advanced, resilient communication technologies in the utility sector. The company’s strong market position in this sector will boost its long-term financial performance.

Itron, Inc. Price and Consensus

Itron, Inc. price-consensus-chart | Itron, Inc. Quote

Headquartered in Liberty Lake, WA, Itron is a technology and services company and one of the leading global suppliers of a wide range of standard, advanced and smart meters and meter communication systems, including networks and communication modules, software, devices, sensors, data analytics and services to the utility and municipal sectors.

Itron's Networked Solutions segment remains a key growth driver, contributing 67.7% to total revenues of $416.7 million for the third quarter of 2024, marking an 8% year-over-year increase. This revenue growth was fueled by the expansion of new initiatives and ongoing deployments.

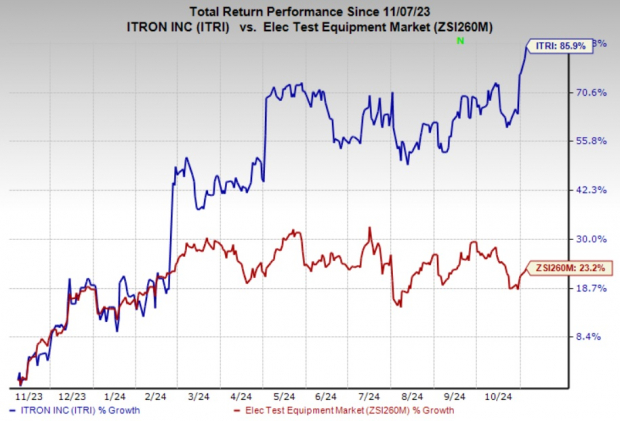

ITRI’s Zacks Rank & Stock Price Performance

ITRI currently carries a Zacks Rank #2 (Buy). Shares of the company have gained 85.9% in the past year compared with the sub-industry's growth of 23.2%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are Cirrus Logic, Inc. CRUS and BlackBerry Limited BB. BB presently sports a Zacks Rank #1 (Strong Buy), whereas CRUS carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Double-digit year-over-year revenue growth across Cybersecurity and IoT businesses is boosting Blackberry’s performance. It delivered an earnings surprise of 131.3%, on average, in the trailing four quarters. In the last reported quarter, BB pulled off an earnings surprise of 100%.

Cirrus Logic’s performance is driven by increasing shipments in the smartphone market. Steady momentum in the laptop market and standout next-generation flagship smartphone design cushion the top line. CRUS delivered an earnings surprise of 55.1%, on average, in the trailing four quarters.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.