Key Points

Canopy Growth has been a disaster of an investment.

Overly aggressive expansion efforts, share dilution, and industry headwinds are to blame.

Unfortunately, it's probably wise to close the book on Canopy Growth.

- 10 stocks we like better than Canopy Growth ›

It's been nearly a decade since Canada legalized recreational cannabis (marijuana), helping set off a boom in cannabis stocks. Today, roughly half of U.S. states have legalized cannabis for recreational use, and most states at least permit it for medicinal purposes.

Canopy Growth Corp. (NASDAQ: CGC) was among a class of cannabis stocks that surged from 2017 through 2019, peaking at a market cap of nearly $18 billion. The investment results have been disastrous since then, despite cannabis use continuing to rise to the point that it has pressured the alcohol industry.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

So, what has gone wrong, and should investors finally dump Canopy Growth stock? Here is what you need to know.

How overly ambitious plans ruined the stock

Canopy Growth's storyline would probably be about a company that tried doing too much, too soon.

After beginning in Canada, the company expanded into the United States and Europe. It also moved beyond cannabis flower and into related products, such as cannabis creams and beverages. Canopy Growth tried to be everywhere all at once, buying up competitors and other cannabis-related businesses over the past decade.

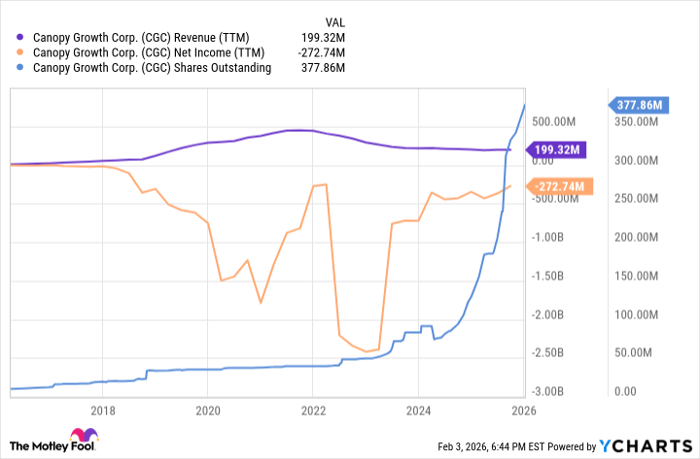

CGC Revenue (TTM) data by YCharts.

Canopy Growth made two catastrophic mistakes. First, it misread the cannabis market. Legalizing cannabis didn't prevent illicit sales, which put pricing pressure on legal suppliers due to the various taxes and regulations tied to legal retail sales. It also rushed its expansion efforts. Instead of funding deals with profits, Canopy Growth continuously issued stock and debt.

As a result of that and poor business execution, Canopy Growth's business isn't growing, and it's still losing money. Meanwhile, the share count has increased by more than 3,700%. The stock's enormous dilution is why the share price has collapsed.

Why investors can probably dump their shares at this point

The company recently announced yet another acquisition, buying MTL Cannabis for $125 million, funded with cash and stock. MTL Cannabis has earned $84 million in revenue over the past year, generating $11 million in operating cash flow. Once again, Canopy Growth doesn't seem able to resist acquisitions it cannot afford.

Image source: Getty Images.

It may not have a choice. Thus far, the legalized cannabis market doesn't seem very easy to survive in. There haven't been many cannabis stocks that have actually performed well for investors. Many companies have been acquired after heavy losses or have gone under. Ultimately, not every growing industry is a slam-dunk investment opportunity.

Time will tell whether Canopy Growth can at least sustain its business. Regardless, shareholders probably won't benefit. The stock is down 99.8% from its all-time high, a massive hole it's unlikely to dig itself out of.

Should you buy stock in Canopy Growth right now?

Before you buy stock in Canopy Growth, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Canopy Growth wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $436,126!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,053,659!*

Now, it’s worth noting Stock Advisor’s total average return is 885% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 7, 2026.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.