Intuitive Surgical’s ISRG third-quarter results reignited the long-running debate around the durability of its growth engine. Combined da Vinci and Ion procedures rose 20% year over year in the third quarter of 2025, accelerating from roughly 18% growth in the first half. The top-line number is impressive — but the key investor question is whether this pace is sustainable or reflects a near-term peak driven by product cycles and timing effects.

On the positive side, the procedure mix underscores earnings durability. da Vinci procedures increased 19%, while Ion volumes surged 52%, with growth spanning benign general surgery, gynecology, colorectal, thoracic, and international markets. Management highlighted that da Vinci 5 is already driving higher utilization than prior-generation Xi systems, with U.S. da Vinci utilization turning positive after being flat earlier in the year. The system’s efficiency gains —higher surgeon autonomy, integrated insufflation, and workflow improvements — are enabling hospitals to absorb more volume without proportionate capital expansion, a powerful lever in a constrained operating environment.

However, management acknowledged anecdotal evidence that some elective procedures may have been pulled forward in July and August amid uncertainty around Medicare funding and insurance dynamics, even if third-party data is yet to confirm this effect. International growth also benefited modestly from holiday timing shifts, contributing roughly a one-point tailwind.

Meanwhile, bariatric procedures continue to decline at high single-digit rates, pressured by GLP-1 adoption, with surgeons unable to predict when volumes will stabilize. While bariatrics represents less than 3% of total da Vinci procedures, the category is a reminder that not all surgical demand is immune to therapeutic substitution. Additionally, hospital budget constraints — particularly outside the United States — and macro health policy shifts could temper capital and utilization momentum over time.

ISRG’s 20% procedure growth appears supported by genuine utilization and technology-driven gains; however, sustaining this pace will depend on continued da Vinci 5 adoption offsetting elective volatility and pockets of softer demand.

Peer Update

Zimmer Biomet ZBH is depending heavily on its robotics strategy to drive ROSA adoption as it works to reaccelerate growth. ZBH emphasized repeatedly that ROSA is central to its differentiated “customer-centric technology suite,” pairing non-CT-based robotics with navigation tools like OrthoGrid to meet diverse surgeon needs.

In the third quarter, ZBH highlighted its strongest robotics capital quarter in over a year, with U.S. ROSA accounts performing over half of knee implants robotically, up 400 bps year to date. ZBH expects upcoming enhancements, such as ROSA with OptimiZe, featuring a simplified UI and kinematic alignment, to deepen penetration across ASCs and competitive accounts.

Stereotaxis STXS is making significant progress with its GenesisX robotic surgery platform, a next-generation solution designed to expand access to robotic electrophysiology procedures. In the second quarter of 2025, Stereotaxis’ GenesisX secured CE Mark approval in Europe, and the first commercial system was manufactured, with FDA clearance expected later this year.

Initial hospital installations are planned in Europe in 2025, followed by a full U.S. and EU launch in 2026. GenesisX is engineered to avoid costly lab construction, lowering barriers to adoption. With second-quarter operating expenses steady at $6 million, Stereotaxis plans disciplined reinvestment in salesforce expansion and catheter-driven recurring revenues to support commercialization.

ISRG’s Price Performance, Valuation and Estimates

Shares of ISRG have gained 8.1% in the past six months compared with 14.8% rise for the industry.

Image Source: Zacks Investment Research

From a valuation standpoint, Intuitive Surgical trades at a forward price-to-earnings ratio of 60.4, above the industry average. But, it is still lower than its five-year median of 71.52. ISRG carries a Value Score of D.

Image Source: Zacks Investment Research

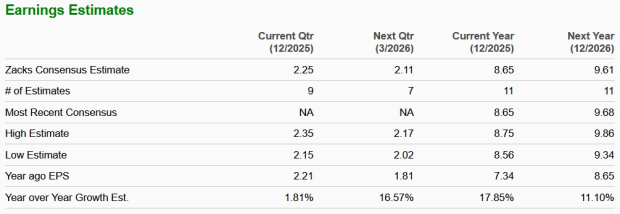

The Zacks Consensus Estimate for Intuitive Surgical’s 2025 earnings implies a 17.9% rise from the year-ago period’s level.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Stereotaxis Inc. (STXS) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.