- Seasonal analysis is the study of a market's tendencies over a set period of time, usually a reflection of the cyclical nature of supply and demand.

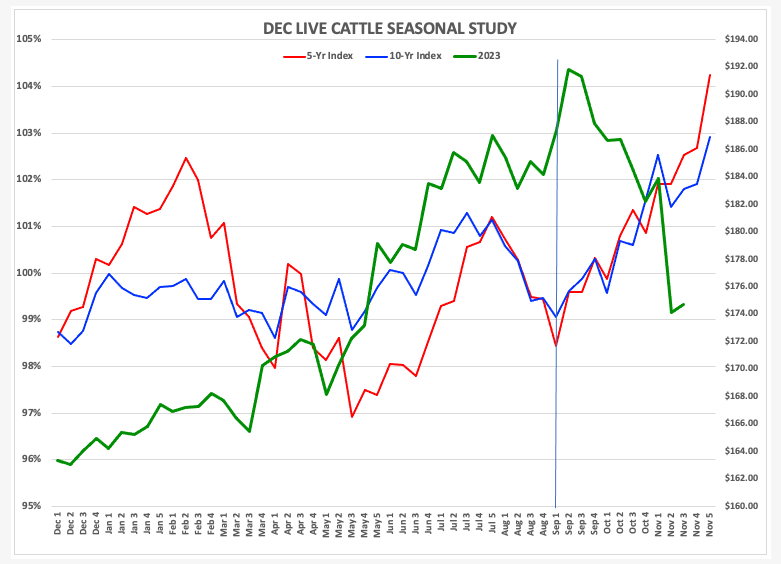

- December live cattle tend to rally from early September through the end of November, meaning this year's strong selloff is a contra-seasonal move.

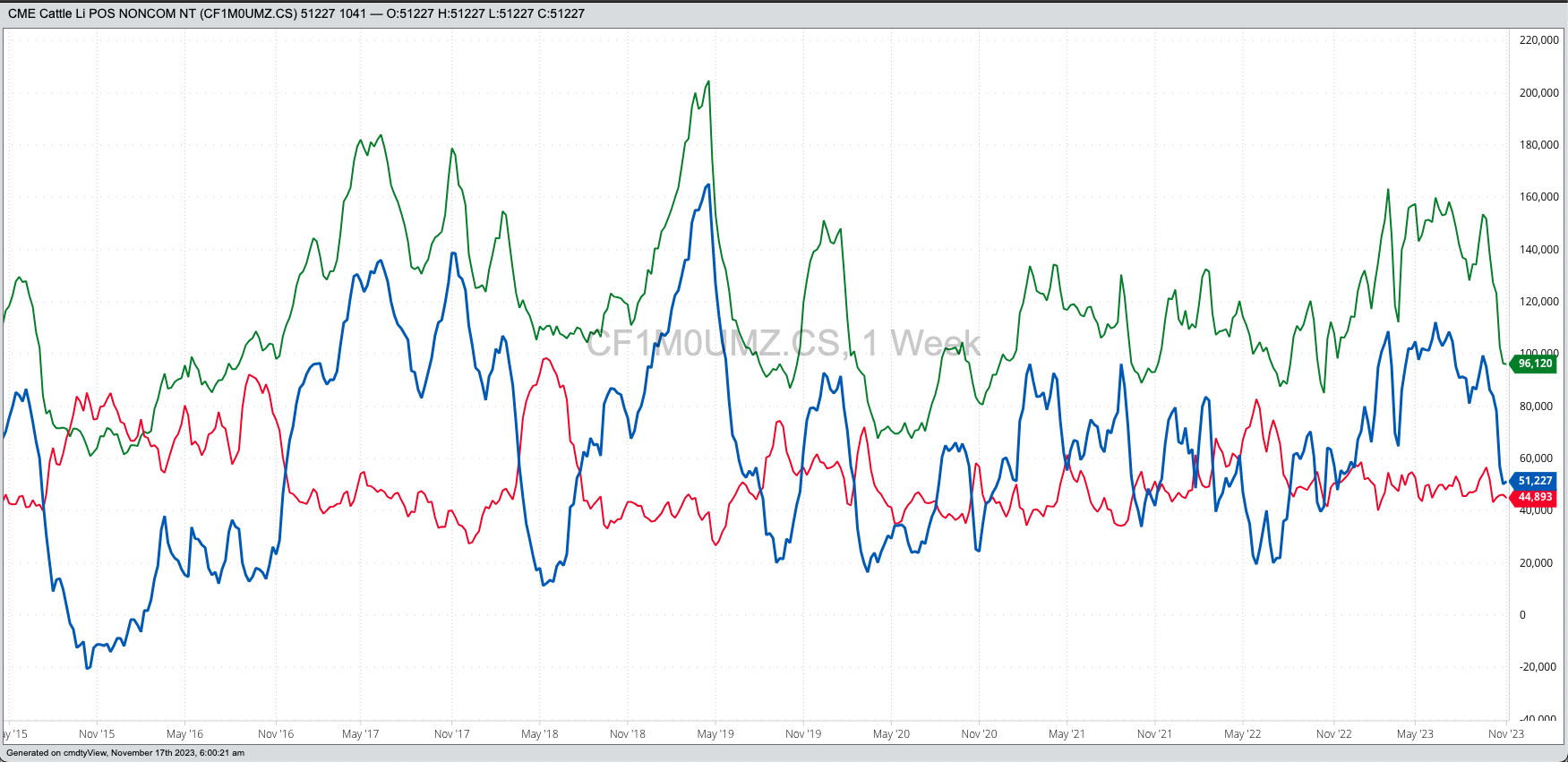

- Contra-seasonal moves tend to be driven by a change in fundamentals. However, this time around in live cattle it is the fund side that seems to be different.

- We can use any timeframe we like, but with most markets I tend to stick with 12 months (either a calendar year or contract year).

- Seasonal analysis should be thought of as a guide rather than a hard and fast rule. The 12-month pattern shows us the ebb and flow of markets influenced by investment money and underlying fundamentals.

- When we see a contra-seasonal move, most of the time it tells us something has changed fundamentally. We usually know this beforehand by studying basis and futures spreads.

- Dec live cattle tends to post a secondary low weekly close the first week of September.

- The 5-year index shows Dec live then rallies 6% through the last weekly close of November.

- The 10-year index shows a gain of 4% during that same timeframe.

- To begin with, the high weekly close of $191.825 was a new all-time high weekly mark. And while new highs generally aren’t thought of as bearish, it’s hard to convince traders a market is a good investment when it is at all-time highs.

- Speaking of investment traders: The CFTC Commitments of Traders report (legacy, futures only) showed the noncommercial net-long futures position had peaked the week of June 13, 2023, at a high of 112,250 contracts. From the position was cut to 81,000 contracts through the week of August 22, before increasing to 99,500 contracts the week of September 26. This activity had all the earmarks of Johnny Come Latelys pushing the market to a new high while older positions were being liquidated. This creates a vacuum underneath the market when the next round of long-liquidation begins. The most recent weekly report showed this same group holding a net-long of 51,230 futures contracts.

- Through this round of long liquidation, we’ve actually seen the market’s real fundamental reads grow more bullish. The Dec-February futures spread posted a low weekly close of (-$4.025) the last week of July, in line with the previous 5-hyear average weekly close for that week. Last Friday saw the same spread close at (-$0.475) as compared to the previous 5-year high weekly close of (-$1.725). The bottom line is commercial traders have been buying, as they tend to do this time of year, while noncommercial traders have been selling.

- Grain Markets: Where are Soybean, Corn, and Wheat Prices Headed?

- Cattle Continue to Firm Back Up

- Another 50c Lower for Hogs at Midday

- Cash Feeder Cattle Fell Double Digits This Week

I was asked earlier this week if the ongoing bloodbath in the live cattle market is a seasonal move. In other words, does the market usually come apart like a steer in a processing plant this time of year, or is 2023 unusual? Before I answer this question, a quick reminder about the theory of seasonality:

Now, for the question at hand: Are we seeing a seasonal move in live cattle? All it takes is one look December live cattle’s ((LEZ23) seasonal study and we can see we are not. In fact, the contract is going through a strong contra-seasonal move, shifting the focus away from technical analysis to fundamentals.

What do we normally see this time of year with the December contract?

The Dec23 contract actually posted a high weekly close of $191.825 the second week of September before falling to a low weekly close of $174.175 last Friday. This was a loss of 9% at a time when the contract tends to rally. What changed?

Given this, not only has the collapse in live cattle been contra-seasonal, but the contra-seasonal nature of the beast has also not been driven by market fundamentals. In this case, noncommercial traders were in the driver’s seat. While unusual from a seasonal point of view, it fits perfectly with Newton’s First Law of Motion applied to Markets: A trending market will stay in that trend until acted upon by an outside force, with that outside force usually noncommercial money.

What happens next? When a market has funds going one way and fundamentals going another, it’s called a Rubber Band Disposition. Like a rubber band that is being stretched, the market will eventually snap and return to its base, with that base being fundamentals. In the case of live cattle, with fundamentals bullish and funds less so, the most likely way this plays out is for the noncommercial traders to start buying again. Is there an outside chance market fundamentals could turn bearish and follow funds? Yes, nothing is impossible. We’ve all learned that by now.

More Livestock News from Barchart

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.