If you invest consistently in the market over a long period of time, whether through an index fund or a curated stock portfolio, you have a good chance of joining the millionaire club. The truth is that if you find that one amazing stock like Amazon or Apple, it can make up for any losses from stocks that didn't take off and propel you, on its own, into millionaire status. But it's almost impossible to know at the earliest stage, when you need to make that investment, which stock is going to be the next winner. That's one of the reasons diversification is so important.

Let's take a look at Lemonade (NYSE: LMND). It's lost investor confidence and a ton of its value. Is there any chance Lemonade can help you become a millionaire?

Why Lemonade became a market darling

Lemonade is an insurance technology company powered by artificial intelligence (AI). In theory, it's a grand, disruptive idea. Traditional insurance is full of legacy operations that aren't easily moved into the digital age. If you could build an insurance company using AI on a digital substrate, it could be much more efficient than traditional companies. That's what Lemonade is.

The user experience looks like an upgrade. Signup is all digital, taking out the pain points of having to get someone on the phone, which is so last year. Since it's all based on AI, Lemonade's chatbot can ask a bunch of questions, run your answers through its millions of data points, and spit out a policy proposal quickly. Claims are done much in the same manner. You can upload pictures and answer questions through the digital system, and your claim can be approved in seconds.

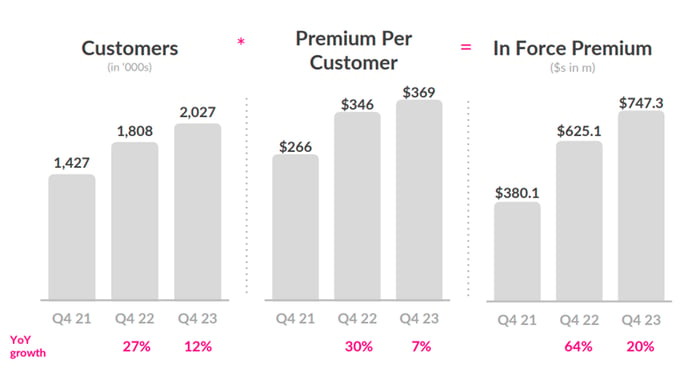

The concept has indeed taken off, and Lemonade is reporting fantastic growth. More customers are signing up, and Lemonade's strategy to hook in younger clients and grow with them and their insurance needs is bearing fruit with higher average policy amounts per customer.

Image source: Lemonade.

Why Lemonade stock has fallen off a cliff

The problem is that it is taking a very long time to prove that this concept can be viable as a profitable business. Lemonade's algorithms are meant to be better than the traditional model, but the traditional model is just that -- it has decades, if not more than a century, of data and underwriting models to get pricing right and lead to profits. Insurance companies are some of the most reliably profitable businesses around. That's one of the reasons Warren Buffett loves them, and they make up a large part of Berkshire Hathaway's business; they produce reliable income streams.

Lemonade says it's still young, and it's laying the groundwork for profit later on. Its financial performance is improving; gross profit increased by 165% year over year in the fourth quarter, and gross margin more than doubled to 29%. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss improved from $51.7 million to $28.9 million, and the net loss improved from $63.7 million to $42.4 million.

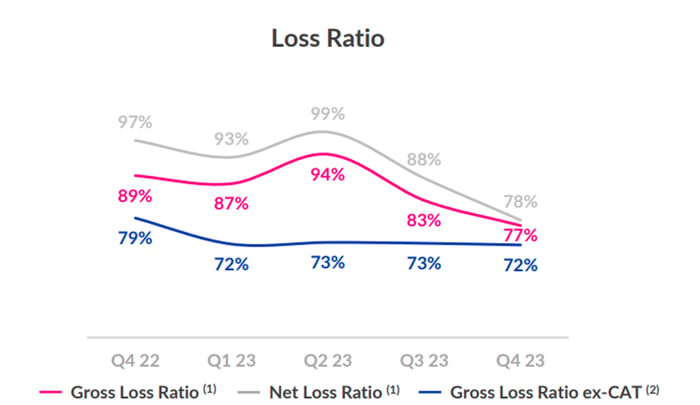

The loss ratio, which measures how much a company pays out of collected premiums as claims, decreased significantly in the fourth quarter.

Image source: Lemonade.

But investors weren't impressed. Management said it's going to increase expenses to generate growth in the coming year, which means that it's not scaling in a cost-efficient way. As much as its performance is improving, the net losses are still heavy. There's no easy path to profitability, and investing in Lemonade right now will require a good deal of patience.

What needs to happen for Lemonade to turn around

One thing that needs to happen for Lemonade to progress is for its underwriting to improve. Last year, it said it was putting the brakes on growth while waiting for regulatory approval for rate increases. It explained how it's rebalancing its homeowners business to account for slower approvals in that area, and it's slowing its business in California, where there's a higher catastrophe rate.

But that's nearsighted and reactionary. Lemonade's model has to be efficient enough to account for these kinds of glitches and still post a profit. Management has many fancy explanations for how its model is improving and will eventually be better than traditional models. The question is how long that's going to take and whether investors' money can be put to better use in the meantime.

Can Lemonade stock rebound and be a millionaire maker?

Lemonade stock is down 90% from its highs, which is brutal. That's despite incredible top-line growth, which underscores just how disappointed investors are right now.

It also means that if Lemonade can bounce back, this is a tremendous opportunity for investors. If Lemonade's model proves to be better over time, it will be the future of insurance. Even where it is now, posing a real challenge to huge, old companies is impressive.

However, this isn't a risk most investors would want to take at the moment. There's plenty of time to see how Lemonade fares without tying up your money in its stock right now. If it starts to demonstrate consistent improvement, its stock could soar, and owning shares could be part of a millionaire-maker portfolio.

Should you invest $1,000 in Lemonade right now?

Before you buy stock in Lemonade, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lemonade wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jennifer Saibil has positions in Lemonade. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, and Lemonade. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.