Infinity Pharma INFI announced additional details on the design of its phase II MARIO-8 study, evaluating eganelisib for squamous cell cancer of the head and neck (SCCHN). Shares of the company were up almost 9% on Jul 10, following the news.

Eganelisib is an immuno-oncology macrophage reprogramming drug candidate.

The MARIO-8 study aims to optimize the dose of eganelisib in combination with the standard dose of Merck’s MRK Keytruda (pembrolizumab). It will be conducted in two parts.

Part A will be a dose optimization study, wherein 30-mg and 20-mg dose regimens of eganelisib will be evaluated. The company has received feedback from the FDA regarding the study's plan. It expects to get initial safety and effectiveness data by the second half of 2024 after the FDA reviews it and the merger with MEI Pharma MEIP is finalized.

Once the best dose in Part A is determined, Part B of the study will involve around 100 additional patients. The primary endpoint of the phase II study will be overall survival, with secondary endpoints including progression-free survival and safety.

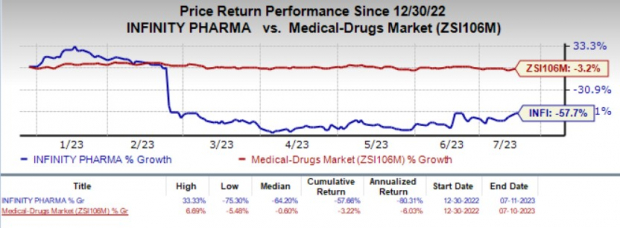

Infinity Pharma’s shares have nosedived 57.7% year to date compared with the industry’s 3.2% decline.

Image Source: Zacks Investment Research

In February, INFI and MEI Pharma entered into a definitive merger agreement to combine their resources and expertise in oncology drug development. The merger aims to create a company with a strong pipeline of three clinical-stage oncology drug candidates.

These candidates are eganelisib, voruciclib and ME-344, which are being evaluated as combination therapy for different cancer indications.

Merck’s Keytruda is already approved for the treatment of many cancers globally. Keytruda sales are gaining from continued strong momentum in metastatic indications, including renal cell carcinoma and SCCHN, as well as a rapid uptake across recent earlier-stage launches.

The drug is continuously growing and expanding into new indications and markets globally. In the first quarter of 2023, Merck recorded revenues of $5.8 billion from Keytruda product sales.

Infinity Pharmaceuticals, Inc. Price and Consensus

Infinity Pharmaceuticals, Inc. price-consensus-chart | Infinity Pharmaceuticals, Inc. Quote

Zacks Rank & Stock to Consider

Infinity Pharma currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the overall healthcare sector is Akero Therapeutics AKRO, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Akero Therapeutics has narrowed from a loss of $2.92 per share to a loss of $2.80 for 2023 in the past 90 days. The company's shares have nosedived 17.9% year to date.

AKRO’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.13%.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof... and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with "black gold."

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you'll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don't want to miss these recommendations.

Download your free report now to see them.Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Infinity Pharmaceuticals, Inc. (INFI) : Free Stock Analysis Report

MEI Pharma, Inc. (MEIP) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.