Immunovant, Inc. IMVT shares gained 10.8% on Wednesday after the company announced new six-month off-treatment results from a proof-of-concept study evaluating its investigational candidate, batoclimab, in patients with uncontrolled Graves’ disease (GD). Batoclimab is a fully human monoclonal antibody targeting FcRn.

The proof-of-concept study evaluated Immunovant’s batoclimab in patients with active GD who continued to show elevated thyroid hormone levels (hyperthyroidism) despite antithyroid drug (ATD) therapy. In the first 24 weeks of the study, patients were treated with the candidate, who then entered a 24-week off-treatment follow-up period. The primary endpoint was normalization or reduction of thyroid hormone levels (free T3 and T4) without increasing baseline ATD dosage at week 24.

IMVT’s GD Study Data of Batoclimab in Detail

Data readout from Immunovant’s proof-of-concept study showed sustained benefits during the off-treatment period. Of the 21 patients who entered the off-treatment period, approximately 80% (17/21) maintained normalized thyroid hormone levels (T3/T4) throughout the follow-up period, demonstrating strong durability of response over six months.

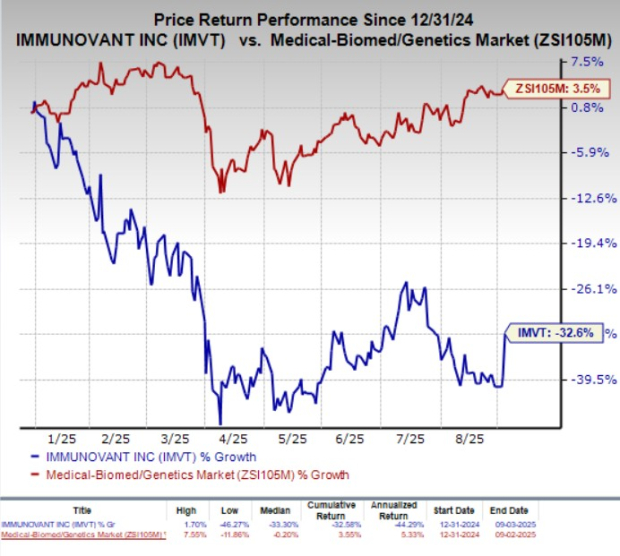

Year to date, Immunovant shares have plunged 32.6% against the industry’s 3.5% growth.

Image Source: Zacks Investment Research

Among the responders, roughly half (8/17) achieved ATD-free remission, while an additional 30% (5/17) required only minimal ATD doses of 2.5 mg/day. In the proof-of-concept study, batoclimab was well-tolerated and demonstrated an acceptable safety profile, consistent with previous studies of the candidate.

The reported data, which will be presented at an upcoming medical conference, suggest that FcRn blockade may offer a promising therapeutic approach for GD. Per IMVT, the findings demonstrate a potential for disease modification, as several patients achieved durable remission even after treatment withdrawal. If approved by the FDA, batoclimab could represent a significant advance in addressing unmet needs in GD treatment, where current treatment options are limited and not as effective.

IMVT’s GD Program for Lead Candidate IMVT-1402

Immunovant is looking to leverage the batoclimab data for GD to expedite the development of its lead candidate, IMVT-1402, for the same indication. IMVT-1402 is a novel, fully-human monoclonal antibody that selectively binds to and inhibits FcRn.

Immunovant has already initiated two potentially registrational global studies of IMVT-1402 for GD. Both studies are designed to evaluate a 600 mg dose of the candidate for up to 52 weeks. The studies are currently enrolling patients worldwide, with top-line results anticipated in 2027.

Immunovant, Inc. Price and Consensus

Immunovant, Inc. price-consensus-chart | Immunovant, Inc. Quote

IMVT’s Zacks Rank and Stocks to Consider

Immunovant currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are CorMedix CRMD, Pharming Group PHAR and Kiniksa Pharmaceuticals KNSA, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s earnings per share have increased from $1.10 to $1.49 for 2025. During the same time, earnings per share estimates for 2026 have increased from $1.46 to $2.16. Year to date, shares of CRMD have surged 69.1%.

CorMedix’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 34.85%.

In the past 60 days, estimates for Pharming Group’s 2025 loss per share have narrowed from 40 cents to 10 cents. For 2026, the estimate for PHAR’s earnings per share has improved from 7 cents to 27 cents. PHAR stock has rallied 42.7% year to date.

Pharming Group’s earnings beat estimates in two of the trailing four reported quarters and missed on the remaining two occasions, delivering an average negative surprise of 39.14%.

In the past 60 days, estimates for Kiniksa Pharmaceuticals’ 2025 earnings per share have increased from 74 cents to $1.03. Earnings per share estimates for 2026 have increased from $1.19 to $1.60 during the same period. KNSA stock has surged 79.4% year to date.

Kiniksa Pharmaceuticals’ earnings beat estimates in two of the trailing four reported quarters and missed on the remaining two occasions, delivering an average negative surprise of 330.56%.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpCorMedix Inc (CRMD) : Free Stock Analysis Report

Kiniksa Pharmaceuticals International, plc (KNSA) : Free Stock Analysis Report

Immunovant, Inc. (IMVT) : Free Stock Analysis Report

Pharming Group N.V. Sponsored ADR (PHAR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.