International Business Machines Corporation (IBM) has extended its partnership with Datavault AI to deliver a secure, ultra-low-latency enterprise AI at the edge in New York and Philadelphia, using SanQtum AI’s zero-trust micro data centers powered by its watsonx AI technology. The collaboration enables customers to securely process, analyze, and monetize data in real time with enhanced cybersecurity, minimizing dependence on public cloud infrastructure.

IBM’s watsonx platform offers enterprise-grade AI features, including trusted foundation models, real-time data analytics, built-in governance, security, and hybrid deployment across cloud, on-premises, and edge environments. With this deal, watsonx enables Datavault AI to transform raw data into trusted, monetizable digital assets in real time through secure, low-latency edge processing, scoring, and tokenization.

The company is upgrading its watsonx platform to support more advanced AI models, stronger security, and better performance across cloud, edge, and on-premises environments. These enhancements position watsonx as a future-ready enterprise AI platform that meets growing demands for real-time, secure, and scalable AI solutions.

IBM’s focus on watsonx AI portfolio in edge computing environments has strengthened its position in enterprise AI beyond traditional cloud deployments. It also allows the company to enter into high-growth markets, such as secure data monetization, digital assets, and zero-trust infrastructure, driving long-term enterprise and government demand.

How Are Competitors Performing in the Advanced AI Market?

IBM faces competition from Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOGL). Amazon Web Services (“AWS”) partnered with OpenAI to provide cloud infrastructure for running and scaling advanced AI workloads. AWS partnered with Infosys to help enterprises adopt generative AI by integrating Infosys’s Topaz AI platform with AWS AI services. Amazon is expanding in generative AI with AWS Bedrock, enabling customers to build apps using foundation models without managing infrastructure.

Google has partnered with retailers like Walmart, Shopify, and Wayfair to enable AI-powered shopping directly through its Gemini chatbot. Google Cloud teamed up with Vodacom to expand AI capabilities in Africa, using cloud and AI tools to support businesses and innovation. The company is using Vertex AI to help businesses build, deploy, and scale machine learning models quickly and efficiently on Google Cloud.

IBM’s Price Performance, Valuation & Estimates

IBM shares have gained 40% over the past year compared with the industry’s growth of 95.4%.

Image Source: Zacks Investment Research

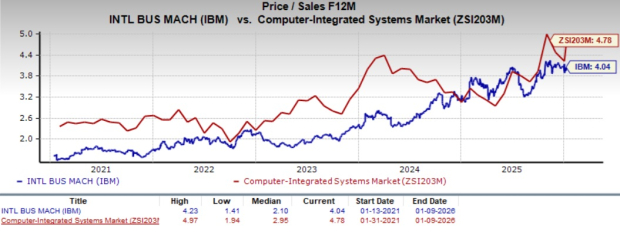

From a valuation standpoint, IBM trades at a forward price-to-sales ratio of 4.04, below the industry average.

Image Source: Zacks Investment Research

Earnings estimates for 2025 have increased 1% to $11.39 over the past 60 days, while the same for 2026 have also rose 1.4% to $12.24.

Image Source: Zacks Investment Research

IBM currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.