Hurco Companies said on March 10, 2023 that its board of directors declared a regular quarterly dividend of $0.16 per share ($0.64 annualized). Previously, the company paid $0.15 per share.

Shares must be purchased before the ex-div date of March 24, 2023 to qualify for the dividend. Shareholders of record as of March 27, 2023 will receive the payment on April 10, 2023.

At the current share price of $27.74 / share, the stock's dividend yield is 2.31%. Looking back five years and taking a sample every week, the average dividend yield has been 1.62%, the lowest has been 0.86%, and the highest has been 2.64%. The standard deviation of yields is 0.43 (n=236).

The current dividend yield is 1.59 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.49. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.25%, demonstrating that it has increased its dividend over time.

Learn to Harvest Dividends

Buy Stock. Capture Dividend. Sell Stock. Repeat. This is the essence of dividend harvesting and you can do it easily with Fintel's Dividend Capture Calendar.

What is the Fund Sentiment?

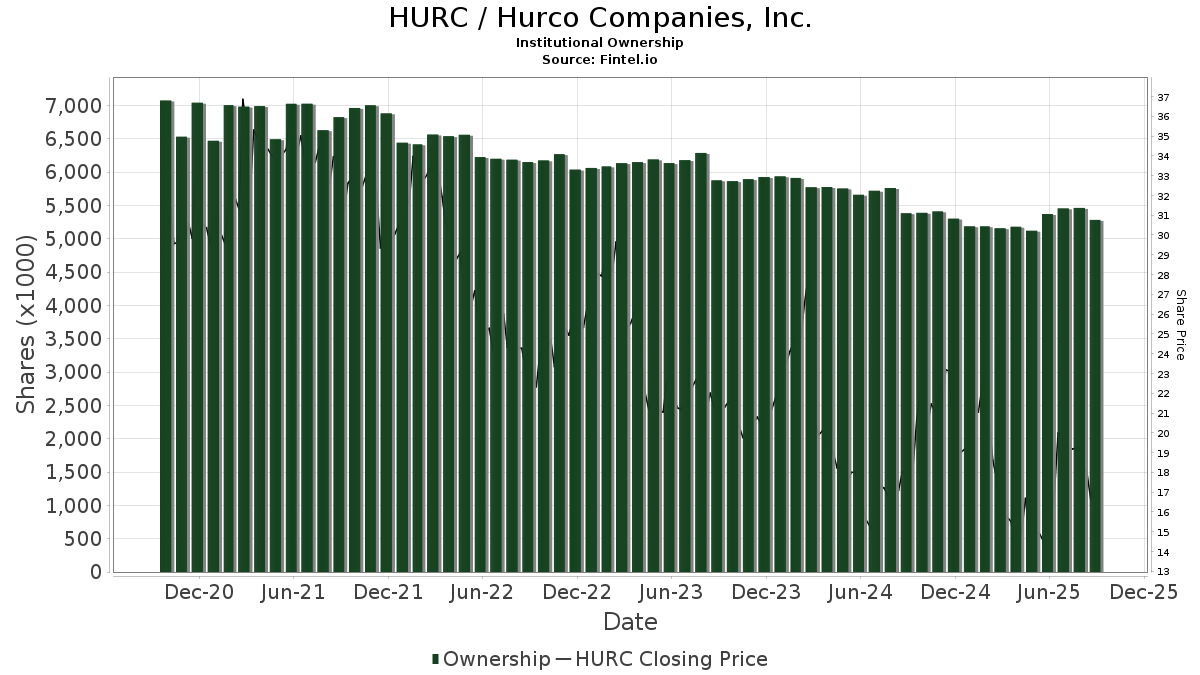

There are 121 funds or institutions reporting positions in Hurco Companies. This is a decrease of 4 owner(s) or 3.20% in the last quarter. Average portfolio weight of all funds dedicated to HURC is 0.14%, a decrease of 21.84%. Total shares owned by institutions increased in the last three months by 1.62% to 6,135K shares.

What are Large Shareholders Doing?

Royce & Associates holds 930K shares representing 13.88% ownership of the company. In it's prior filing, the firm reported owning 889K shares, representing an increase of 4.41%. The firm increased its portfolio allocation in HURC by 12.39% over the last quarter.

Polar Asset Management Partners holds 831K shares representing 12.40% ownership of the company. No change in the last quarter.

RYSEX - Royce Special Equity Fund Investment Class holds 580K shares representing 8.65% ownership of the company. No change in the last quarter.

Brandes Investment Partners holds 249K shares representing 3.71% ownership of the company. In it's prior filing, the firm reported owning 321K shares, representing a decrease of 28.97%. The firm decreased its portfolio allocation in HURC by 3.49% over the last quarter.

Ameriprise Financial holds 245K shares representing 3.66% ownership of the company. In it's prior filing, the firm reported owning 247K shares, representing a decrease of 0.79%. The firm increased its portfolio allocation in HURC by 8.49% over the last quarter.

Hurco Companies Background Information

(This description is provided by the company.)

Hurco Companies, Inc. is an international, industrial technology company that sells its three brands of computer numeric control ('CNC') machine tools to the worldwide metal cutting and metal forming industry. Two of the Company's brands of machine tools, Hurco and Milltronics, are equipped with interactive controls that include software that is proprietary to each respective brand. The Company designs these controls and develops the software. The third brand of CNC machine tools, Takumi, is equipped with industrial controls that are produced by third parties, which allows the customer to decide the type of control added to the Takumi CNC machine tool. The Company also produces high-value machine tool components and accessories and provides automation solutions that can be integrated with any machine tool. The end markets for the Company's products are independent job shops, short-run manufacturing operations within large corporations, and manufacturers with production-oriented operations. The Company's customers manufacture precision parts, tools, dies, and/or molds for industries such as aerospace, defense, medical equipment, energy, transportation, and computer equipment. The Company is based in Indianapolis, Indiana, with manufacturing operations in Taiwan, Italy, the U.S., and China, and sells its products through direct and indirect sales forces throughout the Americas, Europe, and Asia. The Company has sales, application engineering support and service subsidiaries in China, England, France, Germany, India, Italy, the Netherlands, Poland, Singapore, the U.S., and Taiwan.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.