Fintel reports that Huntsman Ronald Kirk has filed a 13G/A form with the SEC disclosing ownership of 2.25MM shares of Vivos Therapeutics Inc (VVOS). This represents 9.0% of the company.

In their previous filing dated February 14, 2022 they reported 2.21MM shares and 9.62% of the company, an increase in shares of 1.67% and a decrease in total ownership of 0.62% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 136.96% Upside

As of February 10, 2023, the average one-year price target for Vivos Therapeutics is $2.30. The forecasts range from a low of $2.02 to a high of $2.62. The average price target represents an increase of 136.96% from its latest reported closing price of $0.97.

The projected annual revenue for Vivos Therapeutics is $24MM, an increase of 44.94%. The projected annual EPS is -$0.92.

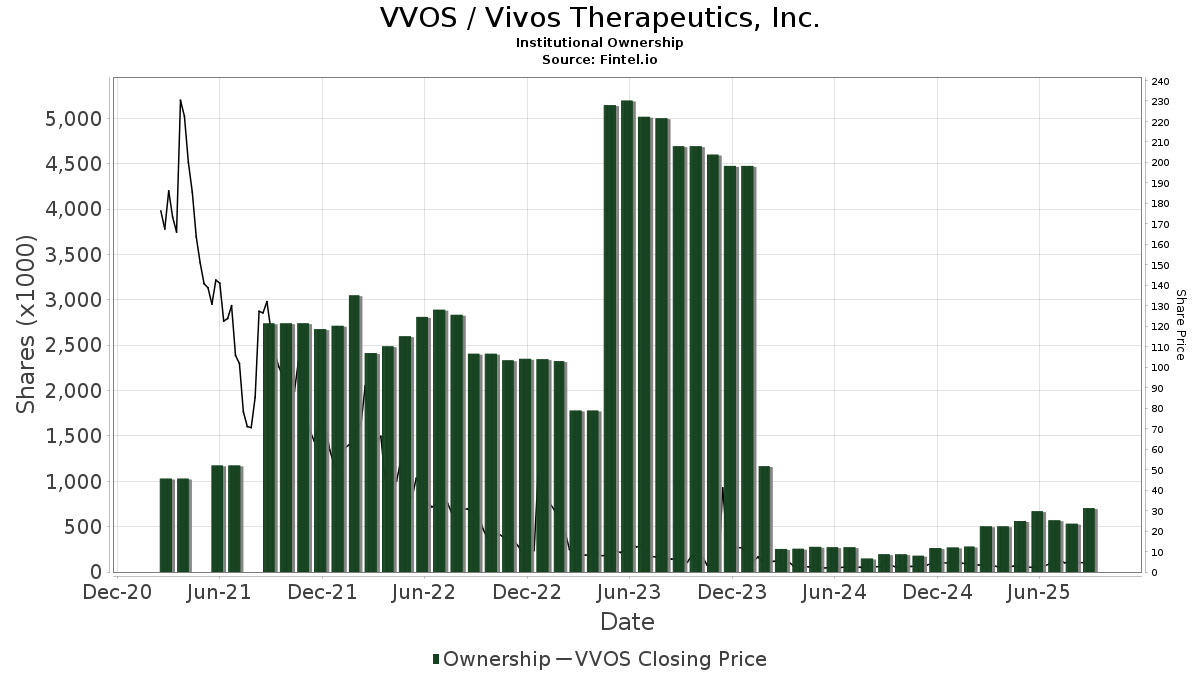

What is the Fund Sentiment?

There are 46 funds or institutions reporting positions in Vivos Therapeutics. This is a decrease of 1 owner(s) or 2.13% in the last quarter. Average portfolio weight of all funds dedicated to VVOS is 0.00%, a decrease of 25.72%. Total shares owned by institutions decreased in the last three months by 16.86% to 1,892K shares. The put/call ratio of VVOS is 0.14, indicating a bullish outlook.

What are large shareholders doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 426K shares representing 1.70% ownership of the company. In it's prior filing, the firm reported owning 390K shares, representing an increase of 8.53%. The firm decreased its portfolio allocation in VVOS by 42.59% over the last quarter.

VEXMX - Vanguard Extended Market Index Fund Investor Shares holds 274K shares representing 1.10% ownership of the company. No change in the last quarter.

Geode Capital Management holds 202K shares representing 0.81% ownership of the company. No change in the last quarter.

Bard Associates holds 202K shares representing 0.81% ownership of the company. In it's prior filing, the firm reported owning 217K shares, representing a decrease of 7.44%. The firm decreased its portfolio allocation in VVOS by 45.14% over the last quarter.

REBYX - U.S. Small Cap Equity Fund Class Y holds 178K shares representing 0.71% ownership of the company. In it's prior filing, the firm reported owning 182K shares, representing a decrease of 2.02%. The firm decreased its portfolio allocation in VVOS by 33.35% over the last quarter.

Vivos Therapeutics Background Information

(This description is provided by the company.)

Vivos Therapeutics Inc. is a medical technology company focused on developing and commercializing innovative treatments for patients suffering from sleep disordered breathing, including obstructive sleep apnea (OSA). Vivos believes that its Vivos System technology represents the first clinically effective non-surgical, non-invasive, non-pharmaceutical and cost-effective solution for people with mild-to-moderate OSA. Combining technologies and protocols that alter the size, shape and position of the tissues of the upper human airway, the Vivos System opens airway space and can eliminate or significantly reduce symptoms and conditions associated with mild-to-moderate OSA. The Vivos System has been shown to significantly lower Apnea Hypopnea Index scores and improve other conditions associated with OSA. Sales of the Vivos System are driven by the Vivos Integrated Practice (VIP) program, which offers dentists training and value-added services in connection with their use of the Vivos System.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.