Heritage Insurance Holdings Inc. HRTG is a compelling long-term investment case, backed by steady growth in premiums-in-force, which, in turn, is driven by strategic underwriting, evolving market conditions and a deliberate business mix shift.

This super-regional U.S. property and casualty insurer has prioritized profitability over volume by exiting less profitable personal lines in high-risk areas and increasing its focus on higher-margin commercial, residential and Excess & Surplus (E&S) segments. This strategy has enabled the company to grow premiums-in-force despite a slight decline in policy count, reflecting improved pricing power and a higher average premium per policy.

As of March 31, 2025, premiums-in-force were $1.4 billion— a 3.3% year-over-year increase —driven largely by rate actions. While Florida premiums-in-force declined 3% due to exposure reductions, non-Florida markets saw a 10.1% rise, highlighting the success of HRTG’s geographic diversification strategy. The pivot toward commercial residential and E&S lines supported this momentum, as both carry superior pricing power and lower loss ratios. Although commercial residential growth accelerated in 2024, HRTG expects it to stabilize in 2025.

Given a tightening reinsurance market and falling returns, HRTG ceased writing new personal lines policy issuance in Florida and the Northeast in late 2022. However, following favorable legislative changes in Florida and more predictable reinsurance pricing, Heritage Insurance has resumed personal lines growth through a disciplined, controlled approach. Ultimately, the rise in premiums-in-force reflects HRTG’s focused growth model, rooted in underwriting rigor, market responsiveness and enhanced digital capabilities.

What About HRTG’s Competitors?

HRTG closely competes with Universal Insurance Holdings UVE and HCI Group HCI, both of which have a strong presence in Florida.

Universal Insurance’s growth is underpinned by a steady rise in premiums-in-force, driven by strategic rate increases, inflation-linked valuation adjustments, and prudent underwriting. This positive trend has bolstered both direct premiums written and earned, supporting stronger underwriting revenues and overall profitability for Universal Insurance.

HCI Group’s growth has been largely fueled by a notable increase in premiums-in-force, driven by disciplined pricing and the strategic acquisition of several rounds of Citizens policies. This expansion has resulted in a strong rise in gross premiums earned, significantly enhancing underwriting revenues and overall profitability.

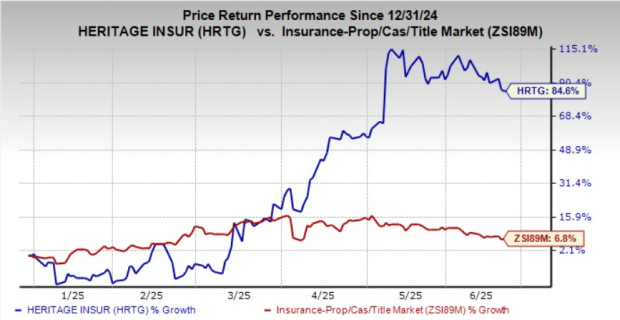

HRTG’s Price Performance

Shares of HRTG have gained 84.6% year to date, underperforming the industry.

Image Source: Zacks Investment Research

HRTG’s Expensive Valuation

HRTG trades at a price-to-book value ratio of 2.1, above the industry average of 1.55. But it has a Value Score of B.

Image Source: Zacks Investment Research

No Estimate Movement for HRTG

The Zacks Consensus Estimate for HRTG’s second-quarter and third-quarter 2025 EPS has remained unchanged over the past 30 days. The consensus estimates for 2025 and 2026 EPS have also not moved in the same time frame.

Image Source: Zacks Investment Research

The consensus estimates for HRTG’s 2025 and 2026 revenues and EPS indicate year-over-year increases.

HRTG currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>HCI Group, Inc. (HCI) : Free Stock Analysis Report

Heritage Insurance Holdings, Inc. (HRTG) : Free Stock Analysis Report

UNIVERSAL INSURANCE HOLDINGS INC (UVE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.