Howmet Aerospace Inc. HWM has steadily expanded its adjusted EBITDA margin over the last four quarters, reflecting consistent operational execution. From 25.7% reported in the second quarter of 2024, the margin rose to 26.5% in the third quarter and reached 26.8% in the fourth quarter. In the first quarter of 2025, HWM reported an adjusted EBITDA margin of 28.8%, up 480 basis points, driven by pricing strength and productivity gains.

Strong momentum in the commercial and defense aerospace markets continues to support Howmet Aerospace’s performance. Robust orders for engine spares for the F-35 program, aerospace fastening systems and airframe structural components also augur well. In 2024, Howmet Aerospace’s cost of goods sold rose 7.3% on a year-over-year basis while in the first quarter of 2025 the metric remained flat. SG&A expenses also decreased slightly in the first quarter compared with the prior year, contributing to improved profit margins.

Despite challenging conditions in the commercial transportation market, Howmet Aerospace’s ability to expand margins shows its focus on operational execution and cost management actions. HWM’s strong operational efficiency, solid demand outlook and supply-chain management efforts suggest that it is well positioned to maintain margin strength and deliver sustained growth in the near term.

Margin Performance of HWM’s Peers

Among its major peers, RTX Corporation’s RTX total costs and expenses increased 2.6% year over year to $18.28 billion in the first quarter of 2025. RTX Corp. generated an adjusted operating profit of $2.66 billion. Despite a rise in operating expenses, RTX Corp.’s adjusted operating margin was 13.1%, up 120 basis points, driven by cost-reduction initiatives and productivity improvements.

GE Aerospace’s GE cost of sales grew 4.3% year over year to $6 billion in the first quarter of 2025. However, GE Aerospace’s adjusted operating profit increased 38.4% year over year. GE Aerospace’s adjusted operating margin increased 460 basis points to 23.8%, driven by improved pricing and favorable customer mix.

HWM's Price Performance, Valuation and Estimates

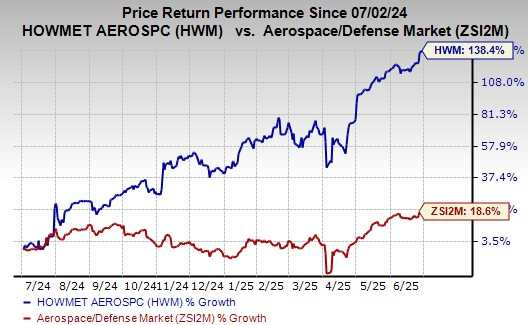

Shares of Howmet Aerospace have surged 138.4% in the past year compared with the industry’s growth of 18.6%.

Image Source: Zacks Investment Research

From a valuation standpoint, HWM is trading at a forward price-to-earnings ratio of 49.13X, above the industry’s average of 26.77X. Howmet Aerospace carries a Value Score of F.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for HWM’s earnings has been on the rise over the past 60 days.

Image Source: Zacks Investment Research

The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>GE Aerospace (GE) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.