Affirm Holdings Inc AFRM, a key player in the Buy Now, Pay Later (BNPL) space, is focusing on vertical integration to boost its profitability in a competitive and capital-heavy industry. With increasing pressure from regulators, high interest rates and stiff competition from rivals, AFRM’s approach to take control of more of the BNPL value chain could be a game-changer.

At its core, vertical integration means the company is taking charge of everything — from underwriting and loan origination to servicing and collections in many cases — rather than leaning heavily on third-party banks or partners. For instance, AFRM now relies on its own in-house algorithm to assess creditworthiness instead of solely depending on traditional credit scores. This shift enables better risk-based pricing, quicker approvals and greater control over loan performance.

One of the key aspects of this strategy is the increasing reliance on in-house funding. By blending its balance sheet with warehouse credit funding, Affirm will be able to lessen its dependence on expensive external capital, which ultimately boosts its net interest margin. This shift in structure could help soften the effects of broader economic challenges, like the rising cost of funds, which is a significant barrier to profitability for many BNPL companies.

In the third quarter of fiscal 2025, the company’s total revenues improved 36% year over year. Also, its adjusted operating margin improved 860 basis points year over year in the same quarter. AFRM’s strategy of vertical integration isn’t just a smart defensive tactic — it’s a key to long-term profitability.

How Are Competitors Faring?

Some of AFRM’s competitors in the BNPL space are PayPal Holdings, Inc. PYPL and Block, Inc. XYZ.

PayPal controls the entire value chain, handling everything from underwriting and transaction processing to collections and customer support. PayPal’s deep integration with merchants and large global user base allows it to offer BNPL services efficiently without incurring high customer acquisition costs.

Afterpay, part of Block, takes a different approach than AFRM by being less vertically integrated. It acts more like a BNPL facilitator that focuses on merchants, offering interest-free installment plans while depending on Block’s access to capital for its funding.

Affirm’s Price Performance, Valuation & Estimates

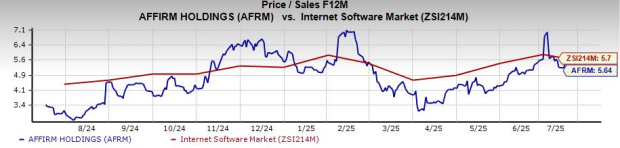

Over the past year, AFRM’s shares have skyrocketed 131.9% compared with the industry’s growth of 41.8%.

Image Source: Zacks Investment Research

From a valuation standpoint, AFRM trades at a forward price-to-sales ratio of 5.64, slightly below the industry average of 5.7. AFRM carries a Value Score of F.

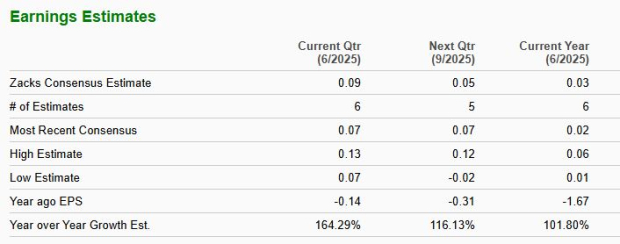

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Affirm’s fiscal 2025 earnings implies 101.8% growth from the year-ago period.

Image Source: Zacks Investment Research

Affirm currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpPayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Block, Inc. (XYZ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.