Serve Robotics Inc.’s SERV partnership with DoorDash marks a meaningful inflection point in the growth narrative, moving its autonomous delivery model from scaled pilots toward true platform leverage. Management framed the agreement as more than incremental volume, positioning it as a catalyst that materially improves fleet utilization and unit economics.

At its core, the DoorDash partnership dramatically expands Serve’s addressable demand. DoorDash, alongside Uber, accounts for more than 80% of the U.S. food delivery market, instantly widening Serve’s access to restaurants and consumers without requiring additional customer-acquisition spend. With more than 1,000 robots already deployed and 2,000 expected by year-end, the timing aligns well, enabling Serve to layer DoorDash orders onto an existing national footprint rather than building capacity ahead of demand.

More importantly, management emphasized interoperability. Robots can alternate between DoorDash and Uber deliveries within the same route cycle, lifting utilization rates and lowering cost per delivery. This multi-platform flexibility is critical, as higher utilization directly enhances Serve’s margin profile while making the service more attractive to partners through improved efficiency and reliability.

The partnership also reinforces Serve’s broader scale flywheel. Incremental deliveries generate more real-world data, accelerating learning across the fleet and improving autonomy, speed and safety. These operational gains compound over time, supporting management’s confidence in a sharp revenue inflection in 2026 as fleet economics improve.

In sum, the DoorDash partnership appears genuinely transformative, not simply as a revenue add-on, but as a strategic lever that enhances utilization, strengthens network effects and supports Serve Robotics’ path toward scalable, capital-efficient growth.

SERV’s Price Performance, Valuation & Estimates

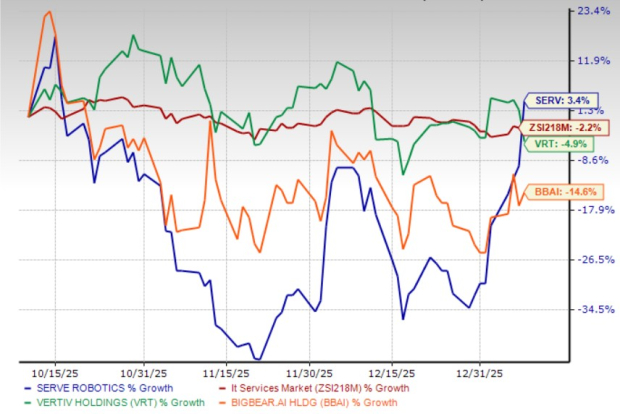

Shares of Serve Robotics have gained 3.4% over the past three months, outperforming the industry’s 2.2% decline. At the same time frame, other industry players, such as Vertiv Holdings Co. VRT and BigBear.ai Holdings, Inc. BBAI, have declined 4.9% and 14.6%, respectively.

SERV’s Three-Month Price Performance

Image Source: Zacks Investment Research

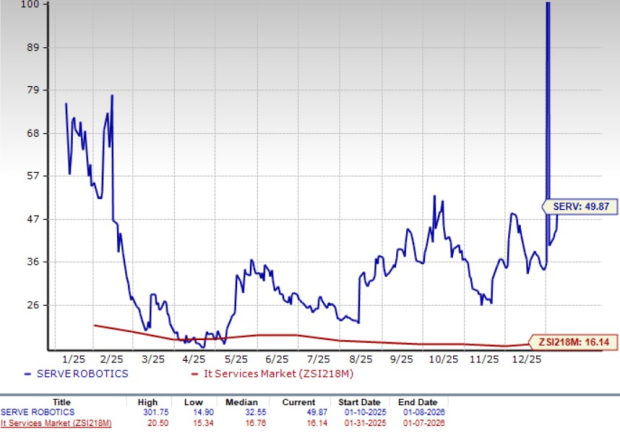

SERV stock is currently trading at a premium. It is currently trading at a forward 12-month price-to-sales (P/S) multiple of 49.87, well above the industry average of 16.14. Then again, other industry players, such as Vertiv and BigBear.ai, have P/S ratios of 4.96 and 15.58, respectively.

P/S (F12M)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Serve Robotics’ 2026 loss per share has widened from $1.76 to $1.83 in the past 30 days.

Image Source: Zacks Investment Research

SERV currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Serve Robotics Inc. (SERV) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

BigBear.ai Holdings, Inc. (BBAI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.