Opendoor Technologies Inc. OPEN is undergoing a major business transformation, moving from a pure-play iBuyer to a distributed platform that relies more heavily on agents and diversified offerings. At the heart of this shift lies a reimagined seller funnel designed to increase conversion, improve efficiency and generate higher-margin, capital-light revenue.

Early signs from the rollout are encouraging. According to management, the new agent-led model—dubbed “Key Connections”—has doubled the number of sellers reaching final underwritten cash offers compared to Opendoor’s traditional direct-to-consumer channel. Listing conversions have increased fivefold, and agents are now active in every market the company serves. These metrics point to a stronger and more flexible seller funnel that can handle multiple pathways: cash offer, market listing, or a hybrid “Cash Plus” option.

Cash Plus, in particular, is emerging as a promising lever. Pilots show that it is driving incremental conversions beyond standalone cash offers, while reducing capital requirements and offering better downside protection.

Still, the company notes that these initiatives are in the early stages and won’t meaningfully impact financials until 2026 due to inherent sales cycle lags. In the near term, macro headwinds—including high mortgage rates and buyer hesitancy—may limit funnel throughput. But the revamped funnel appears structurally sound, offering sellers more choice and Opendoor more ways to monetize each lead. If execution continues as planned, this platform shift could redefine Opendoor’s long-term growth engine.

Peers in the Funnel: How Zillow and Offerpad Compare

As Opendoor evolves its seller funnel, two key competitors—Zillow Group ZG and Offerpad Solutions OPAD—are also refining their approaches to lead capture and conversion.

Zillow is leveraging its vast consumer traffic and Premier Agent ecosystem to strengthen its seller pipeline. While it no longer buys homes directly, Zillow’s focus on seller lead monetization and listing enhancements keeps it entrenched in the funnel game. Zillow’s agent tools, marketing insights and expanding service suite are making it easier for consumers to engage early and convert efficiently. Zillow’s brand and data advantages are difficult to ignore.

Offerpad, in contrast, still competes head-on with Opendoor in iBuying, focusing on fewer markets with a more streamlined, cost-efficient model. Offerpad’s seller funnel remains anchored in direct home purchases but now includes more flexible listing options. Offerpad is ramping its seller engagement tools and digital assessments, trying to match Opendoor’s product diversity while maintaining capital discipline. Both Zillow and Offerpad are pushing hard to keep pace in an increasingly platform-driven landscape.

OPEN Stock's Price Performance, Valuation & Estimates

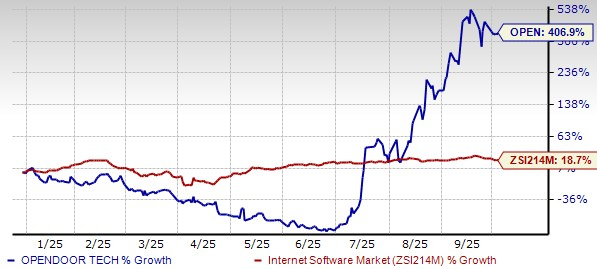

Shares of Opendoor have surged 406.9% year to date compared with the industry’s growth of 18.7%.

OPEN’s YTD Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, OPEN trades at a forward price-to-sales (P/S) multiple of 1.14, significantly below the industry’s average of 5.56X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for OPEN’s 2025 loss per share has widened from 21 cents to 24 cents in the past 60 days. However, the estimated figure indicates a narrower loss from the year-ago loss of 37 cents per share.

Image Source: Zacks Investment Research

OPEN stock currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpOpendoor Technologies Inc. (OPEN) : Free Stock Analysis Report

Zillow Group, Inc. (ZG) : Free Stock Analysis Report

Offerpad Solutions Inc. (OPAD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.