SoundHound AI, Inc. SOUN entered the final stretch of 2025 with a noticeably stronger financial setup as its revenue base expands across restaurants, IoT hardware, enterprise automation and automotive. The company ended the third quarter with $269 million in cash and equivalents, no debt on the balance sheet, and continued improvement in gross margin, which reached 59% on a non-GAAP basis. Management also reiterated that its scale advantages are starting to materialize, supported by deeper deployment of its proprietary Polaris model and ongoing integration of recent acquisitions.

This shift in cost structure comes at an important time, as SoundHound prepares for what it describes as a transition into a “breakeven profitability profile” heading into 2026. Operating expenses remain elevated — driven in part by expanded sales capacity, R&D investment and one-time integration costs — but the company is demonstrating greater capacity to offset them through recurring SaaS revenues, higher interaction volumes and broader use of in-house model infrastructure. The Interactions acquisition is expected to deliver $20 million in annual run-rate synergies, with the majority captured as workloads migrate to SoundHound’s cloud environment.

Importantly, management noted that growth at the current scale is “fully covering” operating costs, a notable contrast to the investment-heavy model of prior years. While adjusted EBITDA remained a $14.5 million loss in the third quarter, the company indicated it is positioned for adjusted EBITDA profitability at the high end of its revenue outlook.

The accelerated move toward a more balanced financial profile is also supported by discipline on the revenue side. SoundHound lifted its full-year 2025 revenue outlook to $165-$180 million (from prior expectation of $160-$178 million), and emphasized that its customer base is now broad enough that no single client represents over 10% of revenues. This diversification is helping smooth sector-specific volatility — such as temporary softness in automotive — and is allowing the company to maintain high growth momentum while tightening control over unit economics.

Looking ahead, SoundHound’s ability to convert its scale, integration benefits and cost efficiencies into sustained margin improvement will be a primary focus for investors. While near-term operating losses persist, the combination of a strengthened cash position, improving gross margin and visible synergy capture provides a clearer line of sight to a breakeven operating model in 2026.

SOUN’s Price Performance, Valuation & Estimates

SoundHound’s shares have declined 9.6% in the past three months compared with the industry’s fall of 3.1%. In the same time frame, other industry players like TaskUs, Inc. TASK have lost 35%, while Vertiv Holdings Co VRT and BigBear.ai Holdings, Inc. BBAI have gained 42.7% and 23.5%, respectively.

SOUN Three-Month Price Performance

Image Source: Zacks Investment Research

SOUN stock is currently trading at a premium. It is currently trading at a forward 12-month price-to-sales (P/S) multiple of 21.06, well above the industry average of 16.37. Then again, other industry players, such as TaskUs, Vertiv and BigBear.ai have P/S ratios of 0.82, 5.64 and 15.56, respectively.

Image Source: Zacks Investment Research

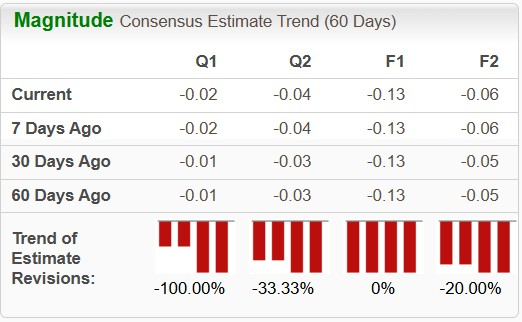

The Zacks Consensus Estimate for SoundHound’s 2026 loss per share has widened from 5 cents to 6 cents in the past 30 days.

Image Source: Zacks Investment Research

The company is likely to report solid earnings, with projections indicating a 53.9% rise in 2026. Conversely, industry players like TaskUs, Vertiv and BigBear.ai are likely to witness growth of 9.2%, 26.3% and 72.8%, respectively, year over year in 2026 earnings.

SOUN currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpVertiv Holdings Co. (VRT) : Free Stock Analysis Report

TaskUs, Inc. (TASK) : Free Stock Analysis Report

BigBear.ai Holdings, Inc. (BBAI) : Free Stock Analysis Report

SoundHound AI, Inc. (SOUN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.