Boomtowns, for those unfamiliar with the term, are towns and communities that undergo sudden growth. This growth typically refers to a population increase and/or economic prosperity. If business is booming, the rich are likely eying the area as a place to keep building their wealth.

Be Aware: I’m a Realtor — 5 Cities Retirees Are Moving To in 2025

Find Out: 10 Best and 10 Worst States for Millennials To Buy a Home

But how much would it cost to reside in these communities? GOBankingRates was able to determine this answer by analyzing data from the US Census American Community Survey in the years 2022, 2021, 2017 and 2014. We sourced Sperling’s BestPlaces for each boomtown’s cost of living index and calculated the average monthly and annual cost of living using each boomtown’s average mortgage and expenditure costs.

In alphabetical order, find out how much it costs to live in each state’s biggest boomtown.

Alabama: Huntsville

- Cost-of-living index: 94.2

- Monthly cost of living: $3,546

- Monthly mortgage cost: $1,583

- Household median income: $67,874

See More: 4 Best US Mountain Towns To Buy Property in the Next 5 Years

Read Next: If Interest Rates Are Going Down, What Will Mortgage Rates Look Like in 2025?

Alaska: Anchorage

- Cost-of-living index: 115.5

- Monthly cost of living: $4,597

- Monthly mortgage cost: $2,272

- Household median income: $95,731

Discover More: 5 Cities Where Homes Will Be a Total Steal in 2 Years

Arizona: Buckeye

- Cost-of-living index: 113.0

- Monthly cost of living: $4,418

- Monthly mortgage cost: $2,293

- Household median income: $94,188

Arkansas: Bentonville

- Cost-of-living index: 91.6

- Monthly cost of living: $4,441

- Monthly mortgage cost: $2,598

- Household median income: $99,074

California: Irvine

- Cost-of-living index: 164.9

- Monthly cost of living: $12,117

- Monthly mortgage cost: $10,013

- Household median income: $122,948

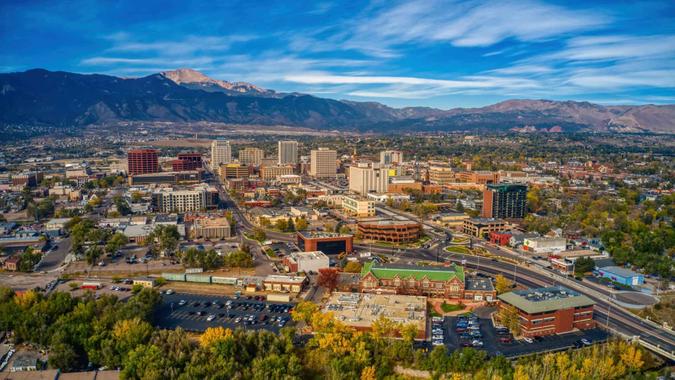

Colorado: Colorado Springs

- Cost-of-living index: 110.3

- Monthly cost of living: $4,478

- Monthly mortgage cost: $2,594

- Household median income: $79,026

Connecticut: Bridgeport

- Cost-of-living index: 138.6

- Monthly cost of living: $4,555

- Monthly mortgage cost: $2,061

- Household median income: $54,440

Explore Next: 5 Housing Markets That Will Plummet in Value Before the End of 2025

Delaware: Wilmington

- Cost-of-living index: 104.1

- Monthly cost of living: $3,895

- Monthly mortgage cost: $1,812

- Household median income: $54,731

Florida: Horizon West

- Cost-of-living index: 106.0

- Monthly cost of living: $5,349

- Monthly mortgage cost: $3,196

- Household median income: $118,064

Georgia: Atlanta

- Cost-of-living index: 113.3

- Monthly cost of living: $4,639

- Monthly mortgage cost: $2,497

- Household median income: $77,655

Hawaii: Honolulu

- Cost-of-living index: 171.5

- Monthly cost of living: $9,916

- Monthly mortgage cost: $7,266

- Household median income: $82,772

Idaho: Meridian

- Cost-of-living index: 119.6

- Monthly cost of living: $4,829

- Monthly mortgage cost: $2,947

- Household median income: $93,296

For You: 10 Housing Markets Buyers Are Flocking To as Rates Drop

Illinois: Plainfield

- Cost-of-living index: 95.2

- Monthly cost of living: $4,226

- Monthly mortgage cost: $2,210

- Household median income: $143,064

Indiana: Westfield

- Cost-of-living index: 106.0

- Monthly cost of living: $4,539

- Monthly mortgage cost: $2,593

- Household median income: $117,519

Iowa: Waukee

- Cost-of-living index: 95.5

- Monthly cost of living: $3,942

- Monthly mortgage cost: $2,066

- Household median income: $106,846

Kansas: Olathe

- Cost-of-living index: 106.2

- Monthly cost of living: $4,201

- Monthly mortgage cost: $2,247

- Household median income: $108,077

Kentucky: Lexington

- Cost-of-living index: 90.8

- Monthly cost of living: $3,615

- Monthly mortgage cost: $1,732

- Household median income: $66,087

See Next: 5 Southern Cities Where You Can Buy a House for Under $100K

Louisiana: Prairieville

- Cost-of-living index: 100.2

- Monthly cost of living: $4,029

- Monthly mortgage cost: $1,842

- Household median income: $111,927

Maine: Portland

- Cost-of-living index: 112.5

- Monthly cost of living: $5,110

- Monthly mortgage cost: $3,211

- Household median income: $71,498

Maryland: Clarksburg

- Cost-of-living index: 138.5

- Monthly cost of living: $6,056

- Monthly mortgage cost: $3,750

- Household median income: $165,551

Massachusetts: Wellesley

- Cost-of-living index: 143.4

- Monthly cost of living: $13,472

- Monthly mortgage cost: $11,213

- Household median income: $250,000

Michigan: Allendale

- Cost-of-living index: 94.3

- Monthly cost of living: $3,951

- Monthly mortgage cost: $2,089

- Household median income: $64,356

Learn More: 3 Best States To Buy Property in the Next 5 Years, According to Experts

Minnesota: Minneapolis

- Cost-of-living index: 107.2

- Monthly cost of living: $3,886

- Monthly mortgage cost: $1,907

- Household median income: $76,332

Mississippi: Olive Branch

- Cost-of-living index: 91.7

- Monthly cost of living: $3,768

- Monthly mortgage cost: $1,849

- Household median income: $93,762

Missouri: Wentzville

- Cost-of-living index: 97.5

- Monthly cost of living: $4,084

- Monthly mortgage cost: $2,136

- Household median income: $109,158

Montana: Bozeman

- Cost-of-living index: 125.7

- Monthly cost of living: $6,551

- Monthly mortgage cost: $4,700

- Household median income: $74,113

Nebraska: Omaha

- Cost-of-living index: 90.8

- Monthly cost of living: $3,563

- Monthly mortgage cost: $1,588

- Household median income: $70,202

Trending Now: 3 Best Florida Cities To Buy Property in the Next 5 Years, According To Real Estate Agents

Nevada: Henderson

- Cost-of-living index: 110.6

- Monthly cost of living: $4,987

- Monthly mortgage cost: $2,857

- Household median income: $85,311

New Hampshire: Dover

- Cost-of-living index: 102.8

- Monthly cost of living: $5,021

- Monthly mortgage cost: $3,092

- Household median income: $90,844

New Jersey: Jersey City

- Cost-of-living index: 139.5

- Monthly cost of living: $5,968

- Monthly mortgage cost: $3,560

- Household median income: $91,151

New Mexico: Rio Rancho

- Cost-of-living index: 94.9

- Monthly cost of living: $3,841

- Monthly mortgage cost: $1,953

- Household median income: $78,978

New York: Kiryas Joel

- Cost-of-living index: 122.5

- Monthly cost of living: $5,467

- Monthly mortgage cost: $2,940

- Household median income: $40,218

View More: Real Estate Agents Explain Why You Should Never Invest in These 7 Home Features

North Carolina: Apex

- Cost-of-living index: 105.8

- Monthly cost of living: $5,422

- Monthly mortgage cost: $3,484

- Household median income: $129,688

North Dakota: Fargo

- Cost-of-living index: 90.6

- Monthly cost of living: $3,574

- Monthly mortgage cost: $1,749

- Household median income: $64,432

Ohio: Marysville

- Cost-of-living index: 98.8

- Monthly cost of living: $3,937

- Monthly mortgage cost: $2,026

- Household median income: $89,104

Oklahoma: Broken Arrow

- Cost-of-living index: 85.3

- Monthly cost of living: $3,529

- Monthly mortgage cost: $1,573

- Household median income: $82,547

Oregon: Bend

- Cost-of-living index: 127.0

- Monthly cost of living: $6,125

- Monthly mortgage cost: $4,252

- Household median income: $82,671

Explore Next: 5 Cities Where Homes Will Be a Total Steal In Two Years

Pennsylvania: Reading

- Cost-of-living index: 94.0

- Monthly cost of living: $3,456

- Monthly mortgage cost: $1,384

- Household median income: $42,852

Rhode Island: Providence

- Cost-of-living index: 108.8

- Monthly cost of living: $4,377

- Monthly mortgage cost: $2,275

- Household median income: $61,365

South Carolina: Bluffton

- Cost-of-living index: 104.3

- Monthly cost of living: $4,848

- Monthly mortgage cost: $2,927

- Household median income: $99,575

South Dakota: Sioux Falls

- Cost-of-living index: 90.7

- Monthly cost of living: $3,705

- Monthly mortgage cost: $1,852

- Household median income: $71,785

Tennessee: Spring Hill

- Cost-of-living index: 139.4

- Monthly cost of living: $4,999

- Monthly mortgage cost: $2,899

- Household median income: $104,880

Read More: 20 Best Cities Where You Can Buy a House for Under $100K

Texas: Leander

- Cost-of-living index: 116.9

- Monthly cost of living: $4,640

- Monthly mortgage cost: $2,550

- Household median income: $129,684

Utah: Herriman

- Cost-of-living index: 121.3

- Monthly cost of living: $5,533

- Monthly mortgage cost: $3,501

- Household median income: $115,198

Vermont: Burlington

- Cost-of-living index: 112.4

- Monthly cost of living: $5,307

- Monthly mortgage cost: $3,142

- Household median income: $64,931

Virginia: Woodbridge

- Cost-of-living index: 125.8

- Monthly cost of living: $4,989

- Monthly mortgage cost: $2,792

- Household median income: $93,347

Washington: Redmond

- Cost-of-living index: 158.1

- Monthly cost of living: $10,462

- Monthly mortgage cost: $8,374

- Household median income: $155,287

Be Aware: How Much Money Is Needed To Be Considered Middle Class in Every State?

West Virginia: Morgantown

- Cost-of-living index: 89.8

- Monthly cost of living: $3,507

- Monthly mortgage cost: $1,550

- Household median income: $41,103

Wisconsin: Madison

- Cost-of-living index: 103.4

- Monthly cost of living: $4,346

- Monthly mortgage cost: $2,411

- Household median income: $74,895

Wyoming: Cheyenne

- Cost-of-living index: 100.3

- Monthly cost of living: $4,126

- Monthly mortgage cost: $2,092

- Household median income: $74,989

Methodology: For this study, GOBankingRates analyzed the American Community Survey data in the United States Census to find the biggest boomtowns in every state. Using the American Community Survey from 2022, 2021, 2017 and 2014, GOBankingRates found total population, owner-occupied housing, occupied housing units and income. Each factor was scored for each year, with all the scores being summed and sorted. The highest-scoring city was kept for each state and total population, population ages 65 and over, total households and household median income were all sourced from the U.S. Census American Community Survey. The cost-of-living indexes were sourced from Sperling’s BestPlaces and include the grocery, healthcare, housing, utilities, transportation and miscellaneous. Using the cost-of-living indexes and the national average expenditure costs, as sourced from the Bureau of Labor Statistics Consumer Expenditure Survey, the average expenditure cost for each location was calculated. The average single-family home value was sourced from Zillow Home Value Index for September 2024. Using the average home value, assuming a 10% down payment, and using the most recent national average 30-year fixed mortgage rate, as sourced from the Federal Reserve Economic Data, the average mortgage was calculated. Using the average mortgage and average expenditure costs, the average cost of living was calculated. All data was collected on and is up to date as of Oct. 21, 2024.

More From GOBankingRates

- Costco, Walmart and Other Stores With Perks Retirees Need To Be Taking Advantage Of

- 8 Common Mistakes Retirees Make With Their Social Security Checks

- The Trump Economy Begins: 4 Money Moves Retirees Should Make Before Inauguration Day

- 3 Things Retirees Should Sell To Build Their Retirement Savings

This article originally appeared on GOBankingRates.com: How Much It Costs To Live in the Biggest Boomtown in Every State

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.