Exxon Mobil Corporation XOM, a U.S.-based integrated energy company, earns a significant part of its revenues from its upstream business. The company’s involvement in the upstream segment makes it vulnerable to volatility in oil and gas prices. However, ExxonMobil’s high-return assets in the Permian Basin and Guyana are expected to support its earnings even during low commodity prices, due to their low cost of production.

The company is ramping up production from its most advantaged assets in Guyana and the Permian Basin, helping sustain earnings growth despite softer crude realizations. These advantaged assets have low breakeven costs, allowing XOM to maintain stable performance and generate positive cash flows even when oil prices are low.

In its most recentearnings call XOM mentioned that it has reached production levels of 700,000 barrels per day in Guyana in the third quarter. The company has sanctioned its seventh development in Guyana, named Hammerhead, which is expected to start production in 2029. By 2030, XOM intends to reach a production capacity of 1.7 million Boe from the eight offshore developments in the Stabroek block. Furthermore, in the Permian Basin, the company has acquired 80,000 net high-quality acres from Sinochem Petroleum. This transaction expands its presence in the basin, allowing full control over new drilling locations where it can implement its technology to generate better returns.

ExxonMobil’s upstream business is poised to generate sustainable cash flows and deliver long-term shareholder value, owing to its focus on production growth from its advantaged assets and structural cost reduction.

The Core of COP and EOG's Competitive Edge

ConocoPhillips COP and EOG Resources, Inc. EOG are two global energy firms that can thrive even during challenging commodity price environments.

ConocoPhillips’ portfolio includes assets in the prolific shale basins of the United States, the oil sands in Canada and conventional assets in Asia, Europe and the Middle East, which support low-cost production. Notably, in the U.S. Lower 48, COP has an advantaged inventory position that can support operations at a breakeven cost as low as $40 per barrel WTI. Even if crude oil prices decline significantly, ConocoPhillips will be able to maintain its financial performance and generate positive cash flows.

EOG Resources is a leading independent exploration and production company with operations focused on the prolific acres in the United States as well as several resource-rich international basins. EOG boasts a high-return, low-decline asset base and stands out among the low-cost producers in the United States. The company’s focus on maintaining a resilient balance sheet and lowering production costs should enable it to weather oil price volatility.

XOM’s Price Performance, Valuation & Estimates

Shares of ExxonMobil have risen 12.9% over the past six months compared with the 13.3% increase of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

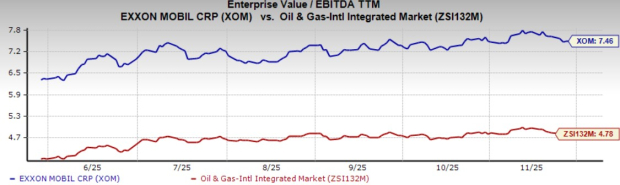

From a valuation standpoint, XOM trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 7.46X. This is above the broader industry average of 4.78X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for XOM’s 2025 earnings has been revised upward over the past seven days.

Image Source: Zacks Investment Research

XOM, COP and EOG each currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpExxon Mobil Corporation (XOM) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.