Duke Energy DUK is increasingly leveraging energy storage technologies as a core part of its grid modernization strategy. By storing power during low-demand periods and deploying it during peak times, the company can optimize its generation mix for fuel savings and reduced emissions.

Battery storage helps integrate renewables by storing excess energy during low-demand periods and supplying it when demand is high. Its versatility allows the companies to improve grid performance, boost operational efficiency and reduce customer costs.

In addition to battery storage, Duke Energy operates pumped-storage hydro plants, which function as large-scale, long-duration energy reservoirs. These facilities store energy by pumping water to higher elevations when demand is low, then release it through turbines to produce electricity during peak periods. This capability provides substantial flexibility and is among the most efficient and reliable forms of bulk energy storage.

The company is consistently monitoring resource adequacy as it braces for significant demand growth, an uptick in extreme-weather events, and upcoming plant retirements. It currently operates more than 300 megawatts (MW) of grid-tied battery storage, and another 300 MW is underway.

By 2035, the company intends to have more than 6,000 MW of energy storage capacity, having already installed more than 2,400 MW of pumped-storage technology. By 2050, it anticipates around 30,000 MW of energy storage.

Battery Storage: A Key Driver of Grid Stability & Clean Energy

Battery storage helps utilities better balance supply and demand, enhance grid reliability and integrate more renewable energy. Companies like NextEra Energy NEE and The Southern Company SO are using battery storage to strengthen grid stability and optimize renewable integration.

NEE is advancing its clean energy transition by pairing renewable generation with expanded battery storage. NEE’s subsidiary NextEra Energy Resources (“NEER”) has plans to invest nearly $5.5 billion in the period of 2025-2029 to add 4,265 MW of storage projects. Southern Company is applying the same approach to boost grid resilience, advance clean energy initiatives and deliver reliable, affordable electricity to its customers.

DUK’s Earnings Estimates

The Zacks Consensus Estimate for 2025 and 2026 EPS indicates an increase of 7.29% and 6.07%, respectively, year over year.

Image Source: Zacks Investment Research

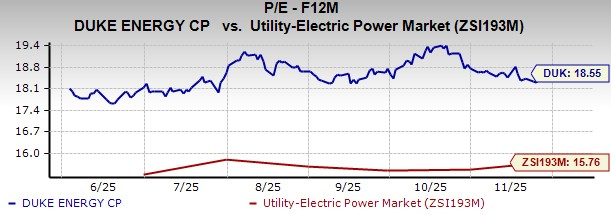

DUK Stock Trading at a Premium

DUK is trading at a premium relative to the industry, with a forward 12-month price-to-earnings of 18.55X compared with the industry average of 15.76X.

Image Source: Zacks Investment Research

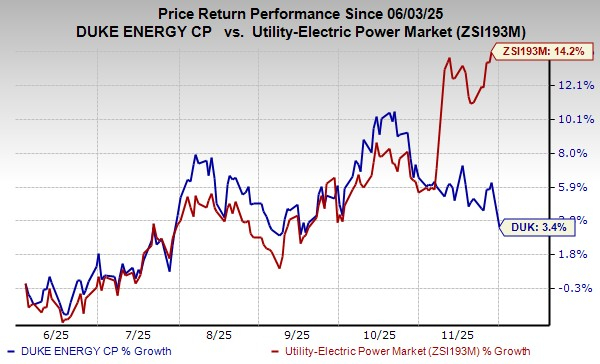

DUK Stock Price Performance

In the past six months, the company’s shares have risen 3.4% compared with the industry’s 14.2% growth.

Image Source: Zacks Investment Research

DUK’s Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpNextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Southern Company (The) (SO) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.