Duke Energy DUK benefits from operating primarily as a regulated utility because regulation provides stable and predictable revenues. Regulators allow the company to earn approved returns on its investments, which supports consistent spending on grid modernization and clean energy projects. Its large customer base across multiple states further reduces risk by diversifying revenue sources and ensuring dependable returns.

Regulated structures allow the company to recover its costs through customer rates, including fluctuating fuel expenses. This cost-recovery framework enables the company to invest in large-scale generation assets, such as nuclear plant life extensions, while managing fuel price volatility and maintaining more stable electricity costs for customers.

Operating in constructive and growing jurisdictions with supportive regulatory environments reduces business risk and creates a lower-risk investment profile for Duke Energy. The company plans to invest nearly $190-$200 billion over the next decade, demonstrating its long-term growth strategy. Of this amount, $95-$105 billion is expected to be spent during 2026-2030, primarily on regulated infrastructure, grid upgrades and clean energy projects.

Regulatory frameworks also support timely returns on Duke Energy’s investments, with most electric capital spending eligible for efficient recovery mechanisms. Growth in gas utilities is supported by riders and annual rate adjustments. The company’s adjusted earnings per share (EPS) growth rate is anticipated to remain in the range of 5-7% through 2029.

Regulated Utilities Driving Stable Growth

Utilities benefit from being a regulated model through a supportive regulatory environment that allows for cost recovery on capital investments and helps maintain a stable earnings.

The Southern Company SO: The majority of SO’s $76 billion, five-year capital plan is allocated to its state-regulated utilities. The focus on regulated assets reduces merchant risk and provides a transparent pathway for earnings growth through rate base expansion and subsequent regulatory recovery.

PPL Corporation’s PPL regulated model allows it to earn approved returns and recover costs efficiently, using streamlined mechanisms for 60% of investments, while its $20 billion infrastructure plan through 2028 is expected to drive 9.8% annual rate base growth.

Estimates for DUK’s Earnings

The Zacks Consensus Estimate for 2025 and 2026 EPS indicates an increase of 7.12% and 6.1%, respectively, year over year.

Image Source: Zacks Investment Research

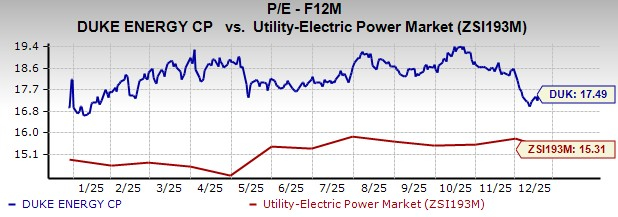

DUK Stock Trading at a Premium

DUK is trading at a premium relative to the industry, with a forward 12-month price-to-earnings of 17.49X compared with the industry average of 15.31X.

Image Source: Zacks Investment Research

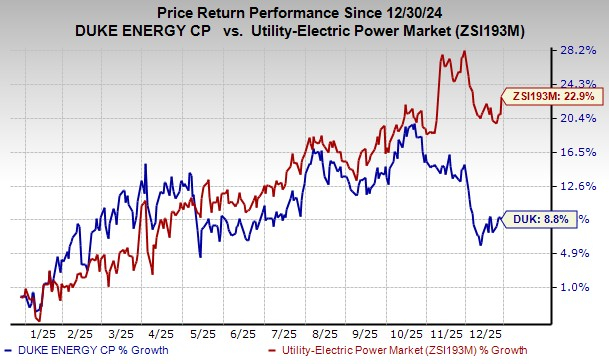

DUK Stock Price Performance

In the past year, the company’s shares have risen 8.8% compared with the industry’s 22.9% growth.

Image Source: Zacks Investment Research

DUK’s Zacks Rank

The company currently has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>PPL Corporation (PPL) : Free Stock Analysis Report

Southern Company (The) (SO) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.