IREN Limited IREN is transitioning from a pure-play crypto-mining company to an AI cloud service provider. This shift from its core crypto mining business will ensure that IREN capitalizes on the growing AI compute infrastructure market, which is witnessing a CAGR of 19.4%, per a report by MarketsAndMarkets, much faster than the crypto-mining space.

To support its AI-compute endeavors, IREN has secured three gigawatt power sources, struck a partnership with Microsoft and is installing a fully integrated AI cloud infrastructure, which will enable it to serve customers with scalability and cost efficiency while avoiding counterparty risk and collocation cost, proving it to be a strong moat for future growth.

In its British Columbia facility, IREN has set a target of late 2026 to convert its 160MW infrastructure from ASIC miners to GPU-based AI compute. At Childress, IREN is working on Microsoft’s 200MW liquid-cooled data center with 100MW high-performance AI training clusters, and flexible rack densities up to 200kW.

IREN’s 2GW Sweetwater Hub is advancing, with the 1,400MW Sweetwater 1 substation expected to be energized by April 2026 and the 600MW Sweetwater 2 substation targeted for late 2027. However, IREN’s expansion into the AI infrastructure market comes with some headwinds, too.

IREN’s capacity expansion comes with higher capital expenditure. IREN is spending $5.8 billion on GPUs to stay relevant in the current market. Nevertheless, IREN is fulfilling its capital needs with $1.9 billion in customer prepayments, $2.5 billion through credit and contract with Microsoft and $1.4 billion at its own capacity.

How Competitors Fare Against IREN

IREN also faces intense competition from Applied Digital APLD and TeraWulf WULF in the AI infrastructure space. TeraWulf’s prospects are expected to benefit from its growing footprint in the high-performance computing (HPC) domain. TeraWulf’s partnership with Fluidstack, a premier AI cloud platform that builds and operates HPC clusters, is likely to give it an upper hand in this space.

Applied Digital is an established player in the AI-data center space with its growing expertise in energy efficiency. Applied Digital’s energized infrastructure services to crypto mining customers and the rising HPC needs due to the AI revolution make it a strong player in both fields.

IREN’s Price Performance, Valuation and Estimates

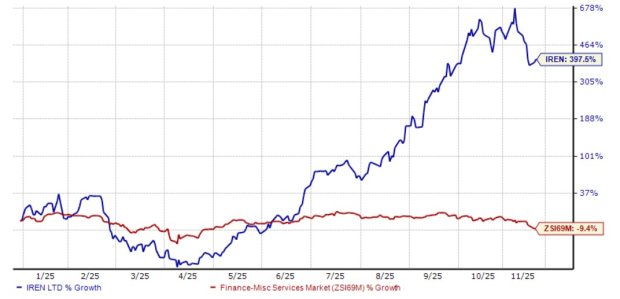

Shares of IREN have gained 397.5% year to date against the Financial - Miscellaneous Services industry decline of 9.8%.

IREN YTD Performance Chart

Image Source: Zacks Investment Research

IREN shares are overvalued, as suggested by the Value Score of F. In terms of forward price/sales, IREN is trading at 9.10X compared with the Zacks Financial Miscellaneous Services industry’s 2.97X.

IREN Forward 12 Month (P/S) Valuation Chart

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for IREN’s fiscal 2026 earnings implies year-over-year growth of 1,875%. The Zacks Consensus Estimate for IREN’s fiscal 2027 earnings indicates a year-over-year decline of 56.3%. The Zacks Consensus Estimate for IREN’s fiscal 2026 earnings has been revised upward in the past 30 days, while the estimate for 2027 has been revised downward in the same time frame.

Image Source: Zacks Investment Research

IREN currently has a Zacks Rank #5 (Strong Sell), which implies investors should avoid the stock for the time being.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Applied Digital Corporation (APLD) : Free Stock Analysis Report

IREN Limited (IREN) : Free Stock Analysis Report

TeraWulf Inc. (WULF) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.